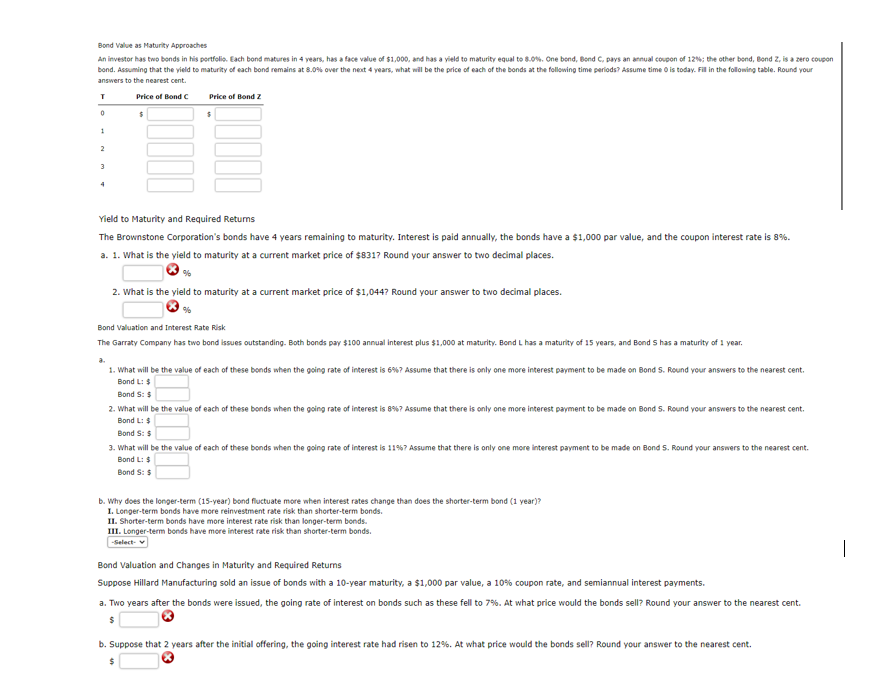

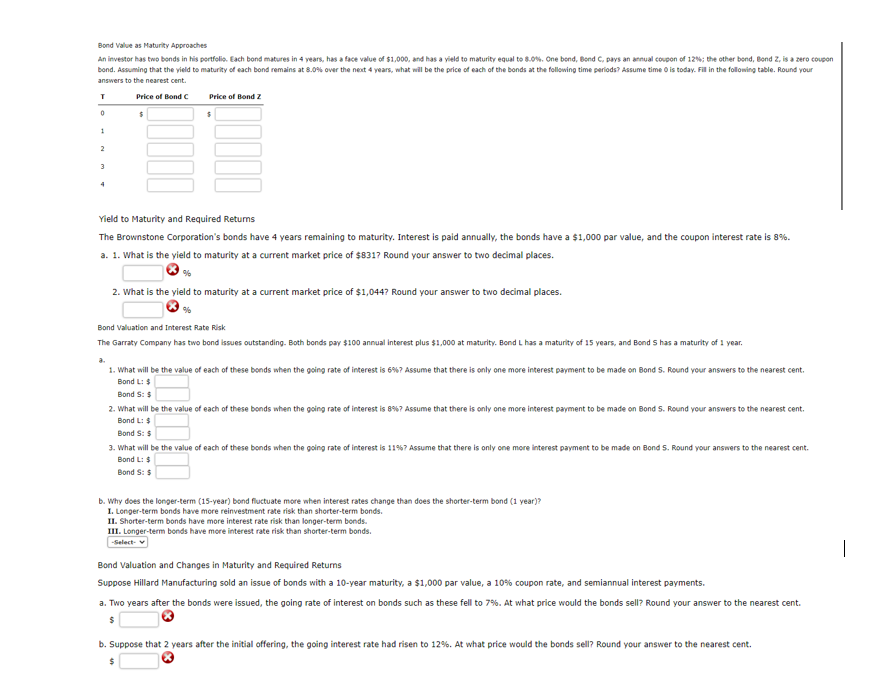

Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 8.0%. One bond, Bond C. pays an annual coupon of 12: the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 8.0% over the next 4 years, what will be the price of each of the bonds at the following time periods? Assume time is today. Fill in the following table. Round your answers to the nearest cent. T Price of Bond Price of Bond z 0 $ 1 2 3 Yield to Maturity and Required Returns The Brownstone Corporation's bonds have 4 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8%. a. 1. What is the yield to maturity at a current market price of $8317 Round your answer to two decimal places. 2. What is the yield to maturity at a current market price of $1,0447 Round your answer to two decimal places. a. Bond Valuation and Interest Rate Risk The Garraty Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1,000 at maturity. Bond L has a maturity of 15 years, and Bond S has a maturity of 1 year. 1. What will be the value of each of these bonds when the going rate of interest is 6%? Assume that there is only one more interest payment to be made on Bond S. Round your answers to the nearest cent. Bond : $ Bond S: $ 2. What will be the value of each of these bonds when the going rate of interest is 897 Assume that there is only one more interest payment to be made on Bond S. Round your answers to the nearest cent. Bond L: $ Bond S: $ 3. What will be the value of each of these bonds when the going rate of interest is 1197 Assume that there is only one more interest payment to be made on Bond 5. Round your answers to the nearest cent. Bond L: $ Bond S: $ | b. Why does the longer-term (15-year) bond fluctuate more when interest rates change than does the shorter-term bond (1 year)? 1. Longer-term bonds have more reinvestment rate risk than shorter-term bonds. IL Shorter-term bonds have more interest rate risk than longer-term bonds. III. Longer-term bonds have more interest rate risk than shorter-term bonds. -Select- Bond Valuation and Changes in Maturity and Required Returns Suppose Hillard Manufacturing sold an issue of bonds with a 10-year maturity, a $1,000 par value, a 10% coupon rate, and semiannual interest payments. a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 7%. At what price would the bonds sell? Round your answer to the nearest cent. $ b. Suppose that 2 years after the initial offering, the going interest rate had risen to 12%. At what price would the bonds sell? Round your answer to the nearest cent