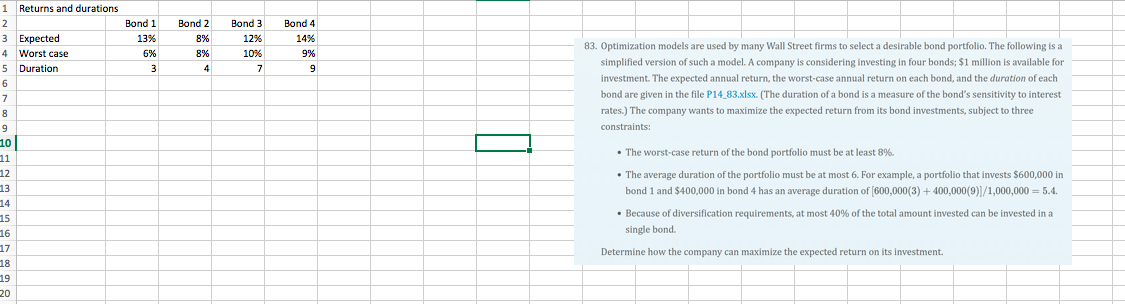

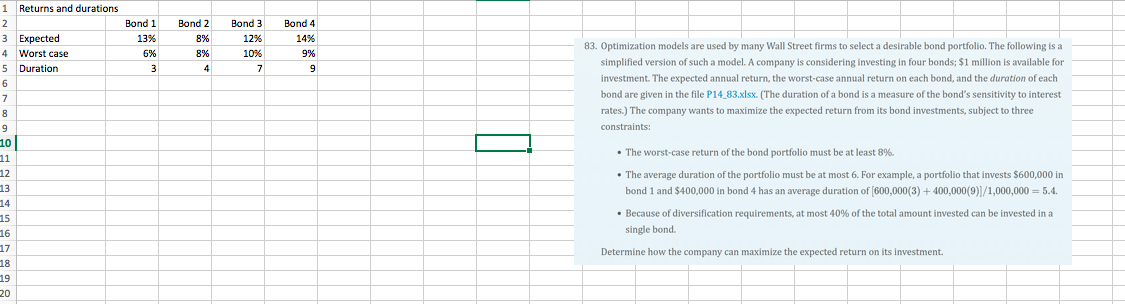

Bond 3 Bond 1 13% 6% Bond 2 8% Bond 4 14% 9% 9 12% 10% 7 8% 4 83. Optimization models are used by many Wall Street firms to select a desirable bond portfolio. The following is a simplified version of such a model. A company is considering investing in four bonds: $1 million is available for investment. The expected annual return, the worst-case annual return on each bond, and the duration of each bond are given in the file P14_83.xlsx. (The duration of a bond is a measure of the bond's sensitivity to interest rates.) The company wants to maximize the expected return from its bond investments, subject to three constraints: 1 Returns and durations 2 3 Expected 4 Worst case 5 Duration 6 7 8 8 9 10 | 11 12 13 14 15 16 17 18 19 20 The worst-case return of the bond portfolio must be at least 8%. The average duration of the portfolio must be at most 6. For example, a portfolio that invests $600,000 in bond 1 and $400,000 in bond 4 has an average duration of (600,000(3) + 400,000(9)]/1,000,000 = 5.4. Because of diversification requirements, at most 40% of the total amount invested can be invested in a single bond Determine how the company can maximize the expected return o its investment Bond 3 Bond 1 13% 6% Bond 2 8% Bond 4 14% 9% 9 12% 10% 7 8% 4 83. Optimization models are used by many Wall Street firms to select a desirable bond portfolio. The following is a simplified version of such a model. A company is considering investing in four bonds: $1 million is available for investment. The expected annual return, the worst-case annual return on each bond, and the duration of each bond are given in the file P14_83.xlsx. (The duration of a bond is a measure of the bond's sensitivity to interest rates.) The company wants to maximize the expected return from its bond investments, subject to three constraints: 1 Returns and durations 2 3 Expected 4 Worst case 5 Duration 6 7 8 8 9 10 | 11 12 13 14 15 16 17 18 19 20 The worst-case return of the bond portfolio must be at least 8%. The average duration of the portfolio must be at most 6. For example, a portfolio that invests $600,000 in bond 1 and $400,000 in bond 4 has an average duration of (600,000(3) + 400,000(9)]/1,000,000 = 5.4. Because of diversification requirements, at most 40% of the total amount invested can be invested in a single bond Determine how the company can maximize the expected return o its investment