Answered step by step

Verified Expert Solution

Question

1 Approved Answer

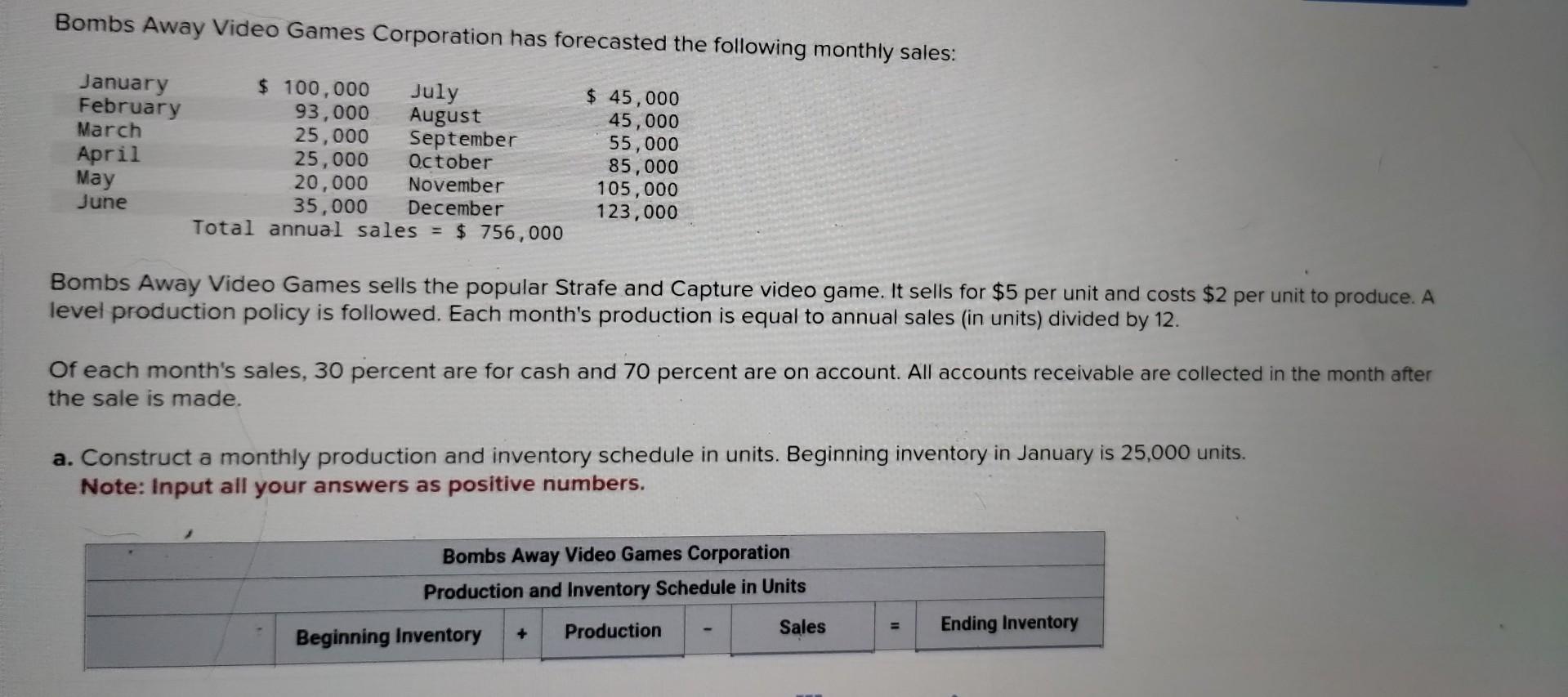

Bombs Away Video Games Corporation has forecasted the following monthly sales: Bombs Away Video Games sells the popular Strafe and Capture video game. It sells

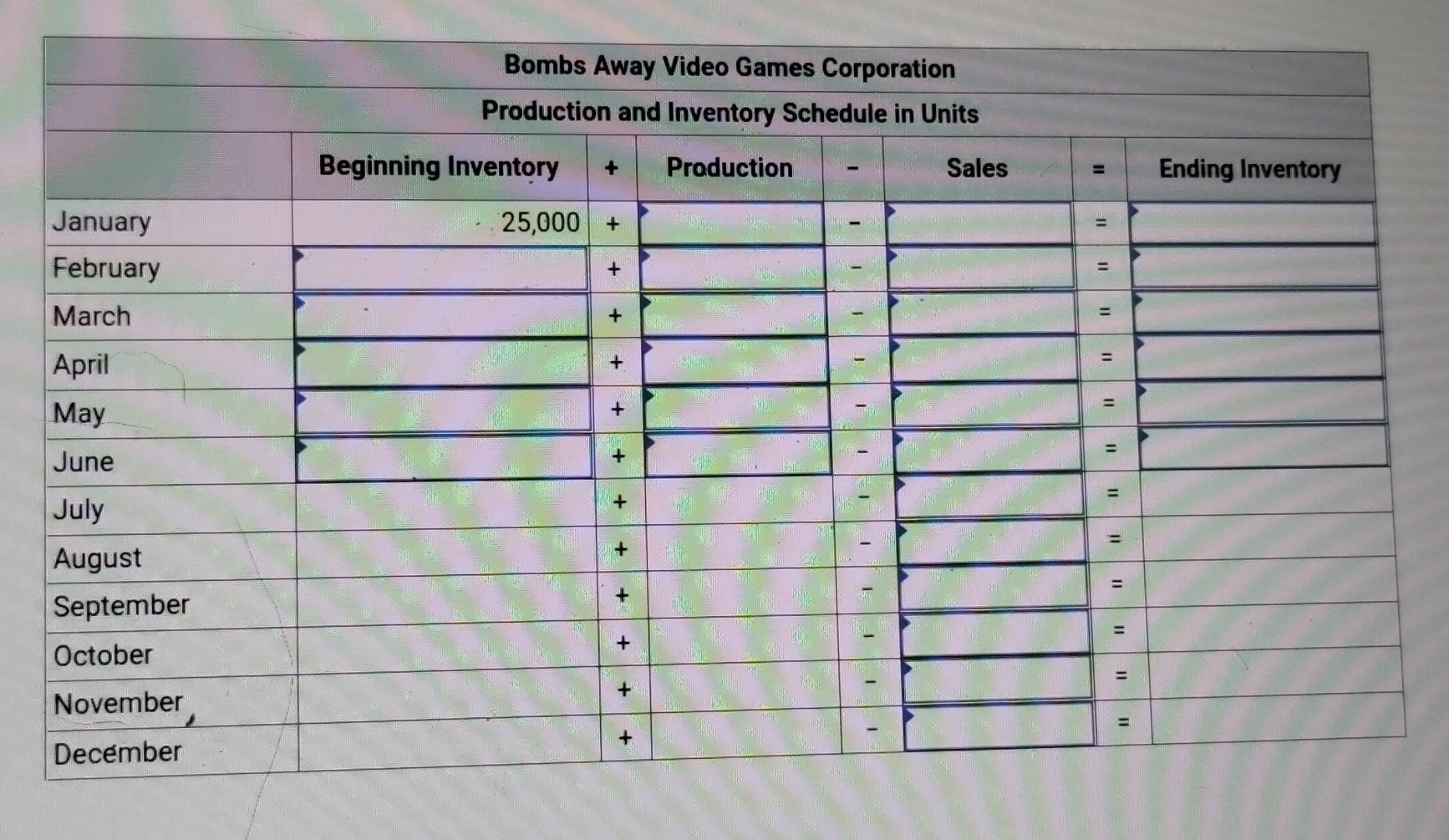

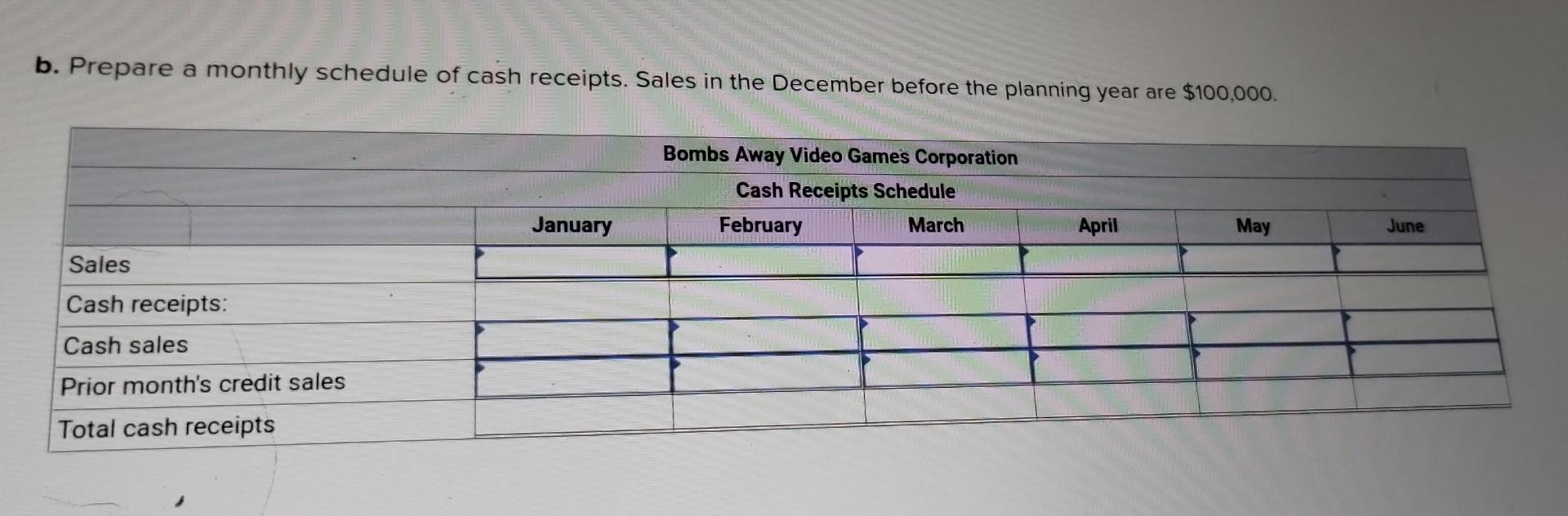

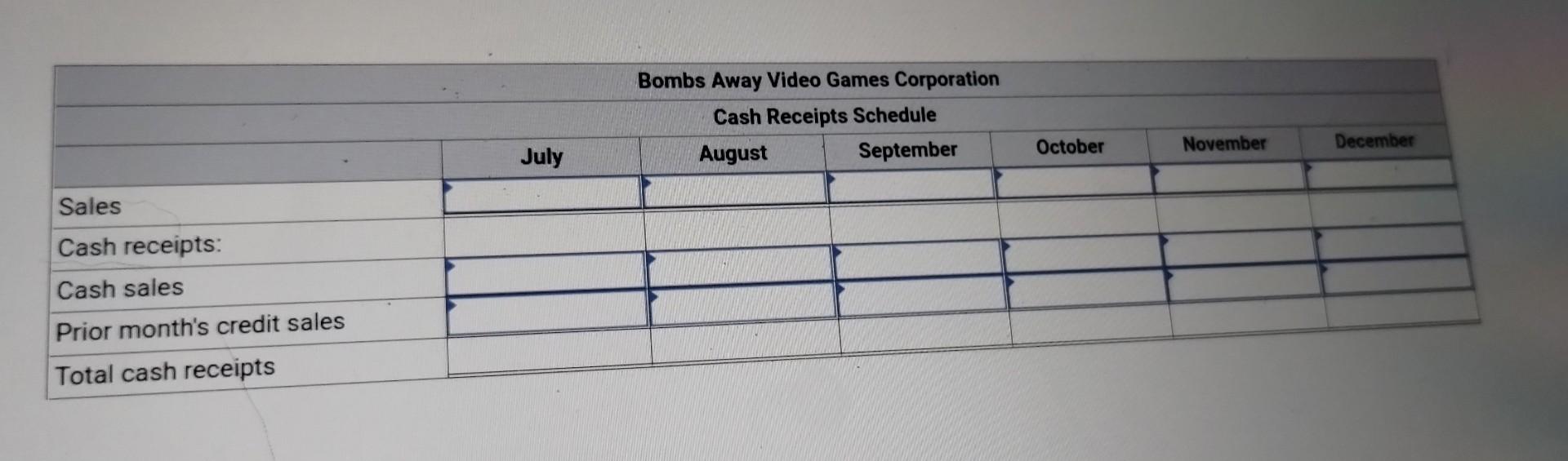

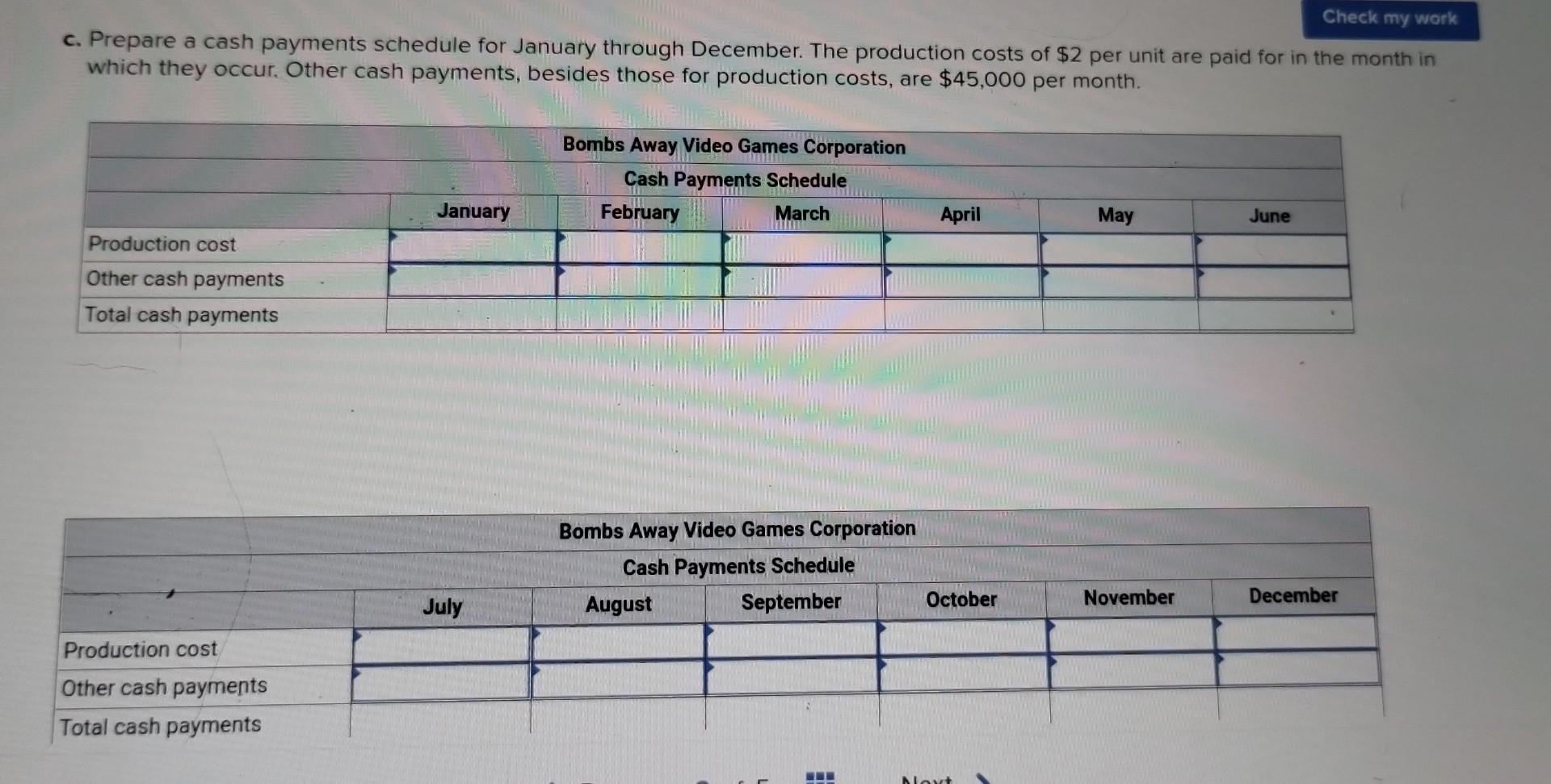

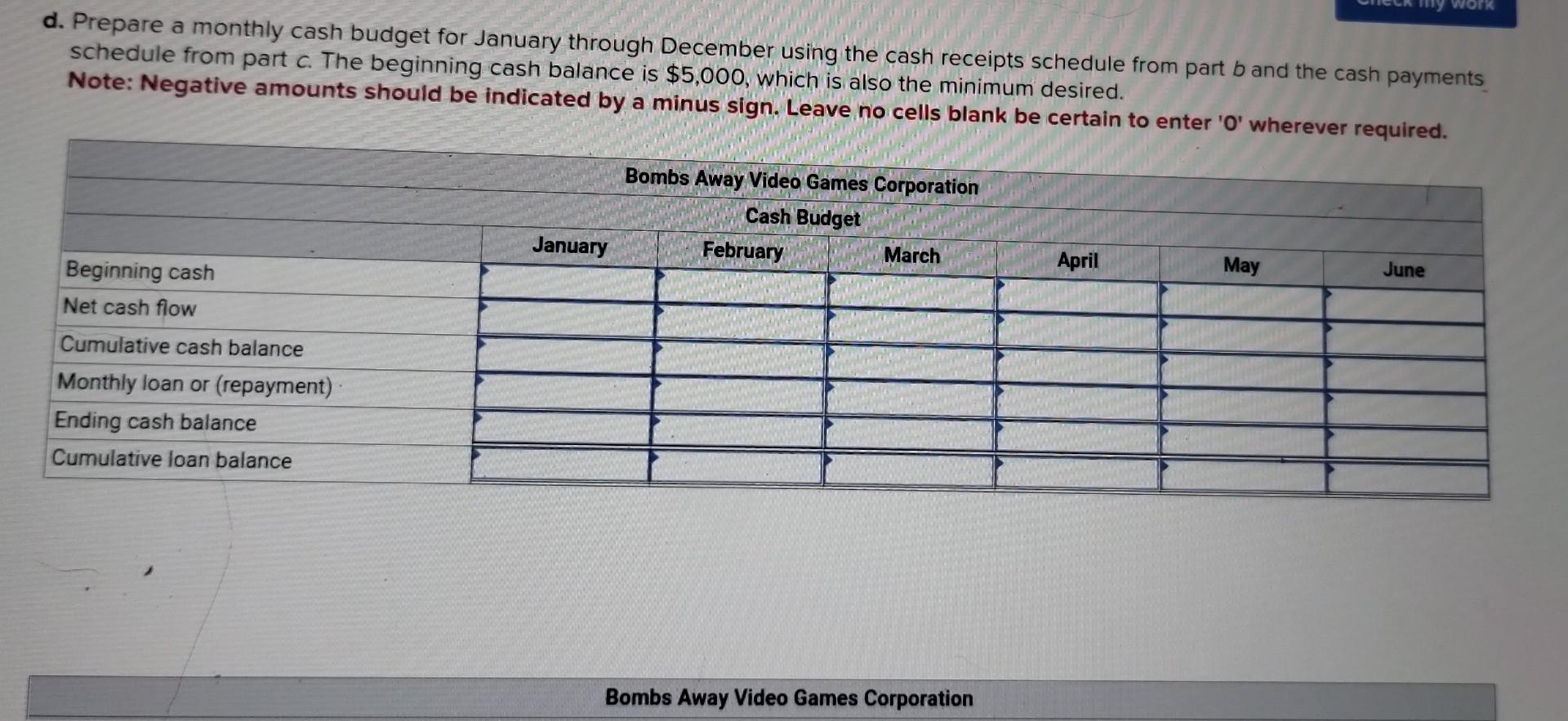

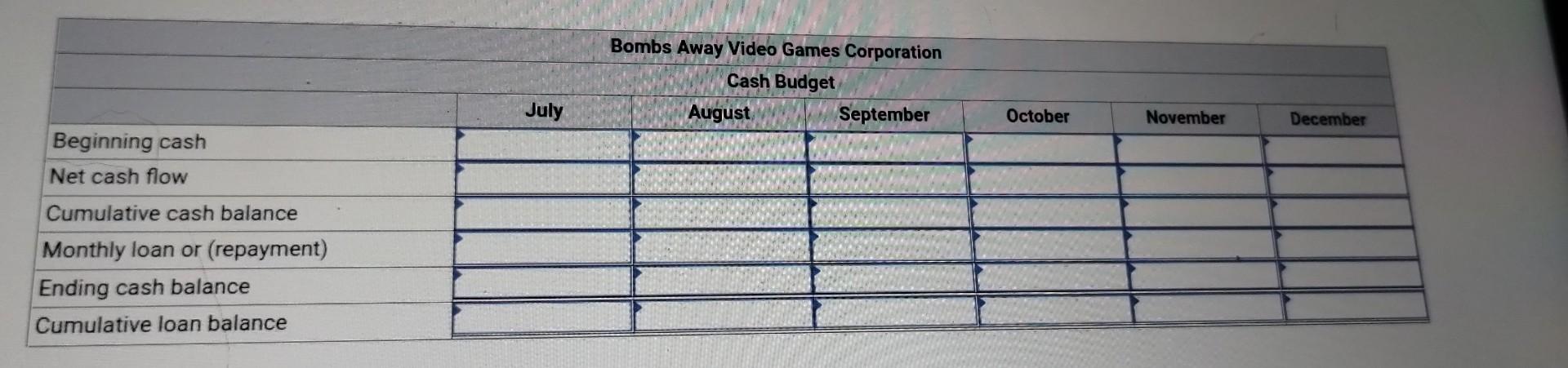

Bombs Away Video Games Corporation has forecasted the following monthly sales: Bombs Away Video Games sells the popular Strafe and Capture video game. It sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Each month's production is equal to annual sales (in units) divided by 12. Of each month's sales, 30 percent are for cash and 70 percent are on account. All accounts receivable are collected in the month after the sale is made. a. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 25,000 units. Note: Input all your answers as positive numbers. b. Prepare a monthly schedule of cash receipts. Sales in the December before the planning year are $100,000. c. Prepare a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $45,000 per month. d. Prepare a monthly cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is $5,000, which is also the minimum desired. Note: Negative amounts should be indicated by a minus sign. Leave no cells blank be certain to enter ' 0 ' wherever required. Bombs Away Video Games Corporation Cash Budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started