Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bond ratings Rating agencies - such as Standard & Poor's ( S&P ) , Moody's Investor Service, and the Dominion Bond Rating Service ( DBRS

Bond ratings

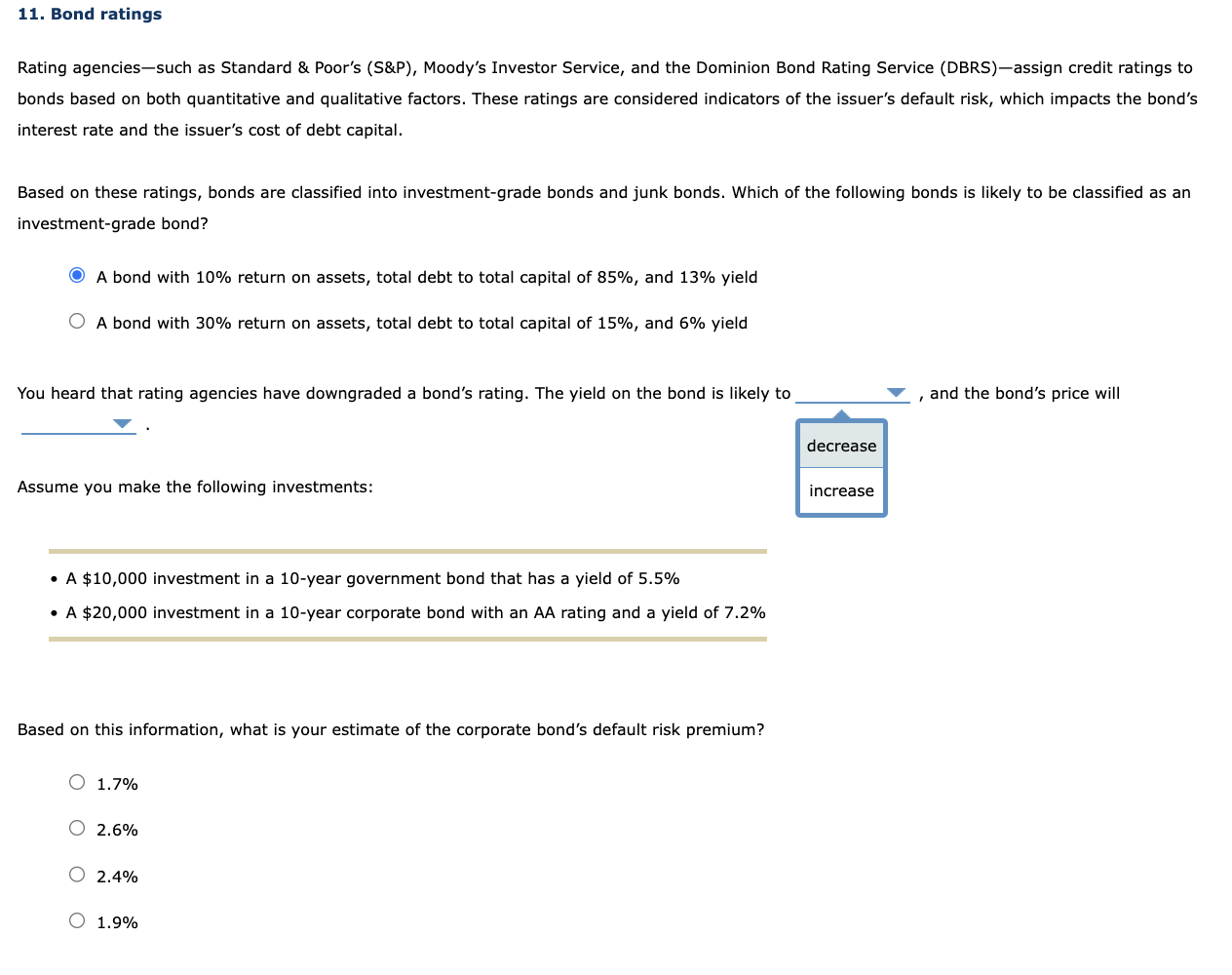

Rating agenciessuch as Standard & Poor's S&P Moody's Investor Service, and the Dominion Bond Rating Service DBRSassign credit ratings to

bonds based on both quantitative and qualitative factors. These ratings are considered indicators of the issuer's default risk, which impacts the bond's

interest rate and the issuer's cost of debt capital.

Based on these ratings, bonds are classified into investmentgrade bonds and junk bonds. Which of the following bonds is likely to be classified as an

investmentgrade bond?

A bond with return on assets, total debt to total capital of and yield

A bond with return on assets, total debt to total capital of and yield

You heard that rating agencies have downgraded a bond's rating. The yield on the bond is likely to

and the bond's price will

Assume you make the following investments:

A $ investment in a year government bond that has a yield of

A $ investment in a year corporate bond with an AA rating and a yield of

Based on this information, what is your estimate of the corporate bond's default risk premium?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started