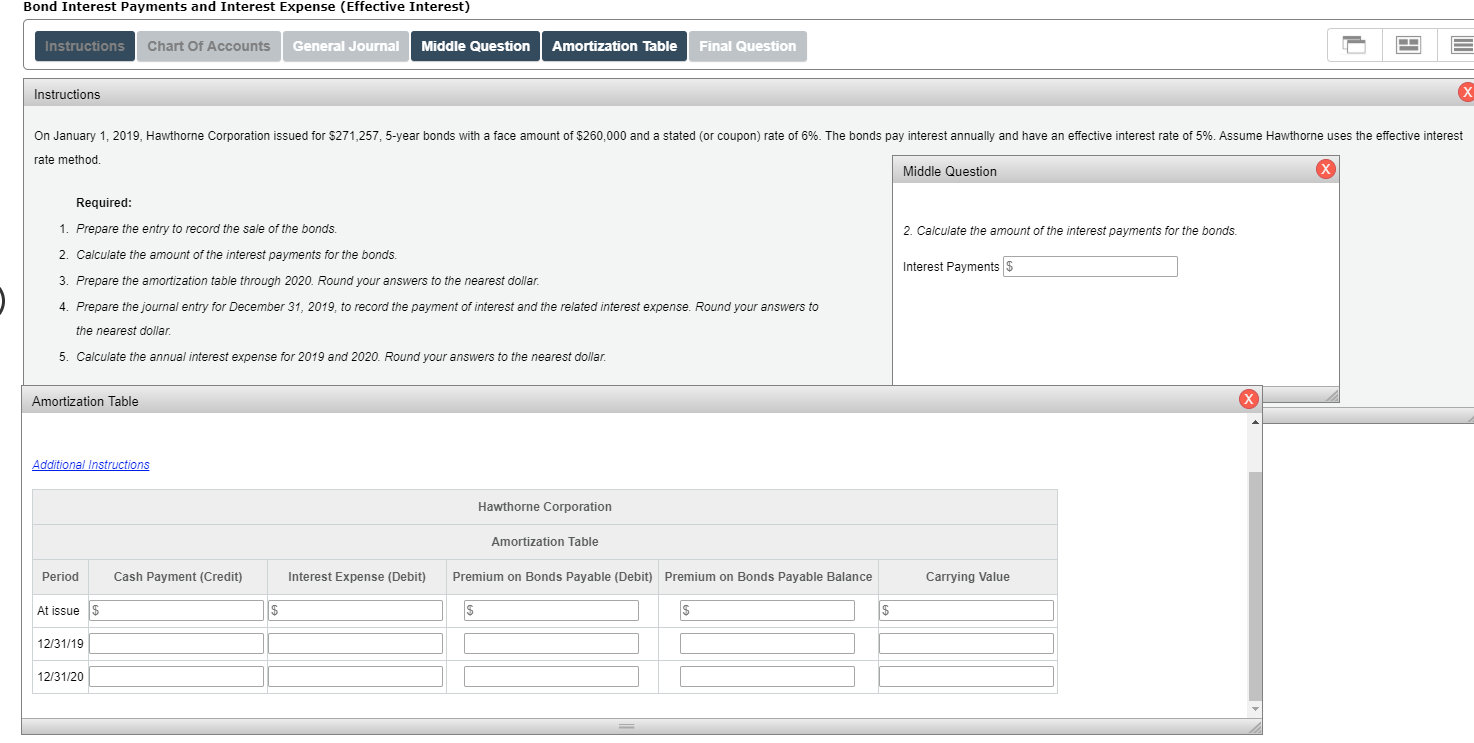

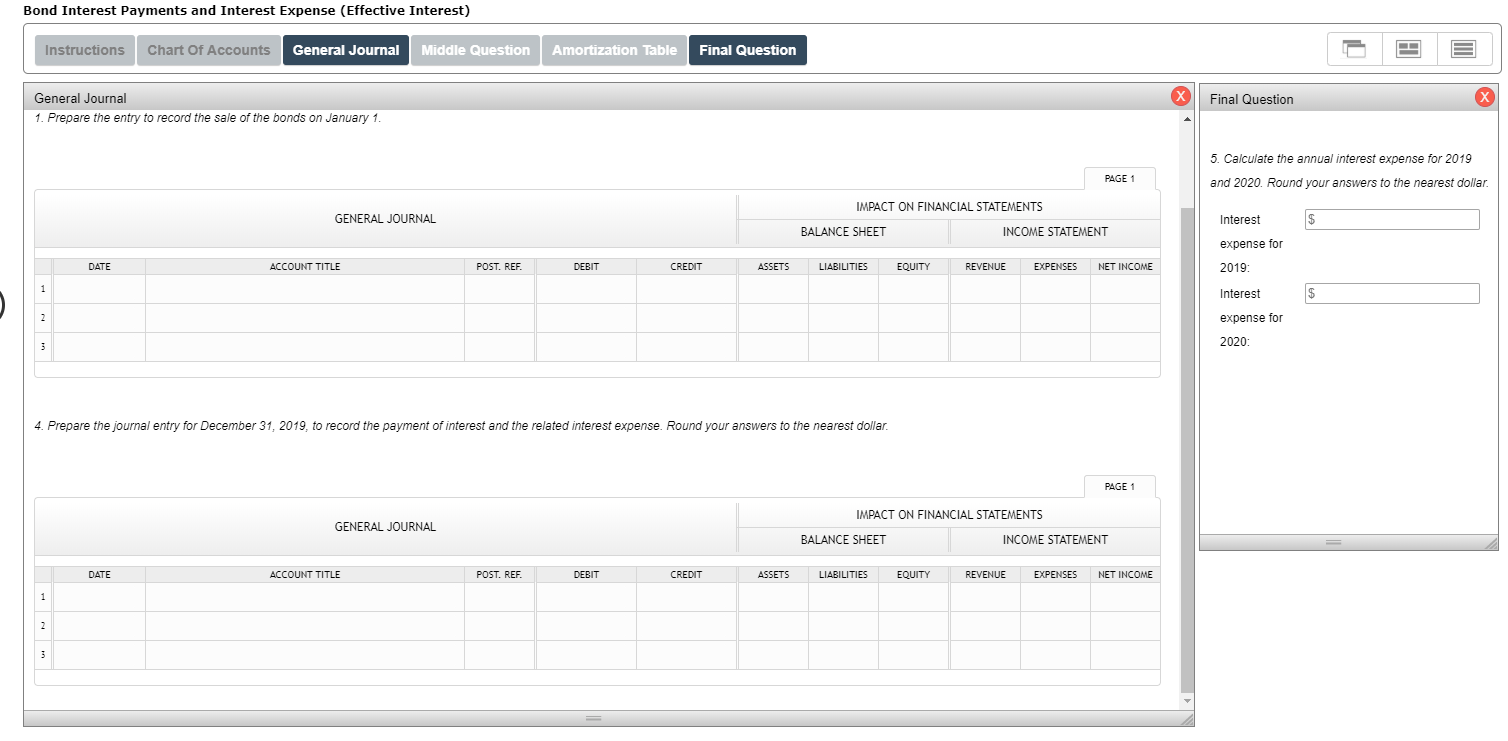

Bond Interest Payments and Interest Expense (Effective Interest) Instructions Chart Of Accounts General Journal Middle Question Amortization Table Final Question Instructions On January 1, 2019, Hawthorne Corporation issued for $271,257, 5-year bonds with a face amount of $260,000 and a stated (or coupon) rate of 6%. The bonds pay interest annually and have an effective interest rate of 5%. Assume Hawthorne uses the effective interest rate method. Middle Question Required: 2. Calculate the amount of the interest payments for the bonds Interest Payments $ 1. Prepare the entry to record the sale of the bonds. 2. Calculate the amount of the interest payments for the bonds. 3. Prepare the amortization table through 2020. Round your answers to the nearest dollar. 4. Prepare the journal entry for December 31, 2019, to record the payment of interest and the related interest expense. Round your answers to the nearest dollar 5. Calculate the annual interest expense for 2019 and 2020. Round your answers to the nearest dollar. Amortization Table Additional Instructions Hawthorne Corporation Amortization Table Period Cash Payment (Credit) Interest Expense (Debit) Premium on Bonds Payable (Debit) Premium on Bonds Payable Balance Carrying Value At issue 12/31/19 12/31/20 Bond Interest Payments and Interest Expense (Effective Interest) Instructions Chart Of Accounts General Journal Middle Question Amortization Table Final Question Final Question General Journal 1. Prepare the entry to record the sale of the bonds on January 1. 5. Calculate the annual interest expense for 2019 and 2020. Round your answers to the nearest dollar PAGE 1 GENERAL JOURNAL IMPACT ON FINANCIAL STATEMENTS BALANCE SHEET INCOME STATEMENT Interests expense for DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY REVENUE EXPENSESN ET INCOME 2019: Interest $ expense for 2020: 4. Prepare the journal entry for December 31, 2019, to record the payment of interest and the related interest expense. Round your answers to the nearest dollar. PAGE 1 GENERAL JOURNAL IMPACT ON FINANCIAL STATEMENTS BALANCE SHEET INCOME STATEMENT DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY REVENUE EXPENSES NET INCOME