Bond Valuation

Bond A has a 9% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond B has a 10% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond C has an 8% annual coupon, matures in 12 years, and has a $1,000 face value

Each bond has a yield to maturity of 9%.

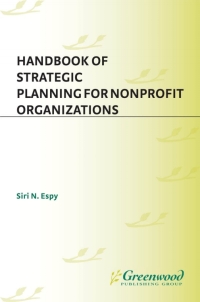

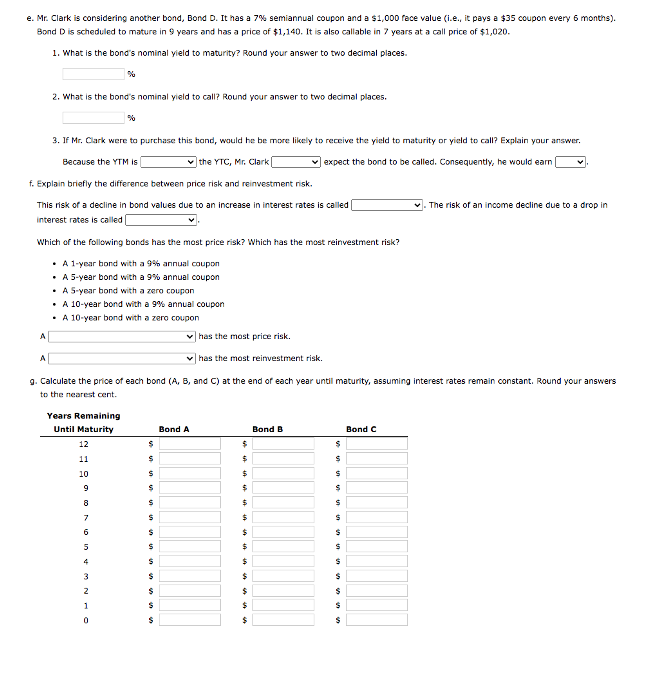

E3 Drop downs:

(1) less than, greater than, equal to. (2) should or should not (3) YTC or YTM

F Drop downs:

(1) price risk or investment risk (2) price risk or investment risk

(2) Last two drop downs in dection F are

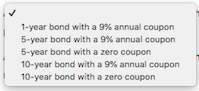

e. Mr. Clark is considering another bond, Bond D. It has a 7% semiannual coupon and a $1,000 face value (i.e., it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 vears and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. \%u 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain yaur answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called . The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year hond with a 9% annual coupon - A 5-year bond with a 9% annual coupon - A S-year bond with a zero coupon - A 10-year bond with a 9% annual coupon - A 10-year bond with a zero coupon A has the most price risk. A has the most reinvestment risk. 1-year bond with a 9% annual coupon 5 -year bond with a 9% annual coupon 5-year bond with a zero coupon 10 -year bond with a 9% annual coupon 10-year bond with a zero coupon e. Mr. Clark is considering another bond, Bond D. It has a 7% semiannual coupon and a $1,000 face value (i.e., it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 vears and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. \%u 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain yaur answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called . The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year hond with a 9% annual coupon - A 5-year bond with a 9% annual coupon - A S-year bond with a zero coupon - A 10-year bond with a 9% annual coupon - A 10-year bond with a zero coupon A has the most price risk. A has the most reinvestment risk. 1-year bond with a 9% annual coupon 5 -year bond with a 9% annual coupon 5-year bond with a zero coupon 10 -year bond with a 9% annual coupon 10-year bond with a zero coupon