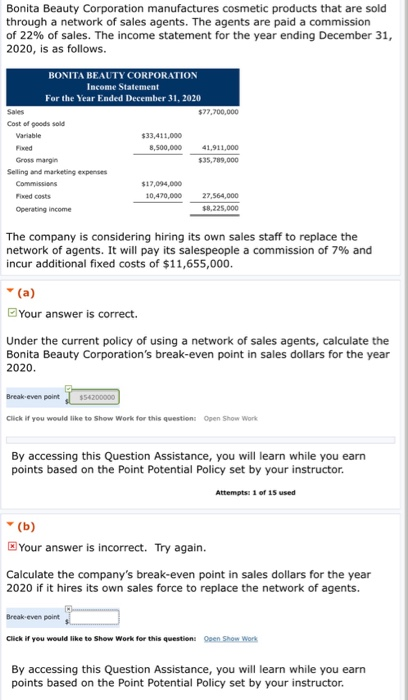

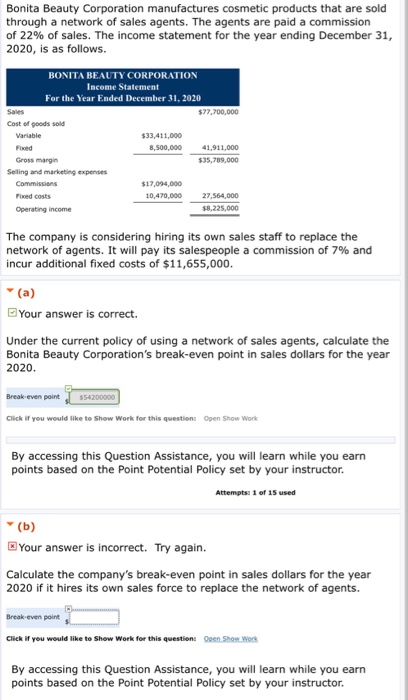

Bonita Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 22% of sales. The income statement for the year ending December 31, 2020, is as follows. BONITA BEAUTY CORPORATION Income Statement For the Year Ended December 31, 2020 Sales $77,700,000 Cost of goods sold Variable $33,411,000 Fixed 8,500,000 41,911,000 Gross margin $35,789,000 Selling and marketing expenses Commissions $17,094,000 Fixed costs 10,470,000 27,564,000 Operating income $8,225,000 The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 7% and incur additional fixed costs of $11,655,000. (a) Your answer is correct. Under the current policy of using a network of sales agents, calculate the Bonita Beauty Corporation's break-even point in sales dollars for the year 2020. Break-even point $54200000 Click if you would like to show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 1 of 15 used (b) Your answer is incorrect. Try again. Calculate the company's break-even point in sales dollars for the year 2020 if it hires its own sales force to replace the network of agents. Break-even point Click if you would like to show Work for this question: Doen Show Work By accessing this question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Bonita Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 22% of sales. The income statement for the year ending December 31, 2020, is as follows. BONITA BEAUTY CORPORATION Income Statement For the Year Ended December 31, 2020 Sales $77,700,000 Cost of goods sold Variable $33,411,000 Fixed 8,500,000 41,911,000 Gross margin $35,789,000 Selling and marketing expenses Commissions $17,094,000 Fixed costs 10,470,000 27,564,000 Operating income $8,225,000 The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 7% and incur additional fixed costs of $11,655,000. (a) Your answer is correct. Under the current policy of using a network of sales agents, calculate the Bonita Beauty Corporation's break-even point in sales dollars for the year 2020. Break-even point $54200000 Click if you would like to show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 1 of 15 used (b) Your answer is incorrect. Try again. Calculate the company's break-even point in sales dollars for the year 2020 if it hires its own sales force to replace the network of agents. Break-even point Click if you would like to show Work for this question: Doen Show Work By accessing this question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor