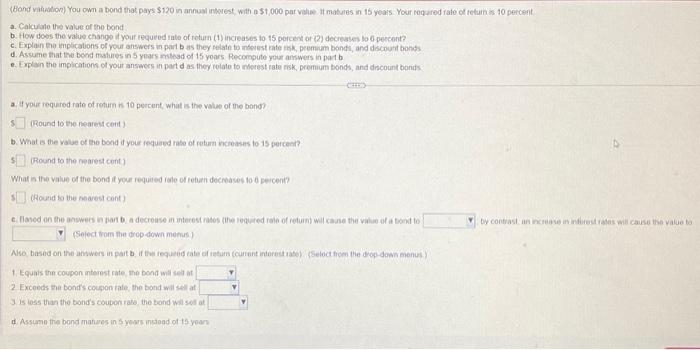

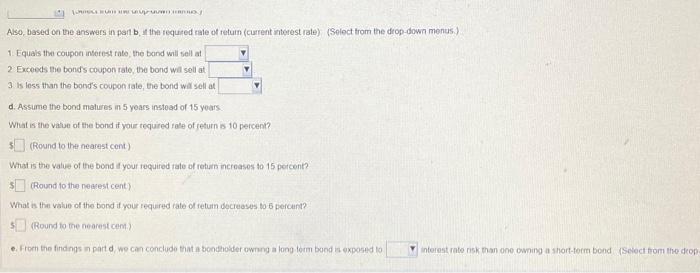

(Bond valudion) You own a bond that pays $120 in annual inhorest, with a $1,000 par vible it matules in 15 yoais. Your coqured iate of tetuin s to percent a. Cakulalo the value of the bond b. How dows the value change it your requeed rale of roturn (1) incieases to 15 percent or (2) decreases h o percent? c. Explan Ea implications of your answers in part b as they pelati to intesest rate nok, peemum bond, and dscount bonds d. Assume that the berd matuies in 5 yoors molead of 15 yoars Recoropute your anwers in pact b e. Explan the implications of your answers in part d as they rolato to morest rate risk, premium bonds, and discount bonids: a. At your requred rate of return in 10 peccent, what is the value of the bond? (Round to the hearest ceit) b. What is the value of the bond if your fequave rate of retum ncreasis to is percent? (Round to the ceparest cent) What is the value of the bond if your requited iale of retian deereaces to 6 seicent? (Round to the nearest cont) c. Hased on the answers in part b a decrease in interest rasos (the loquied rate of return) wal case the vilue of a bont to (Select inom the drog-down memus) 1. Equals the coupon interest rate the bond wil ied at 2. Excoeds the bondts coupon rate the bond will sell at 3is iess than the bond's coupon rate the tond wil sel at d Assume the bond matures in 5 yours insioad of thyoan Alse, based on the answers in parib, th the requeed rale of refuin (current interest rale) (Select trom the drop-down menus) 1. Equals the coupoe inserest tate, the band will sell at 2 Exceeds the bonds coupon rate, the bond wal sell at. 3 is less than the bond's coupon rate, the bond wal sell at d. Assime the bood matures in 5 years instead of 15 years. What is the value of the bond if your tequired tale of return is 10 peicent? (Round to the nearest cent) What is the value of the bond 1 your required rate of return incroases to 15 percent? (Round to the negest cent) What is the value of the bond if your required rate of retum dacteeses to 6 percunt? (Round fo the nearest cem.) e. From the findings in part d, we can condude that a boodholder owrung a long form bond as exposed to interest rate risk than one owaing a short-term bond (Seiect from the deof