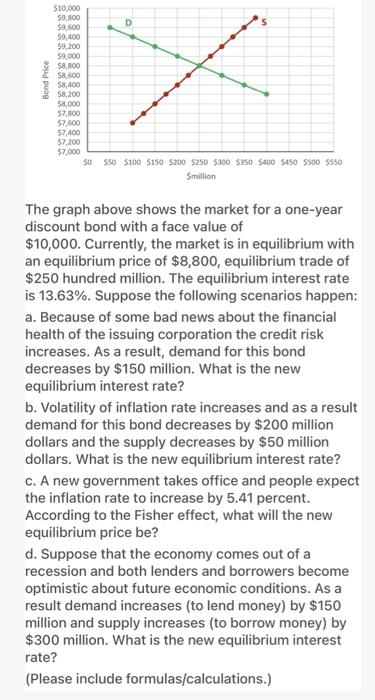

Bond Price $10,000 59,800 $9,600 D 59,400 $9,200 $9,000 $8.800 E $8,600 $8,400 $8,200 $8,000 $7,800 57,600 57,400 57,200 $7,000 $0 $0 $100 $150 $200 $250 $300 $150 SADO SASO $500 $550 Smillion . The graph above shows the market for a one-year discount bond with a face value of $10,000. Currently, the market is in equilibrium with an equilibrium price of $8,800, equilibrium trade of $250 hundred million. The equilibrium interest rate is 13.63%. Suppose the following scenarios happen: a. Because of some bad news about the financial health of the issuing corporation the credit risk increases. As a result, demand for this bond decreases by $150 million. What is the new equilibrium interest rate? b. Volatility of inflation rate increases and as a result demand for this bond decreases by $200 million dollars and the supply decreases by $50 million dollars. What is the new equilibrium interest rate? C. A new government takes office and people expect the inflation rate to increase by 5.41 percent. According to the Fisher effect, what will the new equilibrium price be? d. Suppose that the economy comes out of a recession and both lenders and borrowers become optimistic about future economic conditions. As a result demand increases (to lend money) by $150 million and supply increases (to borrow money) by $300 million. What is the new equilibrium interest rate? (Please include formulas/calculations.) Bond Price $10,000 59,800 $9,600 D 59,400 $9,200 $9,000 $8.800 E $8,600 $8,400 $8,200 $8,000 $7,800 57,600 57,400 57,200 $7,000 $0 $0 $100 $150 $200 $250 $300 $150 SADO SASO $500 $550 Smillion . The graph above shows the market for a one-year discount bond with a face value of $10,000. Currently, the market is in equilibrium with an equilibrium price of $8,800, equilibrium trade of $250 hundred million. The equilibrium interest rate is 13.63%. Suppose the following scenarios happen: a. Because of some bad news about the financial health of the issuing corporation the credit risk increases. As a result, demand for this bond decreases by $150 million. What is the new equilibrium interest rate? b. Volatility of inflation rate increases and as a result demand for this bond decreases by $200 million dollars and the supply decreases by $50 million dollars. What is the new equilibrium interest rate? C. A new government takes office and people expect the inflation rate to increase by 5.41 percent. According to the Fisher effect, what will the new equilibrium price be? d. Suppose that the economy comes out of a recession and both lenders and borrowers become optimistic about future economic conditions. As a result demand increases (to lend money) by $150 million and supply increases (to borrow money) by $300 million. What is the new equilibrium interest rate? (Please include formulas/calculations.)