Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bond a has a coupon rate of 10.52 percent, a yield to maturity of 13.96 percent and a face value of $1000. matures in 8

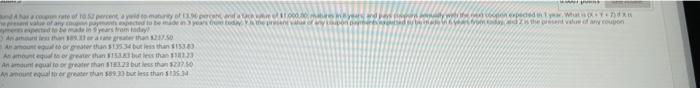

bond a has a coupon rate of 10.52 percent, a yield to maturity of 13.96 percent and a face value of $1000. matures in 8 years. pays coupons annually with the next coupon expected in 1 year. what is (x+y+z) if x is the present value of any coupon payments expected to be made in 3 years from today. y is the present value of any coupon payments expected to be made in 6 years from today, and z is the present balue of any coupon payments expected to be made in 9 years from today?

answers:

to open to Reply w receber the went to andy Ath. Autor 334 but than 150 Asamt watu 13 Anunt than 3 buts 2.0 Art but less than an ammount less than 89.33 or a rate greater than 237.50

an amount wqual to or grater rhan 135.34 but less rhan 153.83

an anount equal to or greater rgan 153.83 but less rhan 183.23

an anount equal to or greater rhan 183.23 but less than 237.50

an anount ewual ro or greatee rhan 89.33 but less than 135.34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started