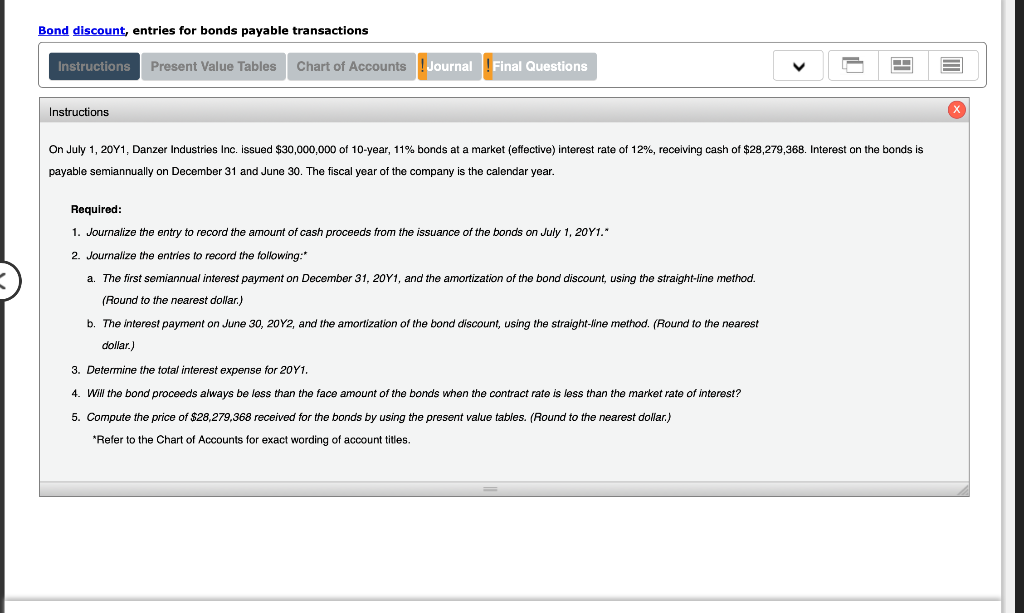

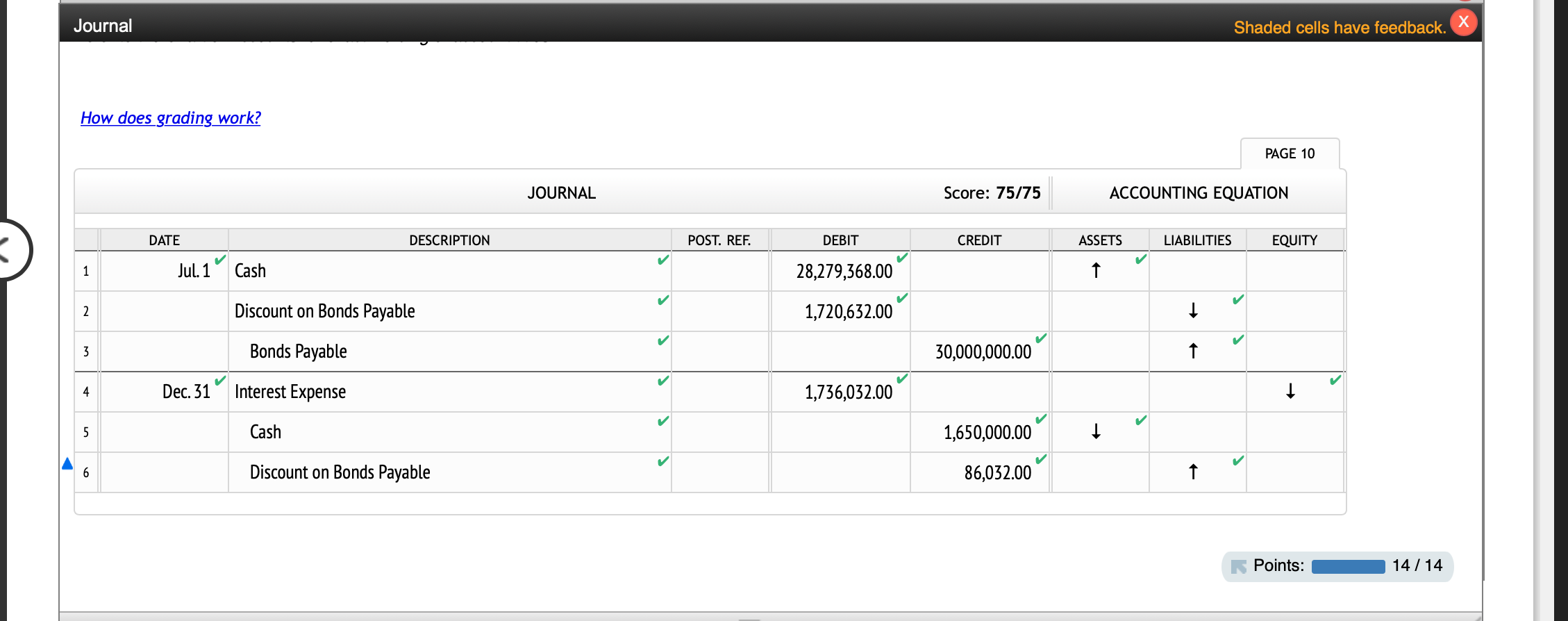

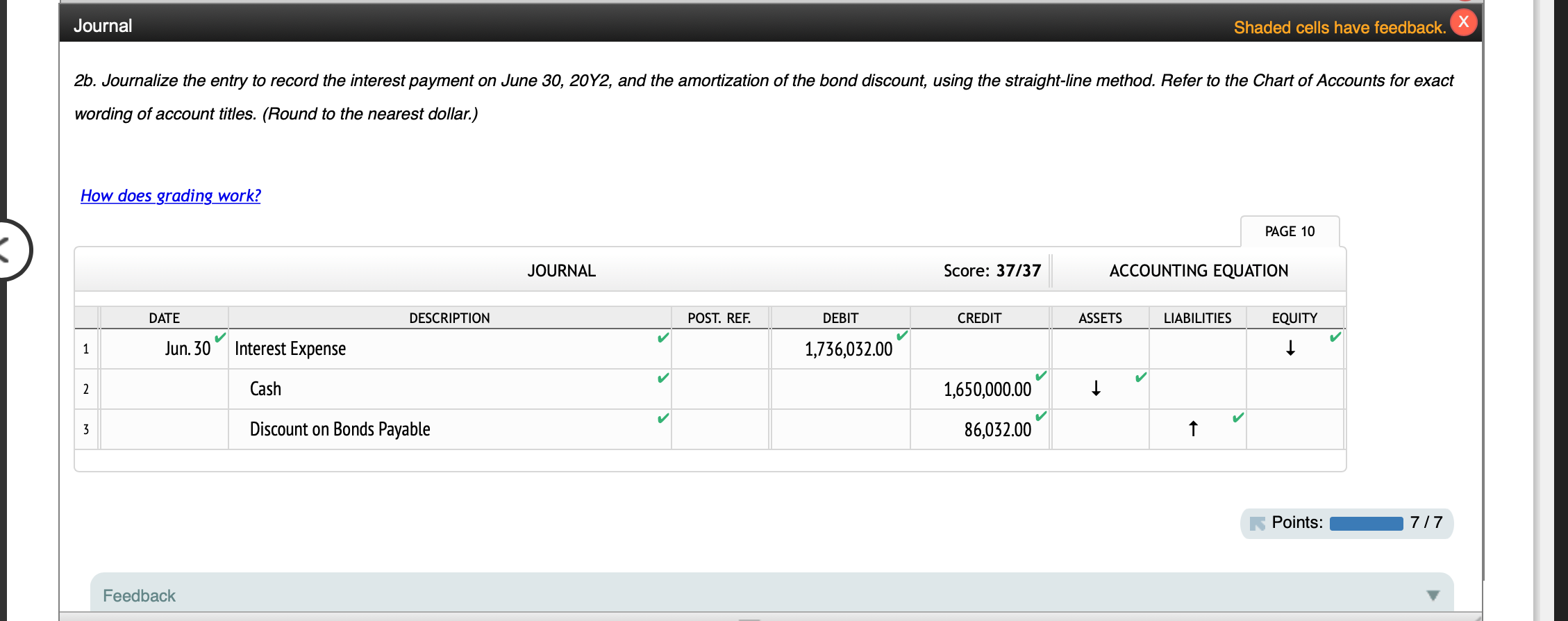

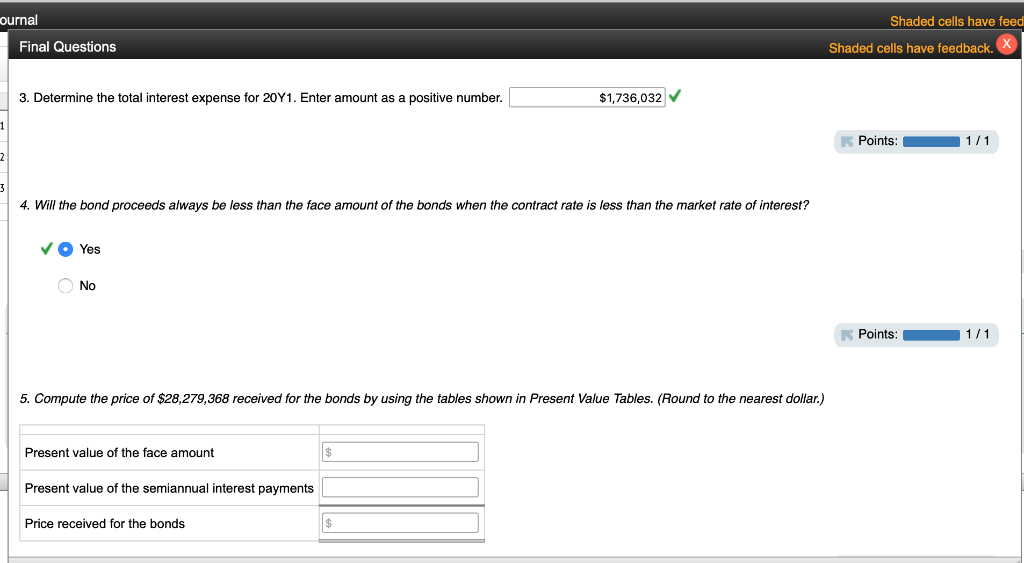

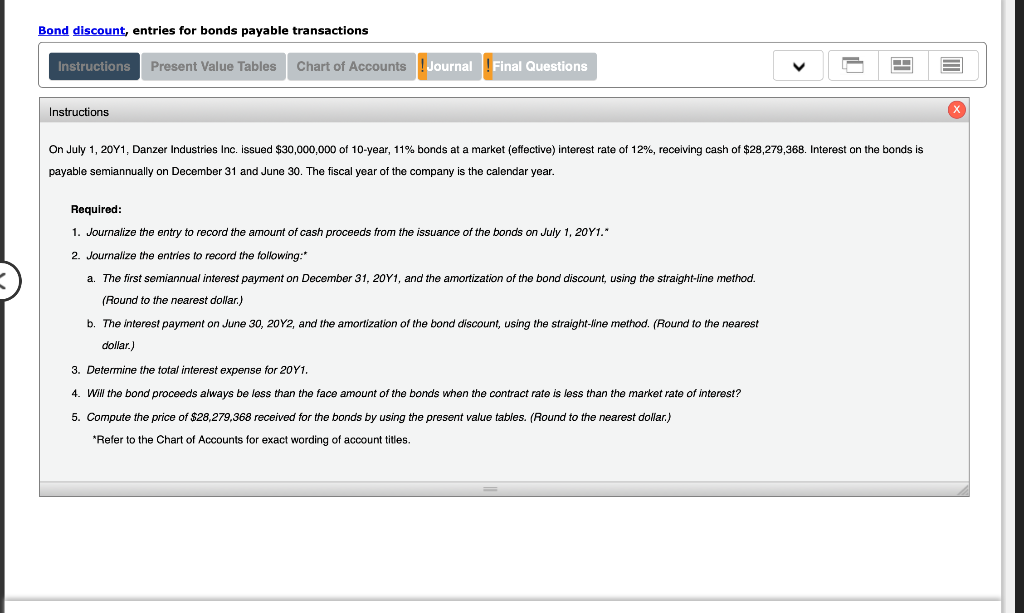

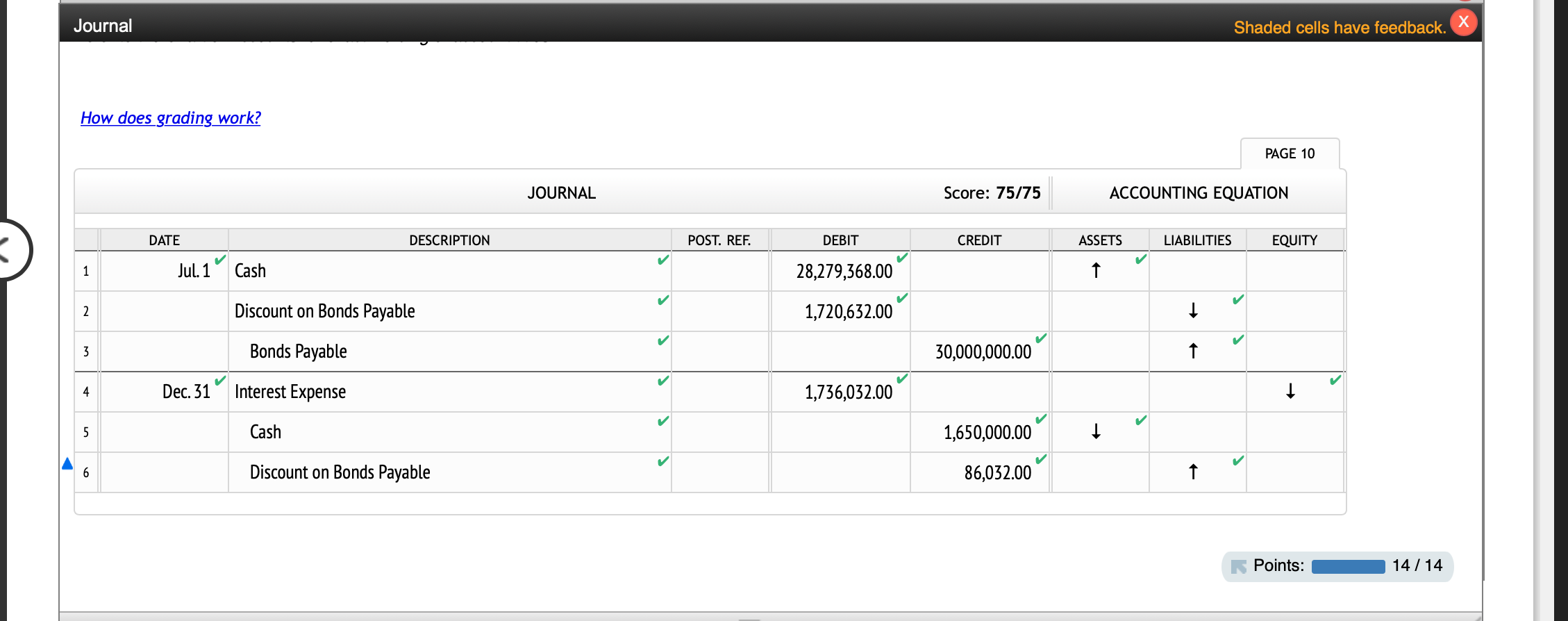

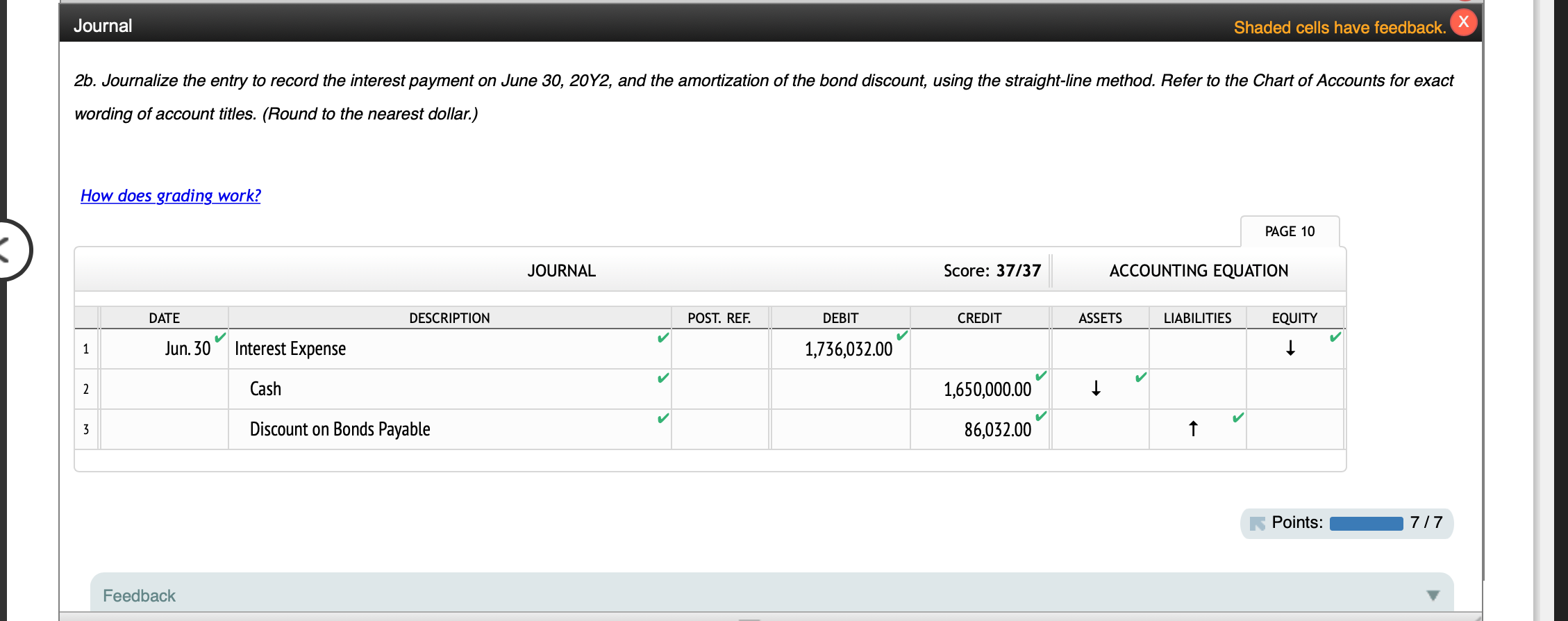

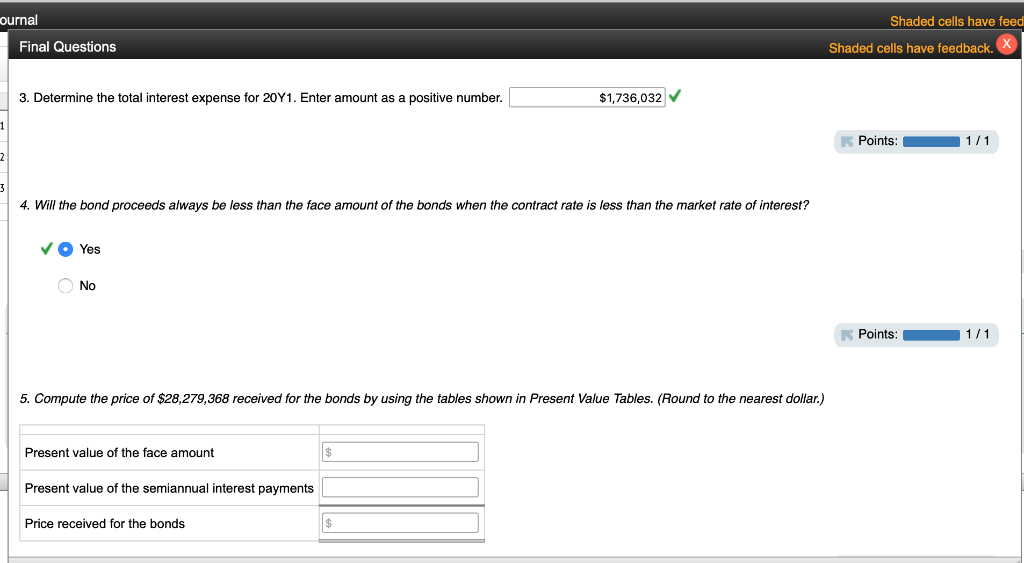

Bond discount, entries for bonds payable transactions ! Journal Instructions Present Value Tables Chart of Accounts !Final Questions X Instructions On July 1, 20Y1, Danzer Industries Inc. issued $30,000,000 of 10-year, 11% bonds at a market (effective) interest rate of 12% , receiving cash of $28,279,368. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 20Y1. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond discount, using the straight-line method (Round to the nearest dollar) b. The interest payment on June 30, 20Y2, and the amortization of the bond discount, using the straight-line method. (Round to the nearest dollar.) 3. Determine the total interest expense for 20Y1. 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? 5. Compute the price of $28,279,368 received for the bonds by using the present value tables. (Round to the nearest dollar.) account titles Refer to the Chart of Accounts for exact wording Journal Shaded cells have feedback. How does grading work? PAGE 10 ACCOUNTING EQUATION JOURNAL Score: 75/75 EQUITY DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES V Jul.1 Cash V 28,279,368.00 Discount on Bonds Payable 1,720,632.00 2 Bonds Payable 1 30,000,000.00 3 Dec. 31 Interest Expense 1,736,032.00 Cash 1,650,000.00 5 Discount on Bonds Payable 1 86,032.00 6 Points: 14 14 Journal Shaded cells have feedback. 2b. Journalize the entry to record the interest payment on June 30, 20Y2, and the amortization of the bond discount, using the straight-line method. Refer to the Chart of Accounts for exact wording of account titles. (Round to the nearest dollar.) How does grading work? PAGE 10 ACCOUNTING EQUATION JOURNAL Score: 37/37 DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY Interest Expense Jun. 30 1,736,032.00 1 Cash 1,650,000.00 2 Discount on Bonds Payable 86,032.00 3 Points: 7/7 Feedback ournal Shaded cells have feed Shaded cells have feedback.X Final Questions $1,736,032 V 3. Determine the total interest expense for 20Y1. Enter amount as a positive number. Points: 1/1 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? Yes No Points 1/1 5. Compute the price of $28,279,368 received for the bonds by using the tables shown in Present Value Tables. (Round to the nearest dollar.) $ Present value of the face amount Present value of the semiannual interest payments $ Price received for the bonds