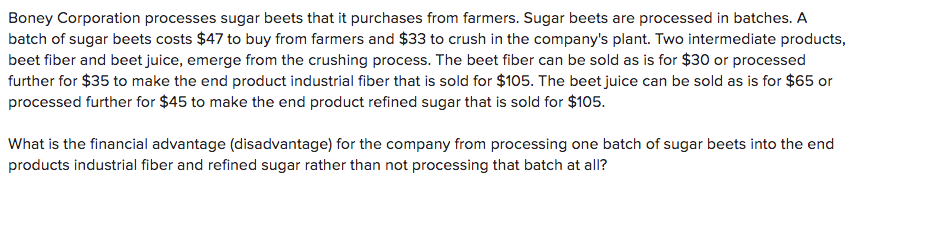

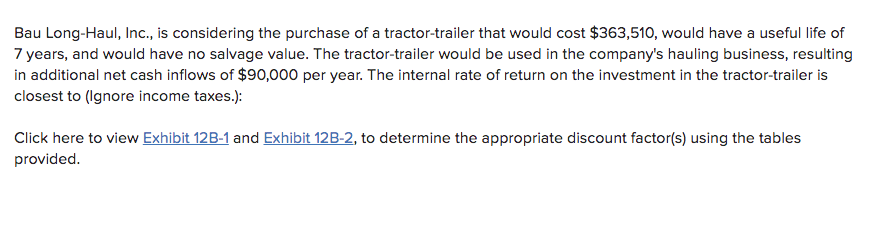

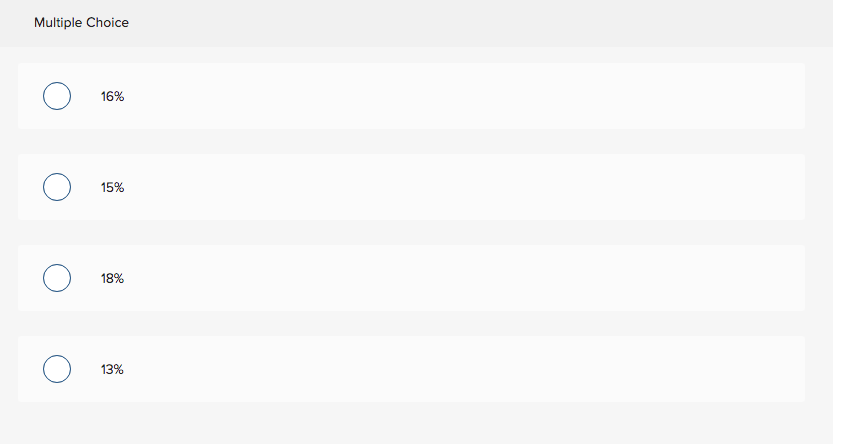

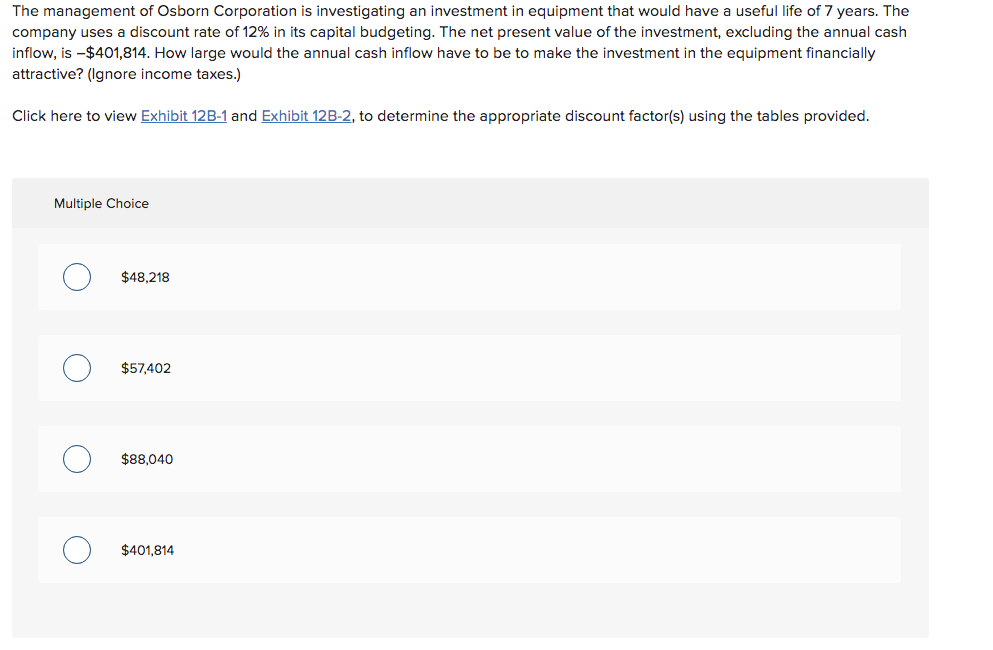

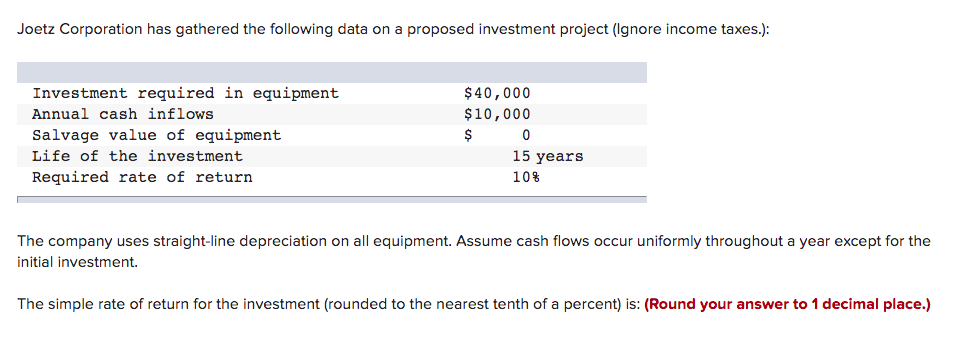

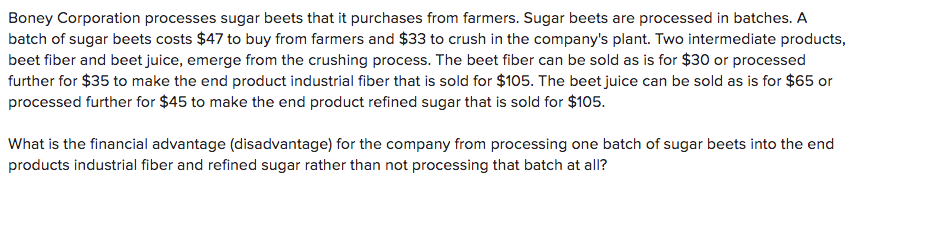

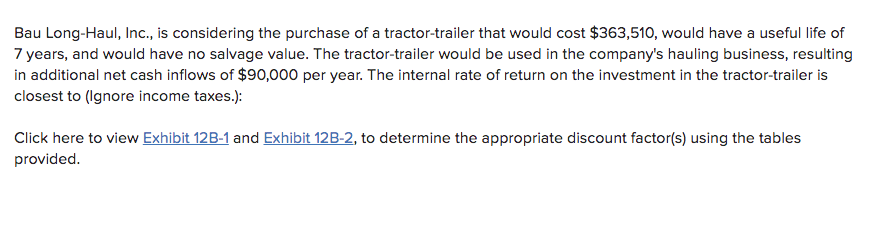

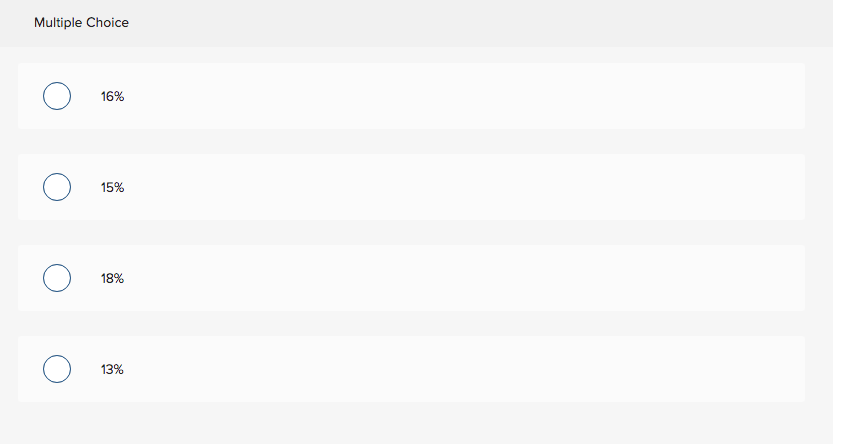

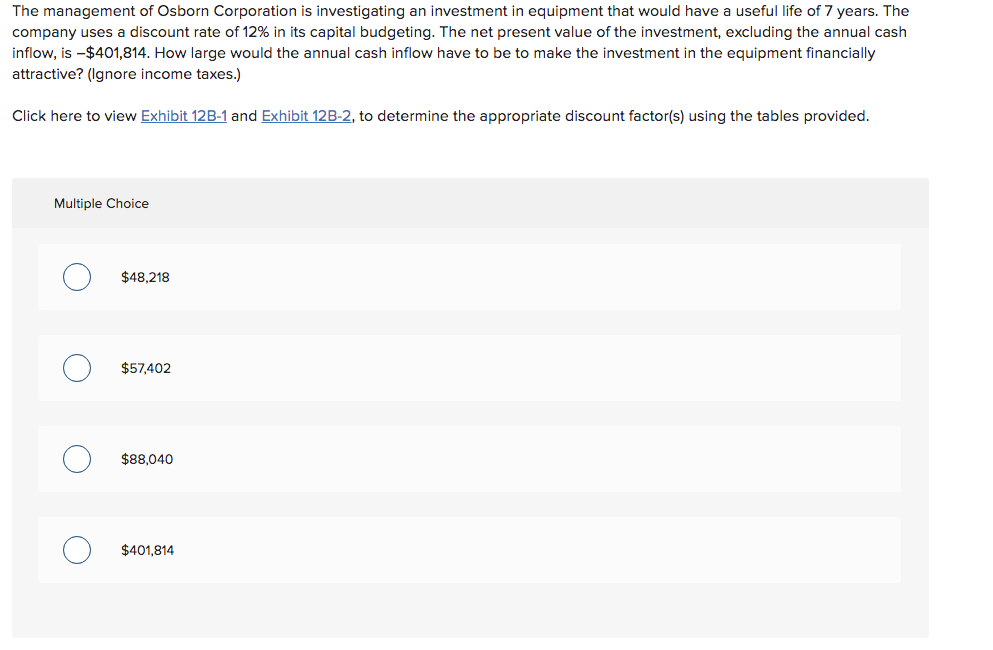

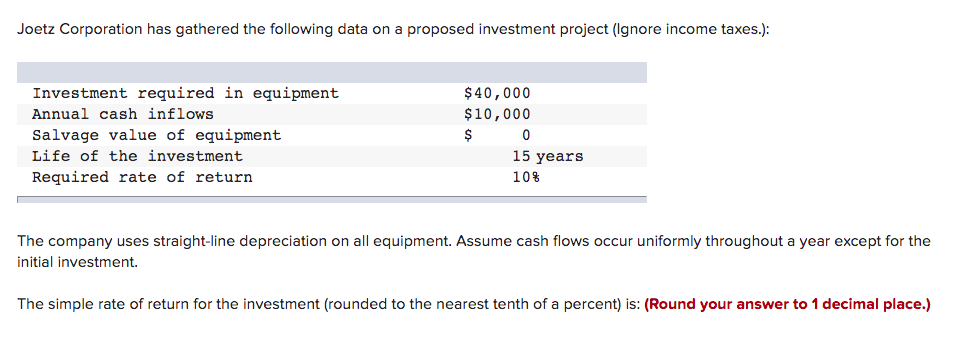

Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $47 to buy from farmers and $33 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $30 or processed further for $35 to make the end product industrial fiber that is sold for $105. The beet juice can be sold as is for $65 or processed further for $45 to make the end product refined sugar that is sold for $105. What is the financial advantage (disadvantage) for the company from processing one batch of sugar beets into the end products industrial fiber and refined sugar rather than not processing that batch at all? Multiple Choice ($160) per batch ($4) per batch $50 per batch $31 per batch Bau Long-Haul, Inc., is considering the purchase of a tractor-trailer that would cost $363,510, would have a useful life of 7 years, and would have no salvage value. The tractor-trailer would be used in the company's hauling business, resulting in additional net cash inflows of $90,000 per year. The internal rate of return on the investment in the tractor-trailer is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice 16% 15% 18% 13% The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 7 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is -$401,814. How large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.) Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $48,218 $57,402 O $88,040 O $401,814 Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment Annual cash inflows Salvage value of equipment Life of the investment Required rate of return $ 40,000 $10,000 $ 0 15 years 10% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The simple rate of return for the investment (rounded to the nearest tenth of a percent) is: (Round your answer to 1 decimal place.) Multiple Choice O 32.4% 18.3% O o 26.8% O 12.8%