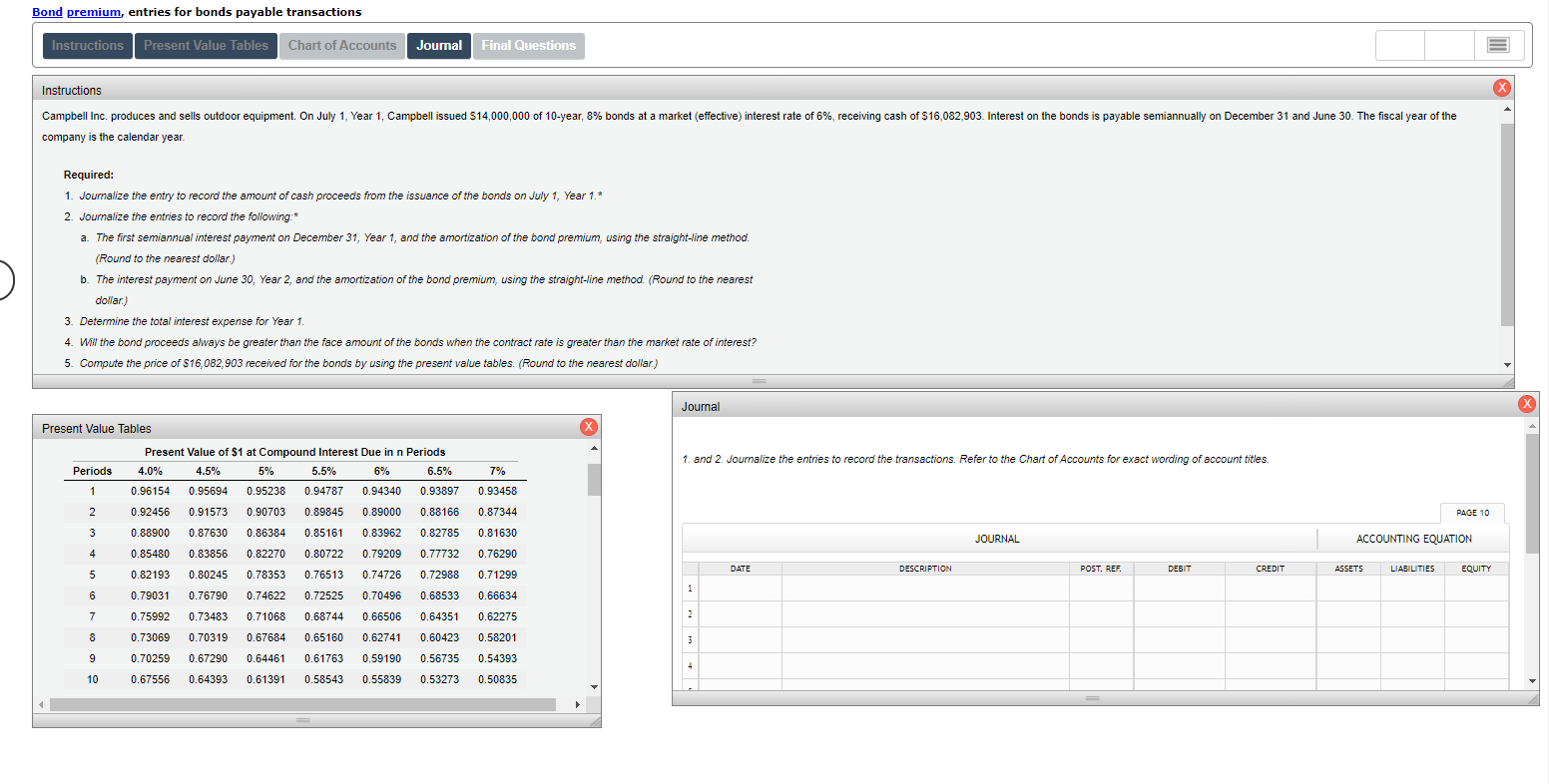

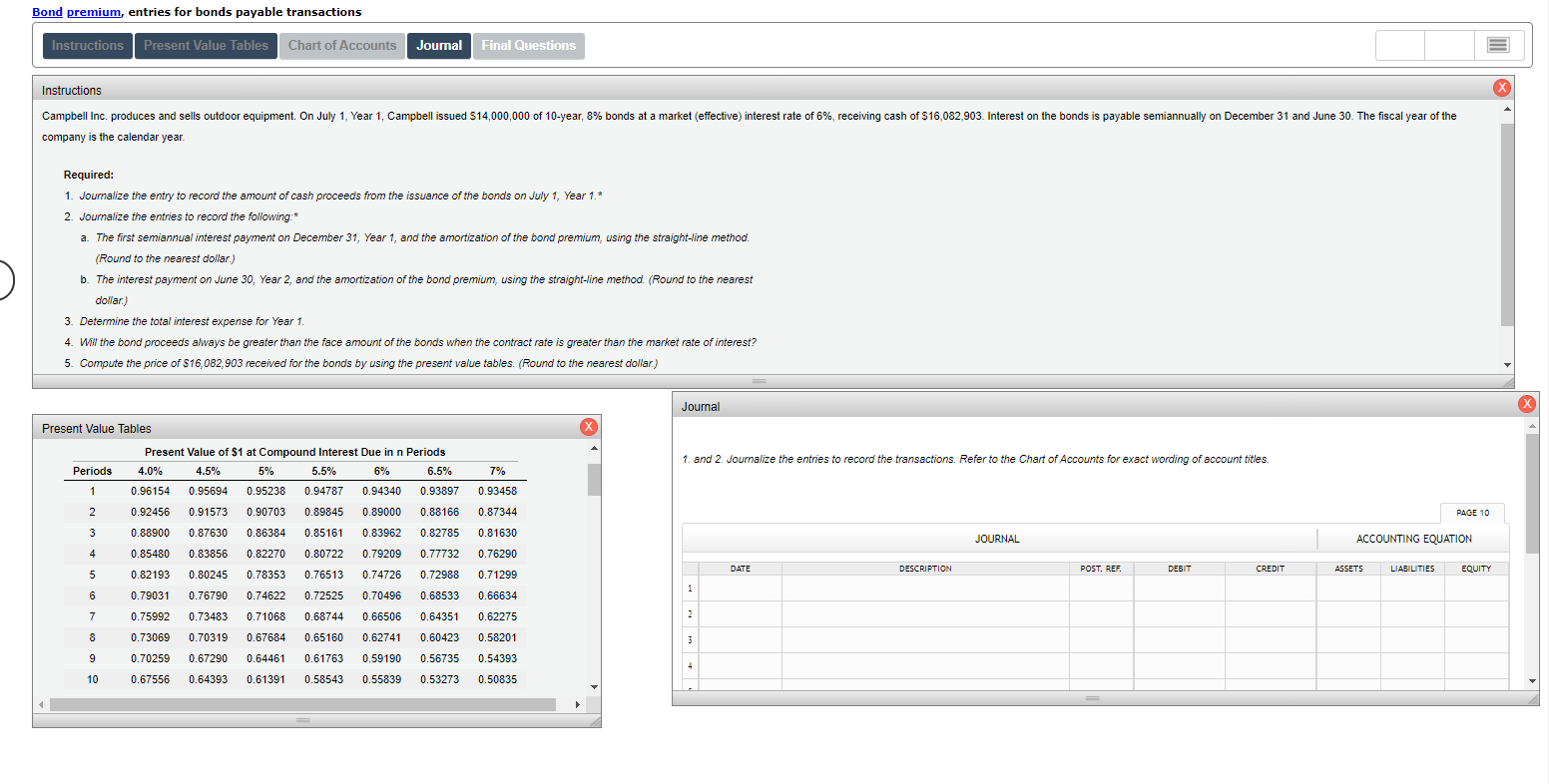

Bond premium, entries for bonds payable transactions Instructions Present Value Tables Chart of Accounts Journal Final Questions Instructions Campbell Inc. produces and sells outdoor equipment. On July 1, Year 1, Campbell issued $14,000,000 of 10-year, 8% bonds at a market (effective) interest rate of 6%, receiving cash of $16,082,903. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.) . b. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar) 3. Determine the total interest expense for Year 1. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? 5. Compute the price of $16,082,903 received for the bonds by using the present value tables. (Round to the nearest dollar.) Journal Present Value Tables X 1. and 2. Journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account titles. Periods 7% 1 Present Value of $1 at Compound Interest Due in n Periods 4.0% 4.5% 5% 5.5% 6% 6.5% 0.96154 0.95694 0.95238 0.94787 0.94340 0.93897 0.92456 0.91573 0.90703 0.89845 0.89000 0.88166 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.93458 2 0.87344 PAGE 10 3 0.81630 JOURNAL ACCOUNTING EQUATION 4 0.85480 0.83856 0.82270 0.80722 0.79209 0.77732 0.76290 DATE DESCRIPTION DEBIT POST. REF. . CREDIT LIABILITIES ASSETS EQUITY 5 0.82193 0.76513 0.80245 0.78353 0.71299 0.74726 0.72988 1 6 0.79031 0.76790 0.74622 0.72525 0.70496 0.68533 0.66634 7 0.75992 0.73483 0.71068 0.68744 0.66506 0.64351 0.62275 2 2 8 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 3 0.60423 0.56735 9 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 4 10 0.67556 0.64393 0.61391 0.58543 0.55839 0.53273 0.50835