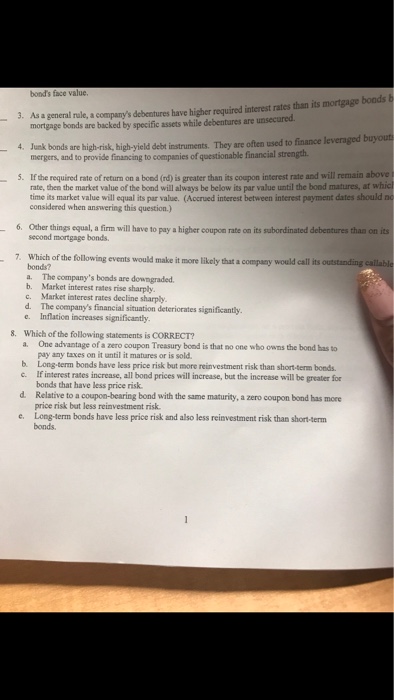

bond's face value. 3. As a general rule, a company's debentures have higher required interest rates than its mortgage boods mortgage bonds are backed by specific assets while debentures are unsecured. Junk bonds are high-tisk, high-yield debt instruments. They are often used to finance leveraged buyout mergers, and to provide inacing to companies of questionable financial strength 4. 5. If the required rate of return on a bond (rd) is greater than its coupon interest rate and will remain above rate, then the market value of the bond will always be below its par value until the bond matures, at whic time its market value will equal its par value. (Accrued interest between interest payment dates should nc considered when answering this question.) 6. Other things equal, a firm will have to pay a higher coupon rate on its subordinated debentures thas on its second mortgage bonds. 7. Which of the following events would make it more likely that a company bonds? The company's boods are downgraded. b. a. Market interest rates rise sharply Market interest rates decline sharply d. The company's financial situation deteriorates significantly e. Inflation increases significantly. Which of the following statements is CORRECT? 8. One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. a. b. Long.term bonds have less price risk but more reinvestment risk than short-term bonds. c. If interest rates increase, all bond prices will increase, but the increase will be greater for d. Relative to a coupon-bearing bond with the same maturity, a zero coupon bond has more e. Long-term bonds have less price risk and also less reinvestment risk than short-term bonds that have less price risk price risk but less reinvestment risk bonds. bond's face value. 3. As a general rule, a company's debentures have higher required interest rates than its mortgage boods mortgage bonds are backed by specific assets while debentures are unsecured. Junk bonds are high-tisk, high-yield debt instruments. They are often used to finance leveraged buyout mergers, and to provide inacing to companies of questionable financial strength 4. 5. If the required rate of return on a bond (rd) is greater than its coupon interest rate and will remain above rate, then the market value of the bond will always be below its par value until the bond matures, at whic time its market value will equal its par value. (Accrued interest between interest payment dates should nc considered when answering this question.) 6. Other things equal, a firm will have to pay a higher coupon rate on its subordinated debentures thas on its second mortgage bonds. 7. Which of the following events would make it more likely that a company bonds? The company's boods are downgraded. b. a. Market interest rates rise sharply Market interest rates decline sharply d. The company's financial situation deteriorates significantly e. Inflation increases significantly. Which of the following statements is CORRECT? 8. One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. a. b. Long.term bonds have less price risk but more reinvestment risk than short-term bonds. c. If interest rates increase, all bond prices will increase, but the increase will be greater for d. Relative to a coupon-bearing bond with the same maturity, a zero coupon bond has more e. Long-term bonds have less price risk and also less reinvestment risk than short-term bonds that have less price risk price risk but less reinvestment risk bonds