Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bond Return 1: You bought a $1,000-face 10%-coupon bond that had four years of remaining maturity one year ago. Rates were 10%. You sold the

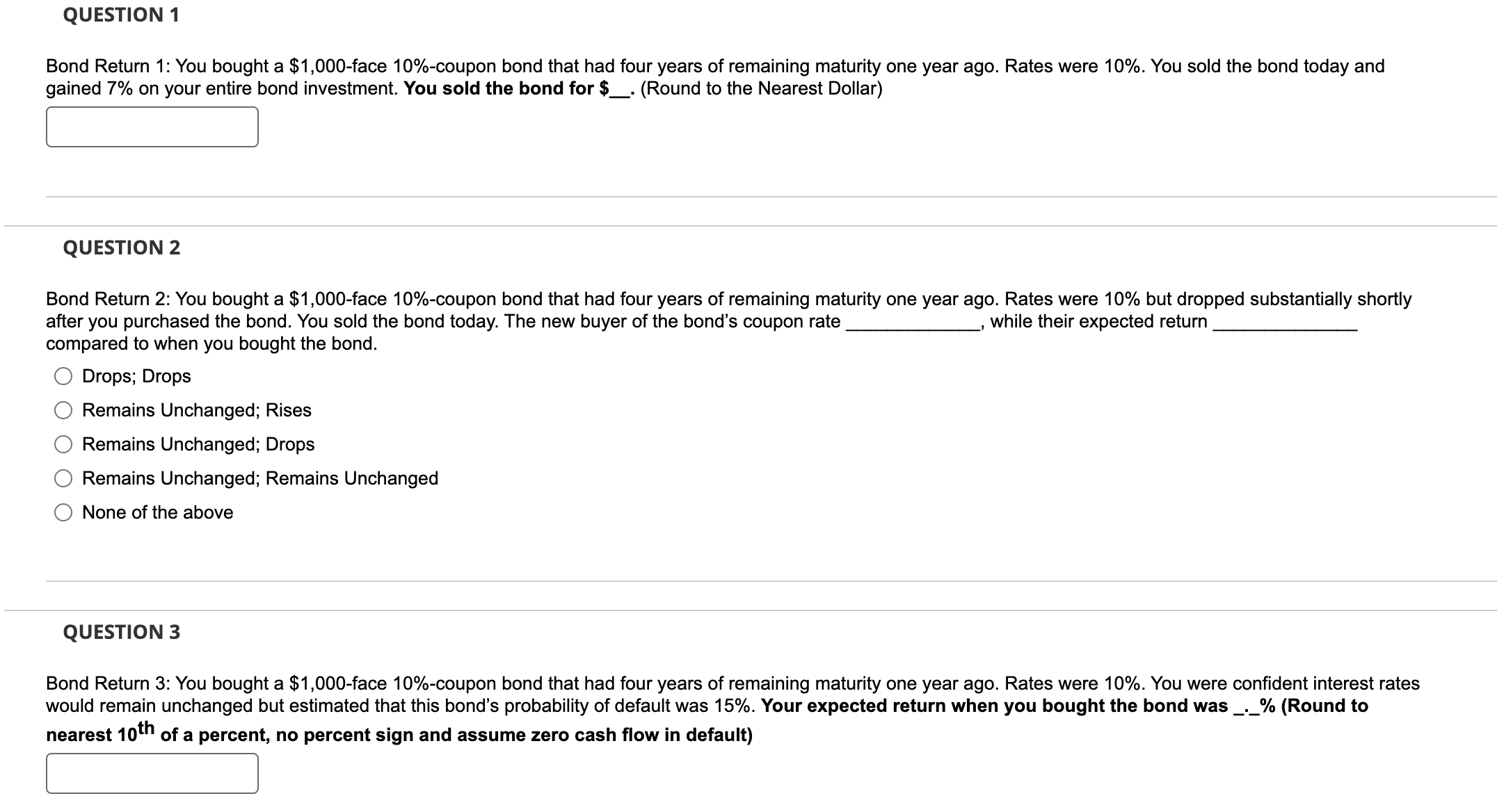

Bond Return 1: You bought a $1,000-face 10%-coupon bond that had four years of remaining maturity one year ago. Rates were 10%. You sold the bond today and gained 7% on your entire bond investment. You sold the bond for \$_. (Round to the Nearest Dollar) QUESTION 2 Bond Return 2: You bought a $1,000-face 10%-coupon bond that had four years of remaining maturity one vear ago. Rates were 10% but dropped substantially shortly after you purchased the bond. You sold the bond today. The new buyer of the bond's coupon rate while their expected return compared to when you bought the bond. Drops; Drops Remains Unchanged; Rises Remains Unchanged; Drops Remains Unchanged; Remains Unchanged None of the above QUESTION 3 Bond Return 3: You bought a \$1,000-face 10\%-coupon bond that had four years of remaining maturity one year ago. Rates were 10%. You were confident interest rates would remain unchanged but estimated that this bond's probability of default was 15%. Your expected return when you bought the bond was _-_ % (Round to nearest 10th of a percent, no percent sign and assume zero cash flow in default)

Bond Return 1: You bought a $1,000-face 10%-coupon bond that had four years of remaining maturity one year ago. Rates were 10%. You sold the bond today and gained 7% on your entire bond investment. You sold the bond for \$_. (Round to the Nearest Dollar) QUESTION 2 Bond Return 2: You bought a $1,000-face 10%-coupon bond that had four years of remaining maturity one vear ago. Rates were 10% but dropped substantially shortly after you purchased the bond. You sold the bond today. The new buyer of the bond's coupon rate while their expected return compared to when you bought the bond. Drops; Drops Remains Unchanged; Rises Remains Unchanged; Drops Remains Unchanged; Remains Unchanged None of the above QUESTION 3 Bond Return 3: You bought a \$1,000-face 10\%-coupon bond that had four years of remaining maturity one year ago. Rates were 10%. You were confident interest rates would remain unchanged but estimated that this bond's probability of default was 15%. Your expected return when you bought the bond was _-_ % (Round to nearest 10th of a percent, no percent sign and assume zero cash flow in default) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started