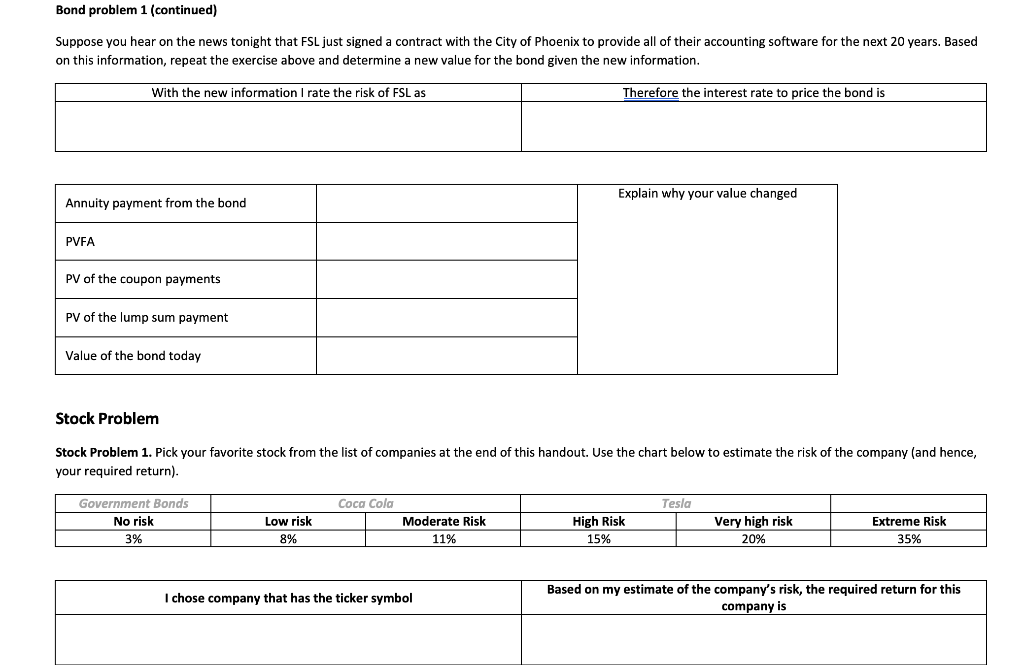

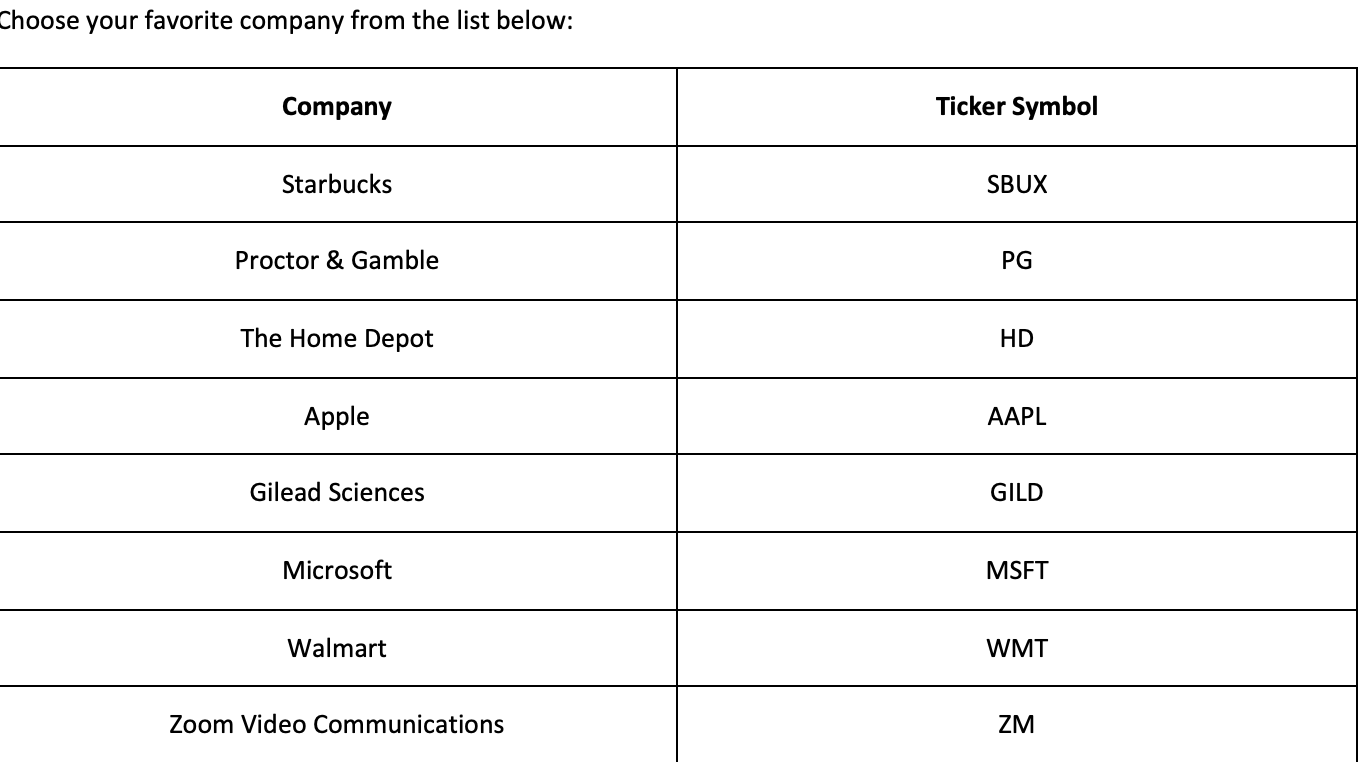

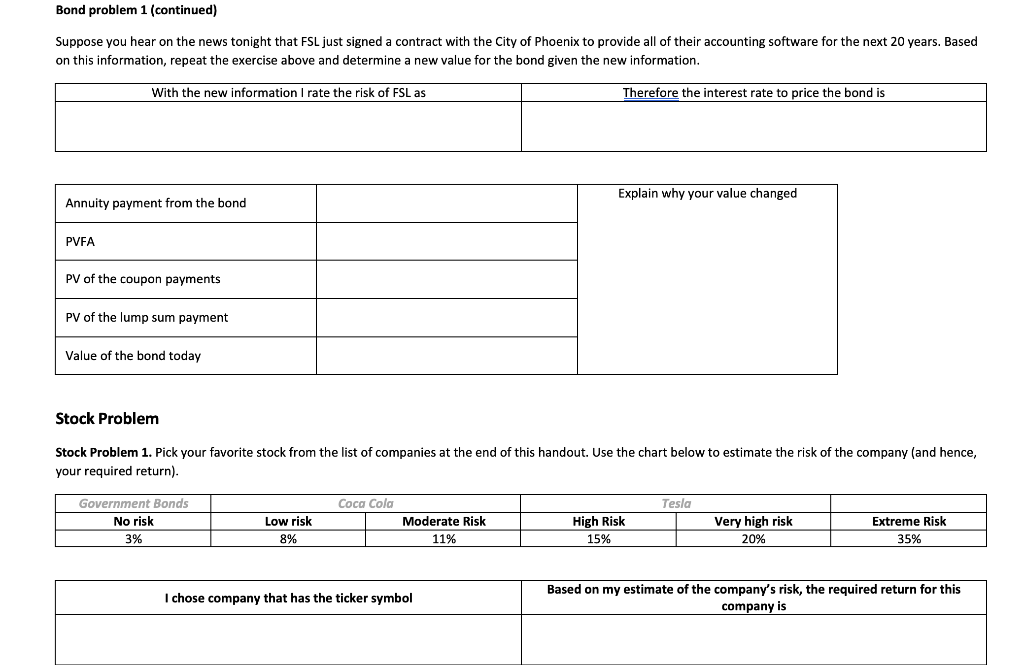

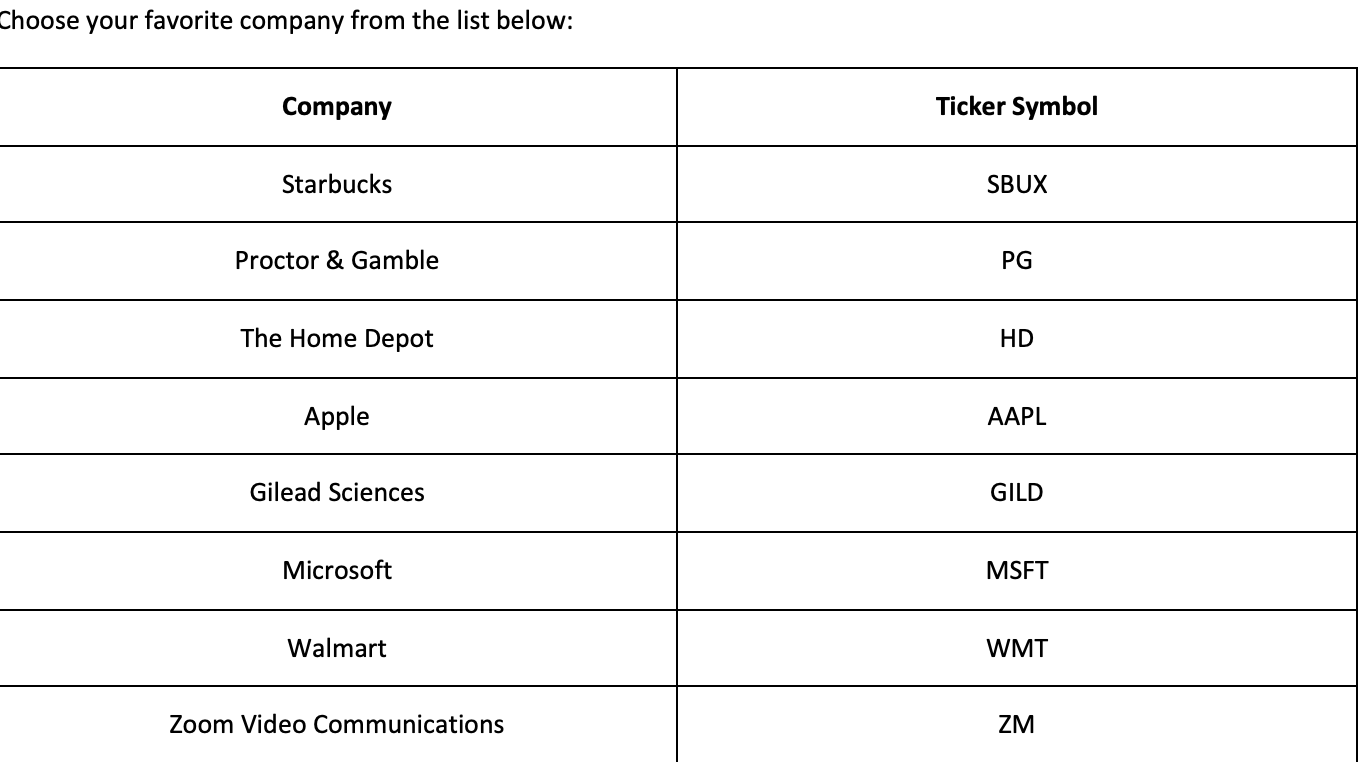

Bond problem 1 (continued) Suppose you hear on the news tonight that FSL just signed a contract with the City of Phoenix to provide all of their accounting software for the next 20 years. Based on this information, repeat the exercise above and determine a new value for the bond given the new information. With the new information I rate the risk of FSL as Therefore the interest rate to price the bond is Explain why your value changed Annuity payment from the bond PVFA PV of the coupon payments PV of the lump sum payment Value of the bond today Stock Problem Stock Problem 1. Pick your favorite stock from the list of companies at the end of this handout. Use the chart below to estimate the risk of the company and hence, your required return). Coca Cola Tesla Government Bonds No risk 3% Low risk 8% Moderate Risk 11% High Risk 15% Very high risk 20% Extreme Risk 35% I chose company that has the ticker symbol Based on my estimate of the company's risk, the required return for this company is Choose your favorite company from the list below: Company Ticker Symbol Starbucks SBUX Proctor & Gamble PG The Home Depot HD Apple AAPL Gilead Sciences GILD Microsoft MSFT Walmart WMT Zoom Video Communications ZM Bond problem 1 (continued) Suppose you hear on the news tonight that FSL just signed a contract with the City of Phoenix to provide all of their accounting software for the next 20 years. Based on this information, repeat the exercise above and determine a new value for the bond given the new information. With the new information I rate the risk of FSL as Therefore the interest rate to price the bond is Explain why your value changed Annuity payment from the bond PVFA PV of the coupon payments PV of the lump sum payment Value of the bond today Stock Problem Stock Problem 1. Pick your favorite stock from the list of companies at the end of this handout. Use the chart below to estimate the risk of the company and hence, your required return). Coca Cola Tesla Government Bonds No risk 3% Low risk 8% Moderate Risk 11% High Risk 15% Very high risk 20% Extreme Risk 35% I chose company that has the ticker symbol Based on my estimate of the company's risk, the required return for this company is Choose your favorite company from the list below: Company Ticker Symbol Starbucks SBUX Proctor & Gamble PG The Home Depot HD Apple AAPL Gilead Sciences GILD Microsoft MSFT Walmart WMT Zoom Video Communications ZM