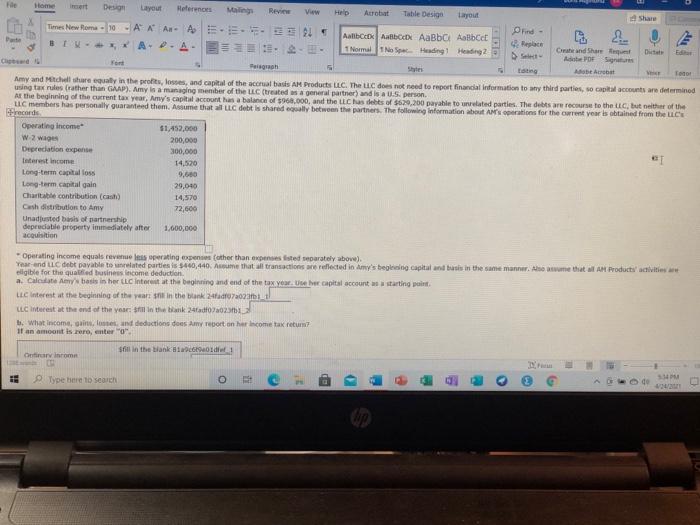

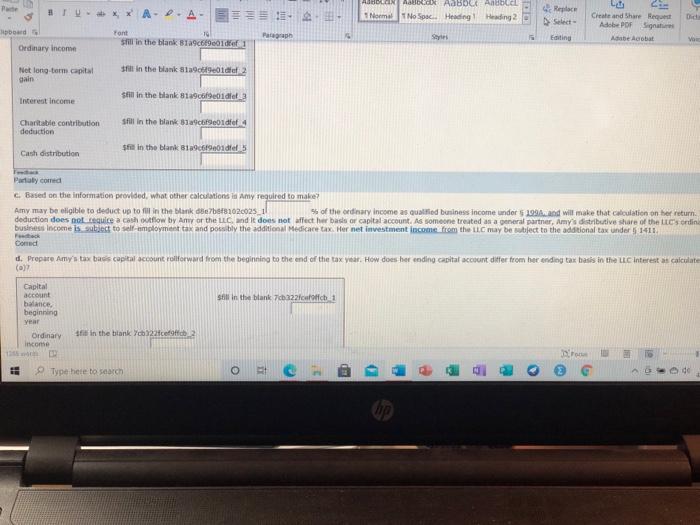

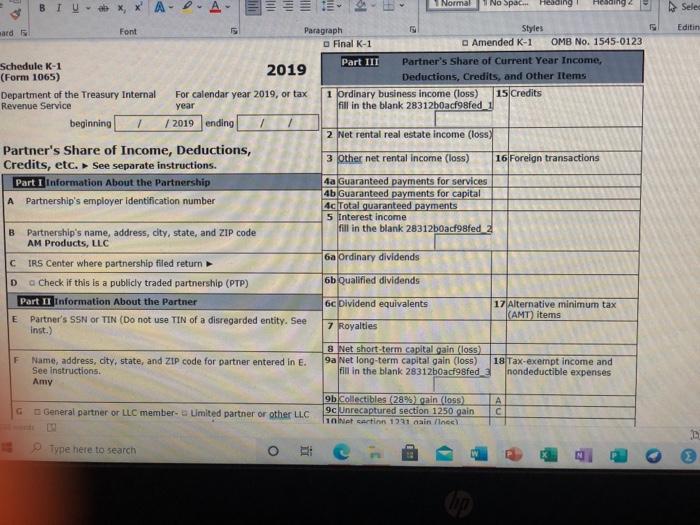

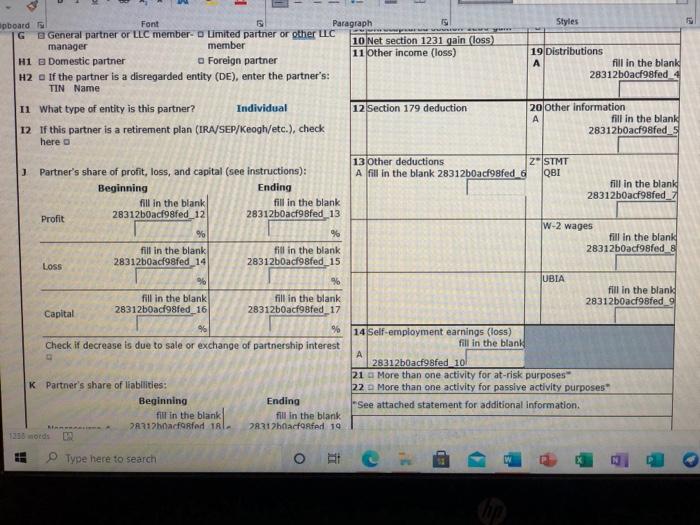

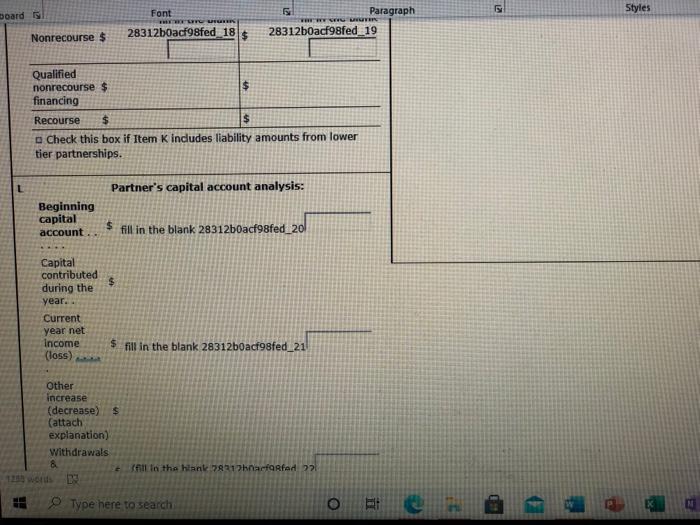

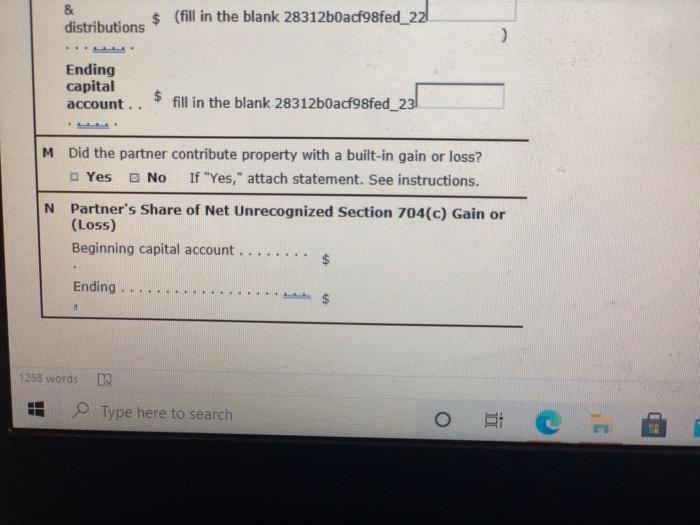

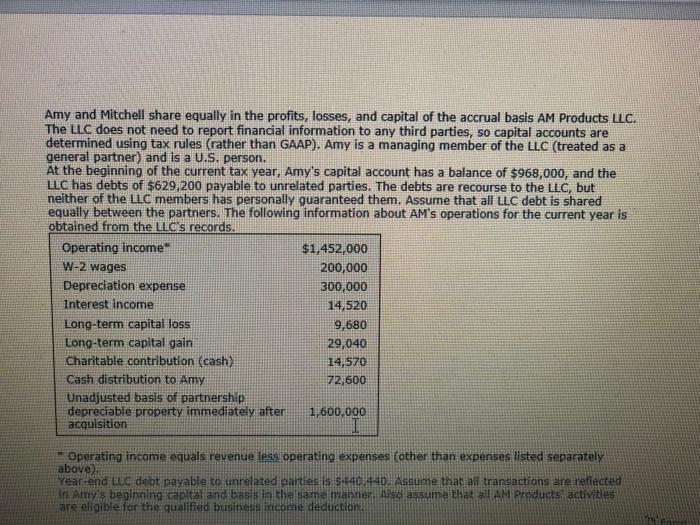

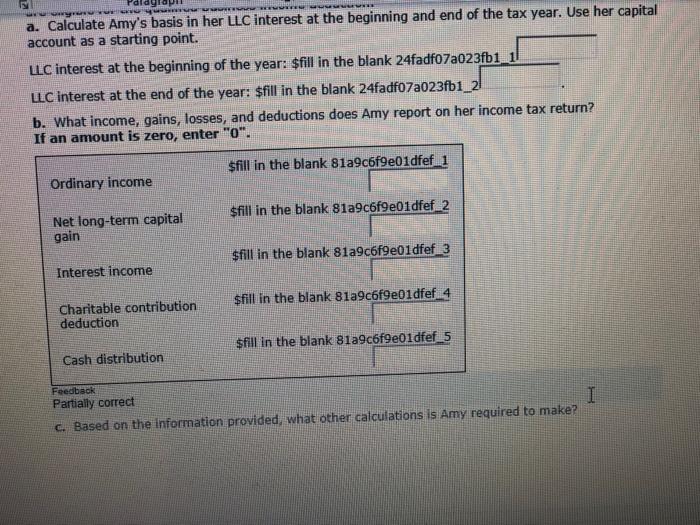

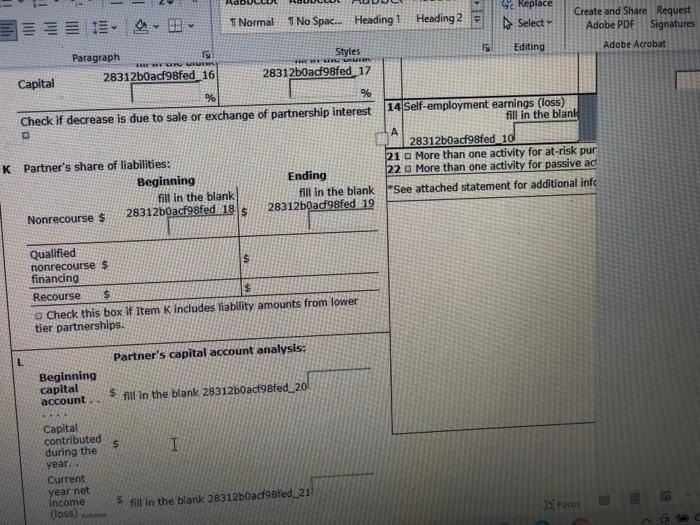

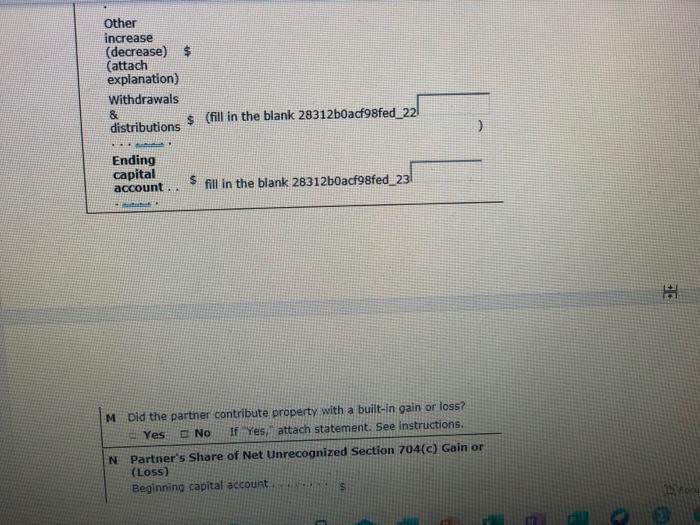

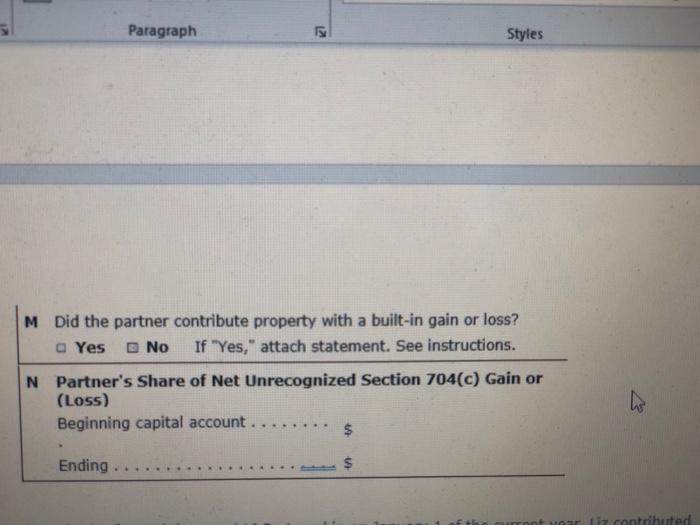

Bome Design Layout Heterenons Mailing Review View Acrobat Table Design Layout Times New Roma - 10-AK A A E... Find - Aalbox Aalbo AaBbc Aalbo ** A-D- A53 1 Normal No Spa Heading: Heading and Share Select POES eigh ting Mobe Acrobat ! Amy and Mitchellstre equally in the profits, losses, and capital of the accrual basis AM Products LLC. The uc does not need to report financial information to my third parties, so capital accounts are determined using tax nules (rather than GAAP). Amy in a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $60,000, and the LLC has debts of $520,200 payable to related parties. The debts are record to the LLC, but neither of the LLC members has personally guaranteed them. Assume that alluc debt is shared ally between the partners. The following information about Actions for the current year is obtained from the Les records Operating income $1,453,000 W-2 Wigs 200,000 Depreciation expense 300,000 Interest income 14,520 Long-term capital loss 9,600 Long-term capital gain 29,040 Charitable contribution (cash) 14,570 Cashbutions to Any Unadjusted basis of partnership depredable property immediately after 1,000,000 acquisition 72,500 Operating income equals revenue les operating expenses (other than expenses listed separately above). Year-end debt payable to related parties is $440,440. Assume that all transactions are reflected in Amy's been capital and buss in the same manner. Aeth AR Products activities eligible for the quared business income deduction a. Calcite Ambasis in her interest at the beginning and end of the tax yeu le capital account starting point LLC interest at the beginning of the years in the bank 207202a LLC Interest at the end of the years in the bank 240002 b. What income, and deduction does Abort on her income tax return If an amount is zero, enter Sfill in the tank code 1 Orriaron Type bere to search O AP Od 54 1 ARDLAIN ASCOX AaboC Andel Normal No Spac. Heading! Heading 2 Did | | | HP x x 4 - 6 A - , Doud Tont Sfill in the blank Bia9c69001 of 1 Ordinary income LU Create and Share Request Adobe PDF Signa Adobe Acrobat Sys vo fill in the blank Blac9e0de2 Net long-term capital Gain still in the blank 8129f9e01 del 2 Interest income Sfill in the blank cfseldfet 4 Charitable contribution deduction son in the blank 316ide 5 Cash distribution Paraly.com C. Based on the information provided, what other calculations is Amy required to make Amy may be eligible to deduct up to fill in the blank 8e7b68102.0025_11 5s of the ordinary income as qualified business Income under 193Aand will make that caulation on her return. deduction does not requice a cash flow by Anwar the candle does not affect her basis of capital account. As someone treated as a peneral partner, Amys distributive share of the Les ordin business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the LLC may be subject to the additional tax under 1411, Cound d. Prepare Amy's tax bass capital account rolforward from the beginning to the end of the tax year. How does her ending capital account differ from ber ending tax basis in the LLC Interest as calculate (0) so in the blank 7c322cafoffcb1 Capita account balance beginning Year Ordinary Income fill in the bank 7322cert 2 Type here to search 0 . 2 2 ed James New Roma Aa- BTW-* * A-D-A. = 90 E. 1 Nom No Spa Heading Heading 2 Replace Select- Did Create and Share Request Adobe PD Site Adobe Acroba Pont fill in the Bank 7322feffcb 3 Pagh Se Editing Interest income Net long torm capital gain fill in the blank 7c32fefoffcb_4 fill in the blank 7c322cf9ffcb 5 $fill in the blank 7c322fefoffcb6 Less: Charitable in the blank c22feffcb contribution Cash Fill in the blank 706322fefoffcb distribution to Amy fill in the blank 7122fcb9 Capital account s in the blank 7cb332feffct 10 balance, end of year my's capital account differs from her basis only by the amount of her share of Lucas y correct Using the information from parts (a) to (o) prepare Amy's Schedule X-1 as if you were the prepare of AM Products Les tax retum. Provide all information that Amy needs to the extent you can Enter all amounts as positive numbers. 651119 Type here to search o . X, X A-D-A lili BIU 1 Normal Heading 1 No Space coding 2 Sele Editin ard Font Paragraph Styles Final K-1 Amended K-1 OMB No. 1545-0123 Schedule K-1 Part III Partner's Share of Current Year Income, 2019 (Form 1065) Deductions, Credits, and other Items Department of the Treasury Internal For calendar year 2019, or tax 1 Ordinary business income (loss) 15 Credits Revenue Service year fill in the blank 28312b0acf98fed beginning / / 2019 ending 2 Net rental real estate income (loss) Partner's Share of Income, Deductions, 3 Other net rental Income (loss) 16 Foreign transactions Credits, etc. See separate instructions. Part I Information About the Partnership 4a Guaranteed payments for services Ab Guaranteed payments for capital A Partnership's employer identification number Ac Total guaranteed payments 5 Interest income B Partnership's name, address, city, state, and ZIP code fill in the blank 28312b0acf98fed AM Products, LLC 6aOrdinary dividends CIRS Center where partnership filed return D a Check if this is a publicly traded partnership (PTP) 6b Qualified dividends Part II Information About the Partner 6c Dividend equivalents 17 Alternative minimum tax E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See (AMT) items inst.) 7 Royalties F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Amy 8 Net short-term capital gain (loss) 9aNet long-term capital gain (loss) fill in the blank 28312b0acf98fed 18 Tax-exempt income and nondeductible expenses G General partner or LLC member. Limited partner or other LLC 9b Collectibles (28% gain (loss) 9c Unrecaptured section 1250 gain innet cartinn 1911 cair incel D Type here to search . Styles w G pboard Font Paragraph 15 General partner or LLC member Limited partner or other LLC manager member 10 Net section 1231 gain (loss) 11 Other income (loss) H1 Domestic partner Foreign partner H2 . If the partner is a disregarded entity (DE), enter the partner's: TIN Name 11 What type of entity is this partner? Individual 12 Section 179 deduction 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check 19 Distributions fill in the blank 28312b0acf98fed 20 other information fill in the blank 28312b0acf98fed 5 here o 13 other deductions Z STMT A fill in the blank 28312b0acf98fed 6 QBI fill in the blank 28312b0acf98fed 7 W-2 wages fill in the blank 28312b0acf98fed 8 Partner's share of profit, loss, and capital (see instructions): Beginning Ending fill in the blank fill in the blank Profit 28312b0acf98fed 12 28312b0acf98fed 13 % % fill in the blank fill in the blank Loss 28312b0ac98fed 14 28312b0acf98fed_15 % 96 fill in the blank fill in the blank Capital 28312b0acf98fed 16 28312b0acf98fed_17 96 % Check if decrease is due to sale or exchange of partnership interest UBIA fill in the blank 28312b0acf98fed 9 14 Self-employment earnings (loss) fill in the blank 28312b0acf98fed 10 21 . More than one activity for at-risk purposes 22. More than one activity for passive activity purposes See attached statement for additional information. K Partner's share of liabilities: Beginning fill in the blank 2412hnacforfed tal 1230 mods Ending fill in the blank 78312acforfed 19 Type here to search OR Styles board Font 28312b0acf98fed 18 s LITLURI Paragraph 28312b0acf98fed_19 EVE Nonrecourse $ Qualified nonrecourse $ $ financing Recourse $ $ Check this box if Item Kindudes liability amounts from lower tier partnerships. Partner's capital account analysis: Beginning capital account $ fill in the blank 28312b0acf98fed_20 $ Capital contributed during the year. Current year net Income (loss) $ fill in the blank 28312b0acf98fed_21 Other increase (decrease) $ (attach explanation) Withdrawals & + fill in the blank 18217hnacfarfed 72 D Type here to search & distributions (fill in the blank 28312b0acf98fed_22 Ending capital account fill in the blank 28312b0acf98fed_23 M Did the partner contribute property with a built-in gain or loss? Yes No If "Yes," attach statement. See instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account.. Ending $ 1258 words o Type here to search Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. The LLC does not need to report financial information to any third parties, so capital accounts are determined using tax rules (rather than GAAP). Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $968,000, and the LLC has debts of $629,200 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. Operating income" $1,452,000 W-2 wages 200,000 Depreciation expense 300,000 Interest income 14,520 Long-term capital loss 9,680 Long-term capital gain 29,040 Charitable contribution (cash) 14,570 Cash distribution to Amy 72,600 Unadjusted basis of partnership depreciable property immediately after 1,600,000 acquisition Operating income equals revenue less operating expenses (other than expenses listed separately above), Year-end LLC debt payable to unrelated parties is 5140.440. Assume that all transactions are reflected in Amy's beginning capital and basis in the same manner. Also assume that all AM Products activities are ellable for the qualified business income deduction, YEV NH a. Calculate Amy's basis in her LLC interest at the beginning and end of the tax year. Use her capital account as a starting point. LLC interest at the beginning of the year: $fill in the blank 24fadfo7a023fb1 LLC interest at the end of the year: $fill in the blank 24fadf07a023fb1_21 b. What income, gains, losses, and deductions does Amy report on her income tax return? If an amount is zero, enter "0". sfill in the blank 81a9c5f9e01dfef 1 Ordinary income $fill in the blank 81a9c6f9e01dfef_2 Net long-term capital gain $fill in the blank 81a9c6f9e01dfef 3 Interest income $fill in the blank 81a9c6f9e01dfef 4 Charitable contribution deduction $fill in the blank 81a9c6f9e01dfef 5 Cash distribution I Feedback Partially correct c. Based on the information provided, what other calculations is Amy required to make? Amy may be eligible to deduct up to fill in the blank d8e7b8f8102c025_1 % of the ordinary income as qualified business income under $ 199A, and will make that calculation on her return. This deduction does not require a cash outflow by Amy or the LLC, and it does not affect her basis or capital account. As someone treated as a general partner, Amy's distributive share of the LLC's ordinary business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the LLC may be subject to the additional tax under 1411. Feedback Correct d. Prepare Amy's tax basis capital account rollforward from the beginning to the end of the tax year. How does her ending capital account differ from her ending tax basis in the LLC interest as calculated in part (a)? $fill in the blank 7cb322fcef9ffcb 1 Capital account balance, beginning year Ordinary income Sfill in the blank 7cb322fcef9ffcb 2 fill in the blank 7cb322fcef9ffcb_3 Interest income fill in the blank 7cb322fcef9ffcb 4 Net long- term capital gain fill in the blank 7cb322fcef9ffcb_5 $fill in the blank 7cb322fcef9ffcb_6 Less: Charitable still in the blank 7cb322fcef9ffcb7 canthin Lou l Select Paragraph contribution Styles Editing fill in the blank 7cb322fcef9ffcb 8 Cash distribution to Amy fill in the blank 7cb322fcef9ffcb_9 Capital account $fill in the blank 7cb322fcef9ffcb 10 balance, end of year Amy's capital account differs from her basis only by the amount of her share of LLC liabilities Feedback Partially correct e. Using the information from parts (a) to (d), prepare Amy's Schedule K-1 as if you were the preparer of AM Products LLC's tax return. Provide all information that Amy needs to the extent you can. Enter all amounts as positive numbers. Part 1 Partners Share of cur Deductions, Credits, a Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service beginning 2 2019 For calendar year 2019, or tax Year /2019 ending 1 / 1 Ordinary business income (loss) 15 fill in the blank 28312b0acf98fed_1 2 Net rental real estate income (loss) 3 Other net rental income (loss) 16 Partner's Share of Income, Deductions, Credits, etc. See separate instructions. Part I Information About the Partnership A Partnership's employer identification number 4a Guaranteed payments for services 4b Guaranteed payments for capital 4c Total guaranteed payments 5 Interest income fill in the blank 28312b0acf98fed 3 B Partnership's name, address, city, state, and ZIP code AM Products, LLC 6a Ordinary dividends 6b Qualified dividends IRS Center where partnership filed return D Check if this is a publidy traded partnership (PTP) Part II Information About the Partner E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See inst.) 6c Dividend equivalents 17 7 Royalties F 18 8 Net short-term capital gain (loss) 9a Net long-term capital gain (loss) fill in the blank 28312b0acf9sfed Name, address, city, state, and ZIP code for partner entered in E. See instructions. Amy C G General partner or LLC member- Limited partner or other LLC manager member HI Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE), enter the partner's: 9b Collectibles (2896) gain (loss) 9c Unrecaptured section 1250 gain 10 Net section 1231 gain loss) 11 Other income (loss) 19 A Focus IM AaBDCCDC AaBb CDC Heading 1 Heading 2 1 Normal 1 No Space s Replace Select Create and She Adobe PDF Paragraph TIN Name Styles Editing Adobe 12 Section 179 deduction 11 What type of entity is this partner? Individual 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here 20 A 3 2 13 other deductions A fill in the blank 28312b0acf98fed d Partner's share of profit, loss, and capital (see instructions): Beginning Ending fill in the blank fill in the blank Profit 28312b0acf98fed 12 28312b0acf98fed 13 % % fill in the blank 2831PbQacf98fed 14 fill in the blank 28312b0acf9Bfed 15 Sc Replace Select 1 Normal 1 No Spac... Heading 1 Heading 2 Create and Share Request Adobe PDF Signatures Adobe Acrobat Editing TEC EL Paragraph Styles Capital 28312b0acf98fed 16 28312b0ad98fed 17 % % Check if decrease is due to sale or exchange of partnership interest 14 Self-employment earnings (loss) fill in the blank K Partner's share of liabilities: Beginning fill in the blank Nonrecourse $ 28312b0acf98fed 18 5 28312b0acf98fed_10 21 More than one activity for at-risk pur 22 More than one activity for passive ad See attached statement for additional info Ending fill in the blank 28312b0acf98fed 19 Qualified nonrecourse $ financing Recourse $ $ Check this box if Item K Includes liability amounts from lower tier partnerships. L Partner's capital account analysis: Beginning capital account $ fill in the blank 28312b0acf98fed_20 $ I Capital contributed during the year. Current year net Income fill in the blank 28312b0ad98fed_21 rout (105) Other increase (decrease) $ (attach explanation) Withdrawals & $(fill in the blank 28312b0acf98fed_221 distributions ) Ending capital account fill in the blank 28312b0acf98fed_23 alt M Did the partner contribute property with a built-in gain or loss? Yes No If Yes, attach statement. See Instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account S Paragraph KI Styles M Did the partner contribute property with a built-in gain or loss? a Yes No If "Yes," attach statement. See instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account.. $ $ Ending $ 11 ributed Bome Design Layout Heterenons Mailing Review View Acrobat Table Design Layout Times New Roma - 10-AK A A E... Find - Aalbox Aalbo AaBbc Aalbo ** A-D- A53 1 Normal No Spa Heading: Heading and Share Select POES eigh ting Mobe Acrobat ! Amy and Mitchellstre equally in the profits, losses, and capital of the accrual basis AM Products LLC. The uc does not need to report financial information to my third parties, so capital accounts are determined using tax nules (rather than GAAP). Amy in a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $60,000, and the LLC has debts of $520,200 payable to related parties. The debts are record to the LLC, but neither of the LLC members has personally guaranteed them. Assume that alluc debt is shared ally between the partners. The following information about Actions for the current year is obtained from the Les records Operating income $1,453,000 W-2 Wigs 200,000 Depreciation expense 300,000 Interest income 14,520 Long-term capital loss 9,600 Long-term capital gain 29,040 Charitable contribution (cash) 14,570 Cashbutions to Any Unadjusted basis of partnership depredable property immediately after 1,000,000 acquisition 72,500 Operating income equals revenue les operating expenses (other than expenses listed separately above). Year-end debt payable to related parties is $440,440. Assume that all transactions are reflected in Amy's been capital and buss in the same manner. Aeth AR Products activities eligible for the quared business income deduction a. Calcite Ambasis in her interest at the beginning and end of the tax yeu le capital account starting point LLC interest at the beginning of the years in the bank 207202a LLC Interest at the end of the years in the bank 240002 b. What income, and deduction does Abort on her income tax return If an amount is zero, enter Sfill in the tank code 1 Orriaron Type bere to search O AP Od 54 1 ARDLAIN ASCOX AaboC Andel Normal No Spac. Heading! Heading 2 Did | | | HP x x 4 - 6 A - , Doud Tont Sfill in the blank Bia9c69001 of 1 Ordinary income LU Create and Share Request Adobe PDF Signa Adobe Acrobat Sys vo fill in the blank Blac9e0de2 Net long-term capital Gain still in the blank 8129f9e01 del 2 Interest income Sfill in the blank cfseldfet 4 Charitable contribution deduction son in the blank 316ide 5 Cash distribution Paraly.com C. Based on the information provided, what other calculations is Amy required to make Amy may be eligible to deduct up to fill in the blank 8e7b68102.0025_11 5s of the ordinary income as qualified business Income under 193Aand will make that caulation on her return. deduction does not requice a cash flow by Anwar the candle does not affect her basis of capital account. As someone treated as a peneral partner, Amys distributive share of the Les ordin business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the LLC may be subject to the additional tax under 1411, Cound d. Prepare Amy's tax bass capital account rolforward from the beginning to the end of the tax year. How does her ending capital account differ from ber ending tax basis in the LLC Interest as calculate (0) so in the blank 7c322cafoffcb1 Capita account balance beginning Year Ordinary Income fill in the bank 7322cert 2 Type here to search 0 . 2 2 ed James New Roma Aa- BTW-* * A-D-A. = 90 E. 1 Nom No Spa Heading Heading 2 Replace Select- Did Create and Share Request Adobe PD Site Adobe Acroba Pont fill in the Bank 7322feffcb 3 Pagh Se Editing Interest income Net long torm capital gain fill in the blank 7c32fefoffcb_4 fill in the blank 7c322cf9ffcb 5 $fill in the blank 7c322fefoffcb6 Less: Charitable in the blank c22feffcb contribution Cash Fill in the blank 706322fefoffcb distribution to Amy fill in the blank 7122fcb9 Capital account s in the blank 7cb332feffct 10 balance, end of year my's capital account differs from her basis only by the amount of her share of Lucas y correct Using the information from parts (a) to (o) prepare Amy's Schedule X-1 as if you were the prepare of AM Products Les tax retum. Provide all information that Amy needs to the extent you can Enter all amounts as positive numbers. 651119 Type here to search o . X, X A-D-A lili BIU 1 Normal Heading 1 No Space coding 2 Sele Editin ard Font Paragraph Styles Final K-1 Amended K-1 OMB No. 1545-0123 Schedule K-1 Part III Partner's Share of Current Year Income, 2019 (Form 1065) Deductions, Credits, and other Items Department of the Treasury Internal For calendar year 2019, or tax 1 Ordinary business income (loss) 15 Credits Revenue Service year fill in the blank 28312b0acf98fed beginning / / 2019 ending 2 Net rental real estate income (loss) Partner's Share of Income, Deductions, 3 Other net rental Income (loss) 16 Foreign transactions Credits, etc. See separate instructions. Part I Information About the Partnership 4a Guaranteed payments for services Ab Guaranteed payments for capital A Partnership's employer identification number Ac Total guaranteed payments 5 Interest income B Partnership's name, address, city, state, and ZIP code fill in the blank 28312b0acf98fed AM Products, LLC 6aOrdinary dividends CIRS Center where partnership filed return D a Check if this is a publicly traded partnership (PTP) 6b Qualified dividends Part II Information About the Partner 6c Dividend equivalents 17 Alternative minimum tax E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See (AMT) items inst.) 7 Royalties F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Amy 8 Net short-term capital gain (loss) 9aNet long-term capital gain (loss) fill in the blank 28312b0acf98fed 18 Tax-exempt income and nondeductible expenses G General partner or LLC member. Limited partner or other LLC 9b Collectibles (28% gain (loss) 9c Unrecaptured section 1250 gain innet cartinn 1911 cair incel D Type here to search . Styles w G pboard Font Paragraph 15 General partner or LLC member Limited partner or other LLC manager member 10 Net section 1231 gain (loss) 11 Other income (loss) H1 Domestic partner Foreign partner H2 . If the partner is a disregarded entity (DE), enter the partner's: TIN Name 11 What type of entity is this partner? Individual 12 Section 179 deduction 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check 19 Distributions fill in the blank 28312b0acf98fed 20 other information fill in the blank 28312b0acf98fed 5 here o 13 other deductions Z STMT A fill in the blank 28312b0acf98fed 6 QBI fill in the blank 28312b0acf98fed 7 W-2 wages fill in the blank 28312b0acf98fed 8 Partner's share of profit, loss, and capital (see instructions): Beginning Ending fill in the blank fill in the blank Profit 28312b0acf98fed 12 28312b0acf98fed 13 % % fill in the blank fill in the blank Loss 28312b0ac98fed 14 28312b0acf98fed_15 % 96 fill in the blank fill in the blank Capital 28312b0acf98fed 16 28312b0acf98fed_17 96 % Check if decrease is due to sale or exchange of partnership interest UBIA fill in the blank 28312b0acf98fed 9 14 Self-employment earnings (loss) fill in the blank 28312b0acf98fed 10 21 . More than one activity for at-risk purposes 22. More than one activity for passive activity purposes See attached statement for additional information. K Partner's share of liabilities: Beginning fill in the blank 2412hnacforfed tal 1230 mods Ending fill in the blank 78312acforfed 19 Type here to search OR Styles board Font 28312b0acf98fed 18 s LITLURI Paragraph 28312b0acf98fed_19 EVE Nonrecourse $ Qualified nonrecourse $ $ financing Recourse $ $ Check this box if Item Kindudes liability amounts from lower tier partnerships. Partner's capital account analysis: Beginning capital account $ fill in the blank 28312b0acf98fed_20 $ Capital contributed during the year. Current year net Income (loss) $ fill in the blank 28312b0acf98fed_21 Other increase (decrease) $ (attach explanation) Withdrawals & + fill in the blank 18217hnacfarfed 72 D Type here to search & distributions (fill in the blank 28312b0acf98fed_22 Ending capital account fill in the blank 28312b0acf98fed_23 M Did the partner contribute property with a built-in gain or loss? Yes No If "Yes," attach statement. See instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account.. Ending $ 1258 words o Type here to search Amy and Mitchell share equally in the profits, losses, and capital of the accrual basis AM Products LLC. The LLC does not need to report financial information to any third parties, so capital accounts are determined using tax rules (rather than GAAP). Amy is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Amy's capital account has a balance of $968,000, and the LLC has debts of $629,200 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC debt is shared equally between the partners. The following information about AM's operations for the current year is obtained from the LLC's records. Operating income" $1,452,000 W-2 wages 200,000 Depreciation expense 300,000 Interest income 14,520 Long-term capital loss 9,680 Long-term capital gain 29,040 Charitable contribution (cash) 14,570 Cash distribution to Amy 72,600 Unadjusted basis of partnership depreciable property immediately after 1,600,000 acquisition Operating income equals revenue less operating expenses (other than expenses listed separately above), Year-end LLC debt payable to unrelated parties is 5140.440. Assume that all transactions are reflected in Amy's beginning capital and basis in the same manner. Also assume that all AM Products activities are ellable for the qualified business income deduction, YEV NH a. Calculate Amy's basis in her LLC interest at the beginning and end of the tax year. Use her capital account as a starting point. LLC interest at the beginning of the year: $fill in the blank 24fadfo7a023fb1 LLC interest at the end of the year: $fill in the blank 24fadf07a023fb1_21 b. What income, gains, losses, and deductions does Amy report on her income tax return? If an amount is zero, enter "0". sfill in the blank 81a9c5f9e01dfef 1 Ordinary income $fill in the blank 81a9c6f9e01dfef_2 Net long-term capital gain $fill in the blank 81a9c6f9e01dfef 3 Interest income $fill in the blank 81a9c6f9e01dfef 4 Charitable contribution deduction $fill in the blank 81a9c6f9e01dfef 5 Cash distribution I Feedback Partially correct c. Based on the information provided, what other calculations is Amy required to make? Amy may be eligible to deduct up to fill in the blank d8e7b8f8102c025_1 % of the ordinary income as qualified business income under $ 199A, and will make that calculation on her return. This deduction does not require a cash outflow by Amy or the LLC, and it does not affect her basis or capital account. As someone treated as a general partner, Amy's distributive share of the LLC's ordinary business income is subject to self-employment tax and possibly the additional Medicare tax. Her net investment income from the LLC may be subject to the additional tax under 1411. Feedback Correct d. Prepare Amy's tax basis capital account rollforward from the beginning to the end of the tax year. How does her ending capital account differ from her ending tax basis in the LLC interest as calculated in part (a)? $fill in the blank 7cb322fcef9ffcb 1 Capital account balance, beginning year Ordinary income Sfill in the blank 7cb322fcef9ffcb 2 fill in the blank 7cb322fcef9ffcb_3 Interest income fill in the blank 7cb322fcef9ffcb 4 Net long- term capital gain fill in the blank 7cb322fcef9ffcb_5 $fill in the blank 7cb322fcef9ffcb_6 Less: Charitable still in the blank 7cb322fcef9ffcb7 canthin Lou l Select Paragraph contribution Styles Editing fill in the blank 7cb322fcef9ffcb 8 Cash distribution to Amy fill in the blank 7cb322fcef9ffcb_9 Capital account $fill in the blank 7cb322fcef9ffcb 10 balance, end of year Amy's capital account differs from her basis only by the amount of her share of LLC liabilities Feedback Partially correct e. Using the information from parts (a) to (d), prepare Amy's Schedule K-1 as if you were the preparer of AM Products LLC's tax return. Provide all information that Amy needs to the extent you can. Enter all amounts as positive numbers. Part 1 Partners Share of cur Deductions, Credits, a Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service beginning 2 2019 For calendar year 2019, or tax Year /2019 ending 1 / 1 Ordinary business income (loss) 15 fill in the blank 28312b0acf98fed_1 2 Net rental real estate income (loss) 3 Other net rental income (loss) 16 Partner's Share of Income, Deductions, Credits, etc. See separate instructions. Part I Information About the Partnership A Partnership's employer identification number 4a Guaranteed payments for services 4b Guaranteed payments for capital 4c Total guaranteed payments 5 Interest income fill in the blank 28312b0acf98fed 3 B Partnership's name, address, city, state, and ZIP code AM Products, LLC 6a Ordinary dividends 6b Qualified dividends IRS Center where partnership filed return D Check if this is a publidy traded partnership (PTP) Part II Information About the Partner E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See inst.) 6c Dividend equivalents 17 7 Royalties F 18 8 Net short-term capital gain (loss) 9a Net long-term capital gain (loss) fill in the blank 28312b0acf9sfed Name, address, city, state, and ZIP code for partner entered in E. See instructions. Amy C G General partner or LLC member- Limited partner or other LLC manager member HI Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE), enter the partner's: 9b Collectibles (2896) gain (loss) 9c Unrecaptured section 1250 gain 10 Net section 1231 gain loss) 11 Other income (loss) 19 A Focus IM AaBDCCDC AaBb CDC Heading 1 Heading 2 1 Normal 1 No Space s Replace Select Create and She Adobe PDF Paragraph TIN Name Styles Editing Adobe 12 Section 179 deduction 11 What type of entity is this partner? Individual 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here 20 A 3 2 13 other deductions A fill in the blank 28312b0acf98fed d Partner's share of profit, loss, and capital (see instructions): Beginning Ending fill in the blank fill in the blank Profit 28312b0acf98fed 12 28312b0acf98fed 13 % % fill in the blank 2831PbQacf98fed 14 fill in the blank 28312b0acf9Bfed 15 Sc Replace Select 1 Normal 1 No Spac... Heading 1 Heading 2 Create and Share Request Adobe PDF Signatures Adobe Acrobat Editing TEC EL Paragraph Styles Capital 28312b0acf98fed 16 28312b0ad98fed 17 % % Check if decrease is due to sale or exchange of partnership interest 14 Self-employment earnings (loss) fill in the blank K Partner's share of liabilities: Beginning fill in the blank Nonrecourse $ 28312b0acf98fed 18 5 28312b0acf98fed_10 21 More than one activity for at-risk pur 22 More than one activity for passive ad See attached statement for additional info Ending fill in the blank 28312b0acf98fed 19 Qualified nonrecourse $ financing Recourse $ $ Check this box if Item K Includes liability amounts from lower tier partnerships. L Partner's capital account analysis: Beginning capital account $ fill in the blank 28312b0acf98fed_20 $ I Capital contributed during the year. Current year net Income fill in the blank 28312b0ad98fed_21 rout (105) Other increase (decrease) $ (attach explanation) Withdrawals & $(fill in the blank 28312b0acf98fed_221 distributions ) Ending capital account fill in the blank 28312b0acf98fed_23 alt M Did the partner contribute property with a built-in gain or loss? Yes No If Yes, attach statement. See Instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account S Paragraph KI Styles M Did the partner contribute property with a built-in gain or loss? a Yes No If "Yes," attach statement. See instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning capital account.. $ $ Ending $ 11 ributed