Question

Bond prices and maturity dates. Les Company is about to issue a bond with semiannual coupon payments, an annual coupon rate of 9%, and

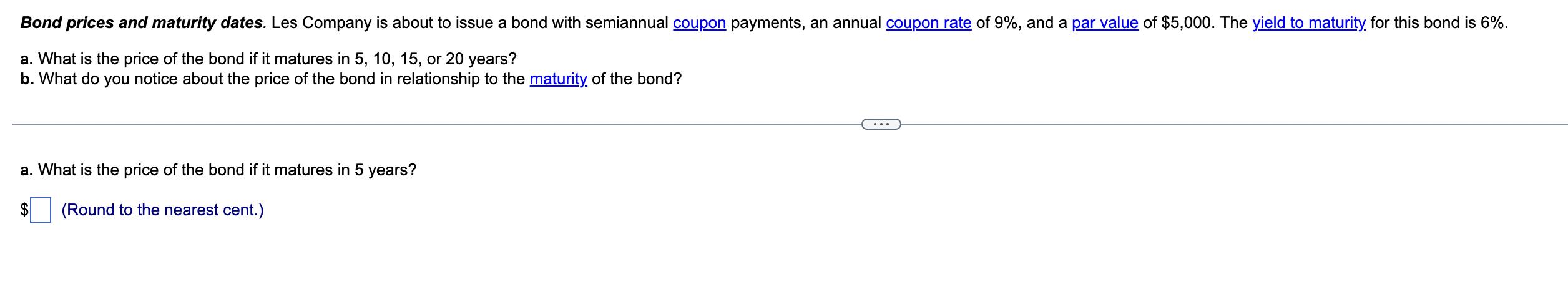

Bond prices and maturity dates. Les Company is about to issue a bond with semiannual coupon payments, an annual coupon rate of 9%, and a par value of $5,000. The yield to maturity for this bond is 6%. a. What is the price of the bond if it matures in 5, 10, 15, or 20 years? b. What do you notice about the price of the bond in relationship to the maturity of the bond? a. What is the price of the bond if it matures in 5 years? $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the price of the bond for Les Company using the yield to maturity YTM formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Core Concepts

Authors: Raymond M Brooks

2nd edition

132671034, 978-0132671033

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App