Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bond valuation-Semiannual interest Find the value of a bond maturing in 7 years, with a $1,000 par value and a coupon interest rate of 14%

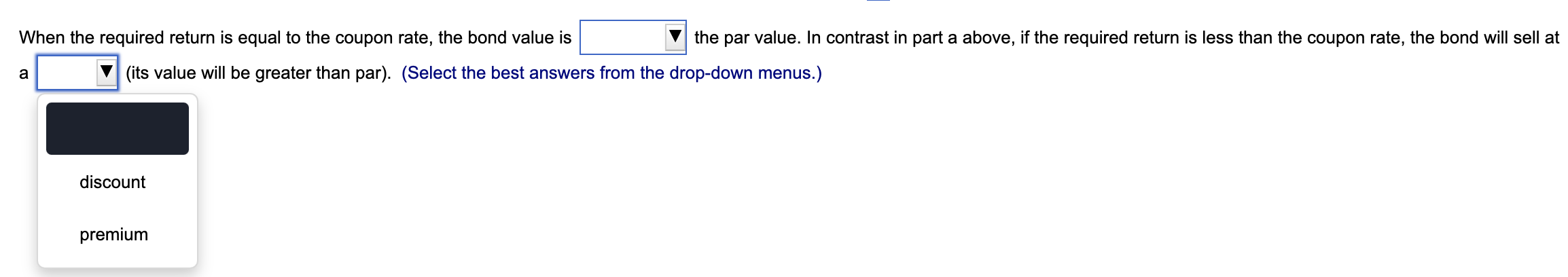

Bond valuation-Semiannual interest Find the value of a bond maturing in 7 years, with a $1,000 par value and a coupon interest rate of 14% ( 7% paid semiannually) if the required return on similar-risk bonds is 17% annual interest ( 8.5% paid semiannually). The present value of the bond is $ (Round to the nearest cent.) Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 14% coupon interest rate. The issue pays interest annually and has 10 years remaining to its maturity date. a. If bonds of similar risk are currently earning a rate of return of 9%, how much should the Complex Systems bond sell for today? b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. c. If the required return were at 14% instead of 9%, what would be the current value of Complex Systems' bond? Contrast this finding with your findings in part a and discuss. a. If bonds of similar risk are currently earning a rate of return of 9%, the Complex Systems bond should sell today for (Round to the nearest cent.) b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. (Select the best answer below.) A. Since Complex Systems' bonds were issued, there may have been a shift in the supply-demand relationship for their product or a change in the risk towards loans. B. Since Complex Systems' bonds were issued, there may have been a change in the number of bonds available or a change in the coupon interest rate. C. Since Complex Systems' bonds were issued, there may have been a change in the supply-demand relationship for money or a shift in the investors' attitudes towards the firm. D. Since Complex Systems' bonds were issued, there may have been a shift in the supply-demand relationship for money or a change in the risk towards the firm. c. If the required return were at 14% instead of 9%, the current value of Complex Systems' bond would be $ (Round to the nearest cent.) When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answers from the drop-down menus.) When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answe lenus.) equal to greater than less than When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answers from the drop-down menus.)

Bond valuation-Semiannual interest Find the value of a bond maturing in 7 years, with a $1,000 par value and a coupon interest rate of 14% ( 7% paid semiannually) if the required return on similar-risk bonds is 17% annual interest ( 8.5% paid semiannually). The present value of the bond is $ (Round to the nearest cent.) Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 14% coupon interest rate. The issue pays interest annually and has 10 years remaining to its maturity date. a. If bonds of similar risk are currently earning a rate of return of 9%, how much should the Complex Systems bond sell for today? b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. c. If the required return were at 14% instead of 9%, what would be the current value of Complex Systems' bond? Contrast this finding with your findings in part a and discuss. a. If bonds of similar risk are currently earning a rate of return of 9%, the Complex Systems bond should sell today for (Round to the nearest cent.) b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. (Select the best answer below.) A. Since Complex Systems' bonds were issued, there may have been a shift in the supply-demand relationship for their product or a change in the risk towards loans. B. Since Complex Systems' bonds were issued, there may have been a change in the number of bonds available or a change in the coupon interest rate. C. Since Complex Systems' bonds were issued, there may have been a change in the supply-demand relationship for money or a shift in the investors' attitudes towards the firm. D. Since Complex Systems' bonds were issued, there may have been a shift in the supply-demand relationship for money or a change in the risk towards the firm. c. If the required return were at 14% instead of 9%, the current value of Complex Systems' bond would be $ (Round to the nearest cent.) When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answers from the drop-down menus.) When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answe lenus.) equal to greater than less than When the required return is equal to the coupon rate, the bond value is the par value. In contrast in part a above, if the required return is less than the coupon rate, the bond will sell at a (its value will be greater than par). (Select the best answers from the drop-down menus.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started