Answered step by step

Verified Expert Solution

Question

1 Approved Answer

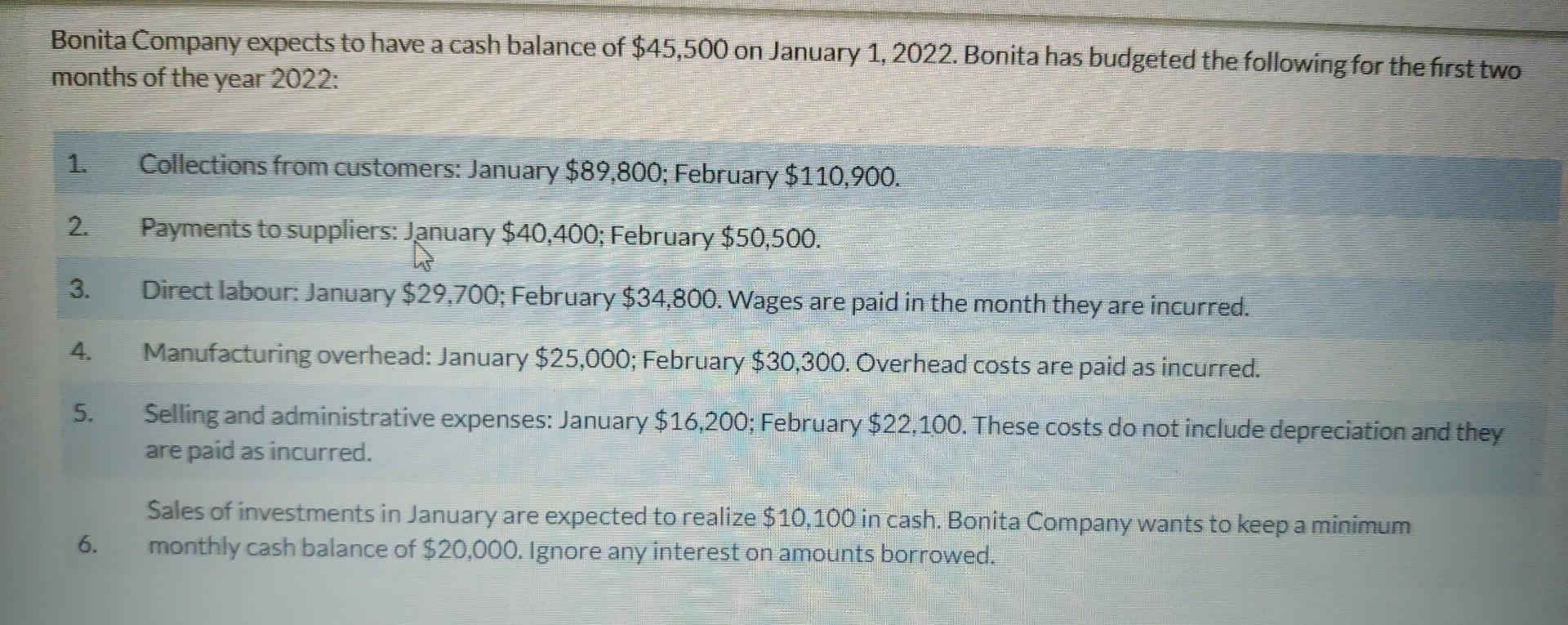

Bonita Company expects to have a cash balance of $45,500 on January 1,2022 . Bonita has budgeted the following for the first two months of

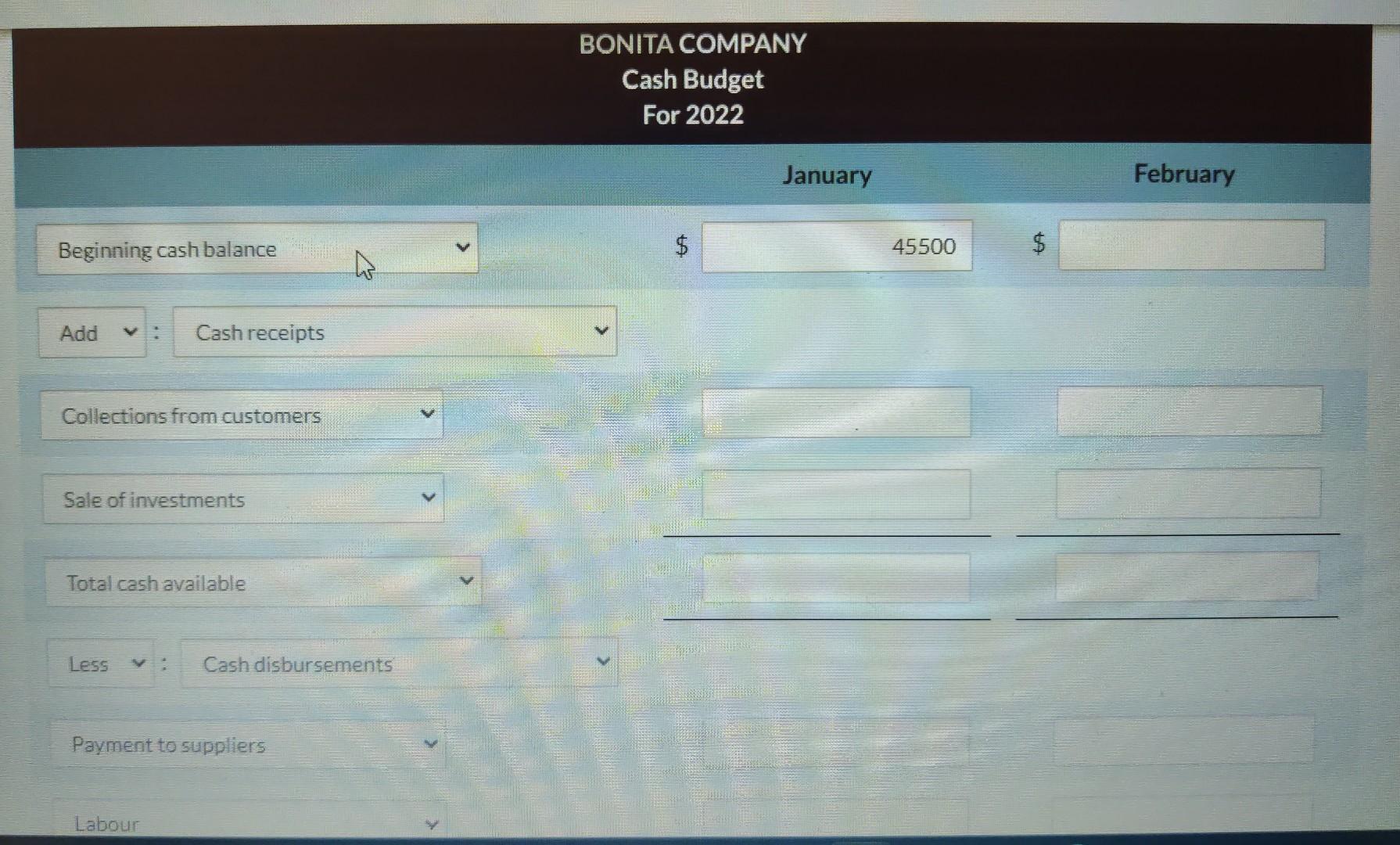

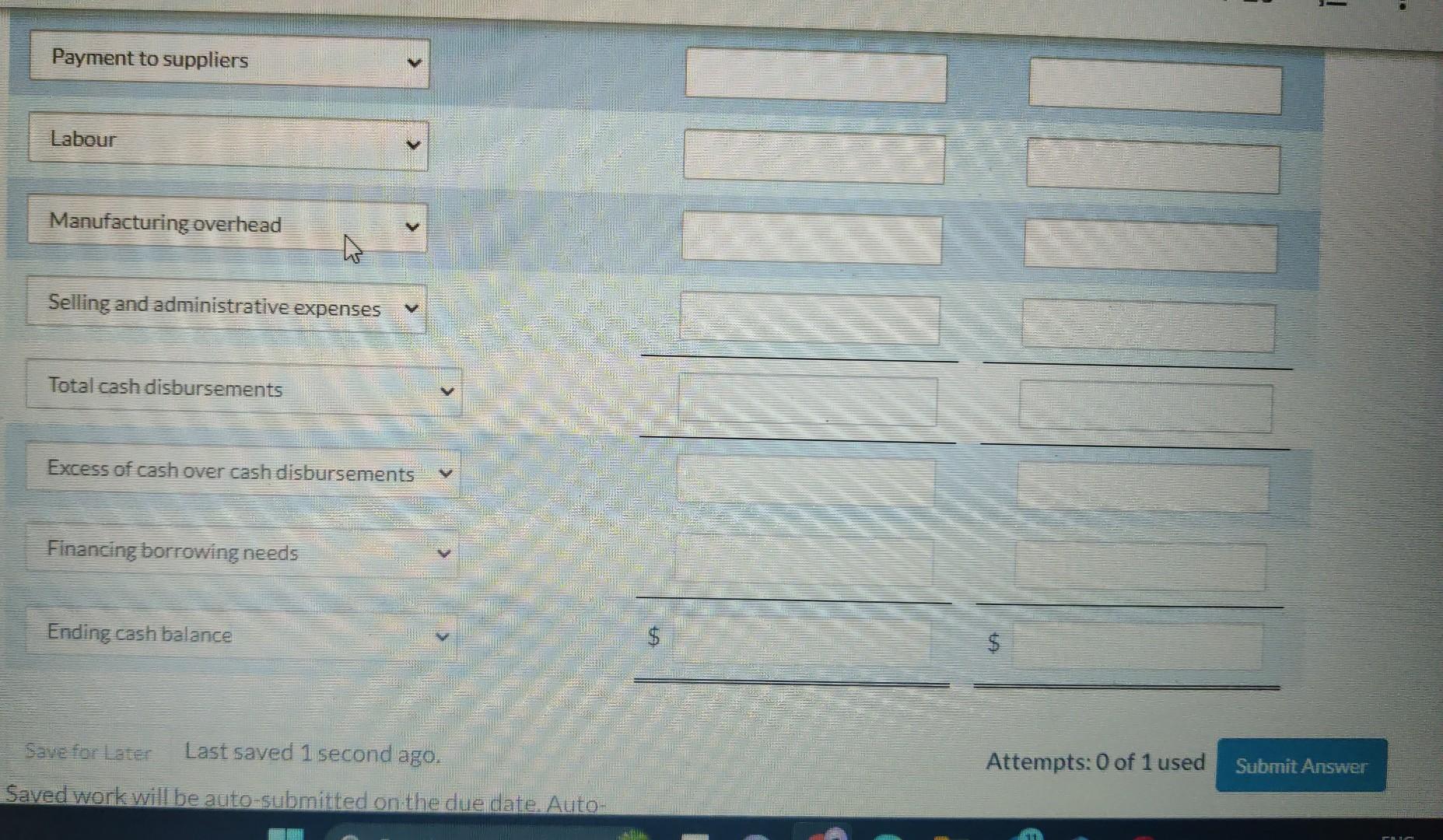

Bonita Company expects to have a cash balance of $45,500 on January 1,2022 . Bonita has budgeted the following for the first two months of the year 2022: 1. Collections from customers: January $89,800; February $110,900. 2. Payments to suppliers: January $40,400; February $50,500. 3. Direct labour: January $29,700; February $34,800. Wages are paid in the month they are incurred. 4. Manufacturing overhead: January $25,000; February $30,300. Overhead costs are paid as incurred. 5. Selling and administrative expenses: January $16,200; February $22,100. These costs do not include depreciation and they are paid as incurred. Sales of investments in January are expected to realize $10,100 in cash. Bonita Company wants to keep a minimum 6. monthly cash balance of $20,000. Ignore any interest on amounts borrowed. BONITA COMPANY Cash Budget For 2022 January February Beginning cash balance $ 45500$ Add : Cash receipts Collections from customers Sale of investments Total cash available Less : Cashdisbursements Payment to suppliers Labour Selling and administrative expenses Total cash disbursements Excess of cash over cash disbursements Financing borrowing needs Ending cash balance Save for Later Last saved 1 second ago. Attempts: 0 of 1 used Submit Answer Saved work will be auto-submitted on the due date. Auto

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started