Question

Bond Pricer: Construct an Excel spread-sheet that uses the input variables below (you may assume realistic values of your choice): Trade date Spot rate curve

Bond Pricer: Construct an Excel spread-sheet that uses the input variables below (you may assume realistic values of your choice):

Trade date

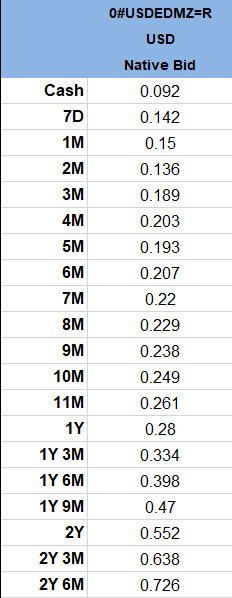

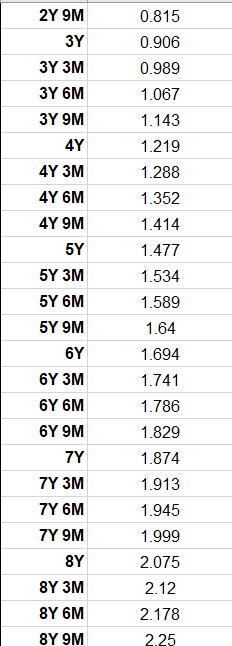

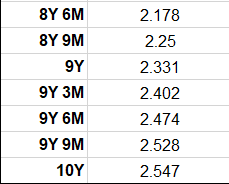

Spot rate curve

Coupon rate

Coupon frequency (semi-annual or annual)

Maturity (up to 10 years)

Current price

(a) Compute the Yield to Maturity (YTM). You may use the built-in excel function to calculate the YTM.

(b) Verify the accuracy of the YtM computed in (a) by recalculating the bond price as a sum of discounted cash-flows (i.e. using the arbitrage-free valuation approach).

Spot rate curve provided below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started