Answered step by step

Verified Expert Solution

Question

1 Approved Answer

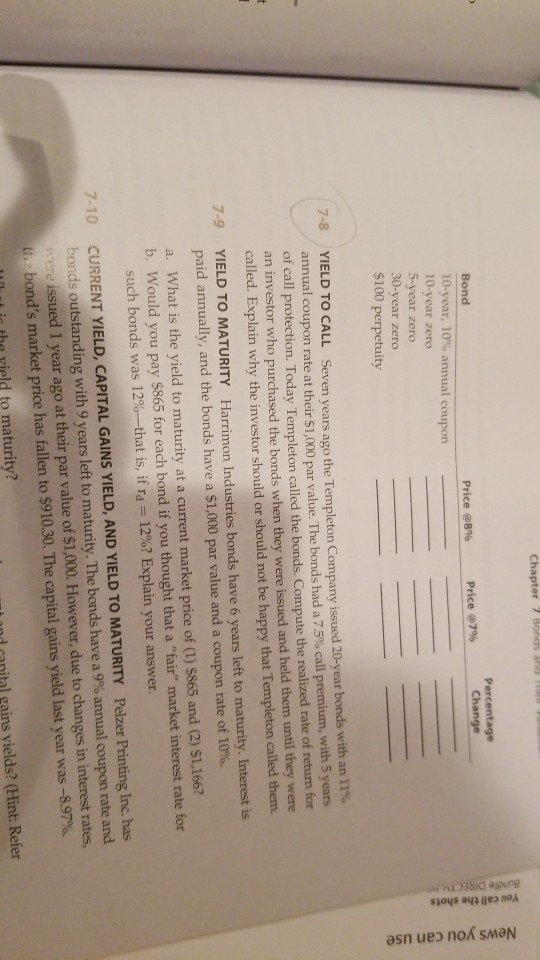

Bond Price @7% 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity 7-8 YIELD TO CALL annual coupon rate at their $1,000

Bond Price @7% 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity 7-8 YIELD TO CALL annual coupon rate at their $1,000 par value. The bonds had a 7.5% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Explain why the investor should or should not be happy that Templeton called them. Seven years ago the Templeton Com pany issued 20-year bonds with an 11% Harrimon Industries bonds have 6 years left to maturity. Interest is YIELD TO MATURITY paid annually, and the bonds have a $1,000 par value and a coupon rate of 10%. 7-9 a. What is the yield to maturity at a current market price of (1) 5865 and (2) $1,166? b. Would you pay $865 for each bond if you thought that a "fair" market interest rate for such bonds was 12%--that is, if rd 12%? Explain your answer. CURRENT YIELD, CAPITAL GAINS YIELD, AND YIELD TO MATURITY Pelzer Printing Inc. has bonds outstanding with 9 years left to maturity. The bonds have a 9% annual coupon rate and 7-10 e issued 1 year ago at their par value of $1,000. However, due to changes in interest rates, u.-bond's market price has fallen to $910.30. The capital gains yield last year was-897 in the vield to maturity? d canital gains yields? (Hint: Refer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started