Answered step by step

Verified Expert Solution

Question

1 Approved Answer

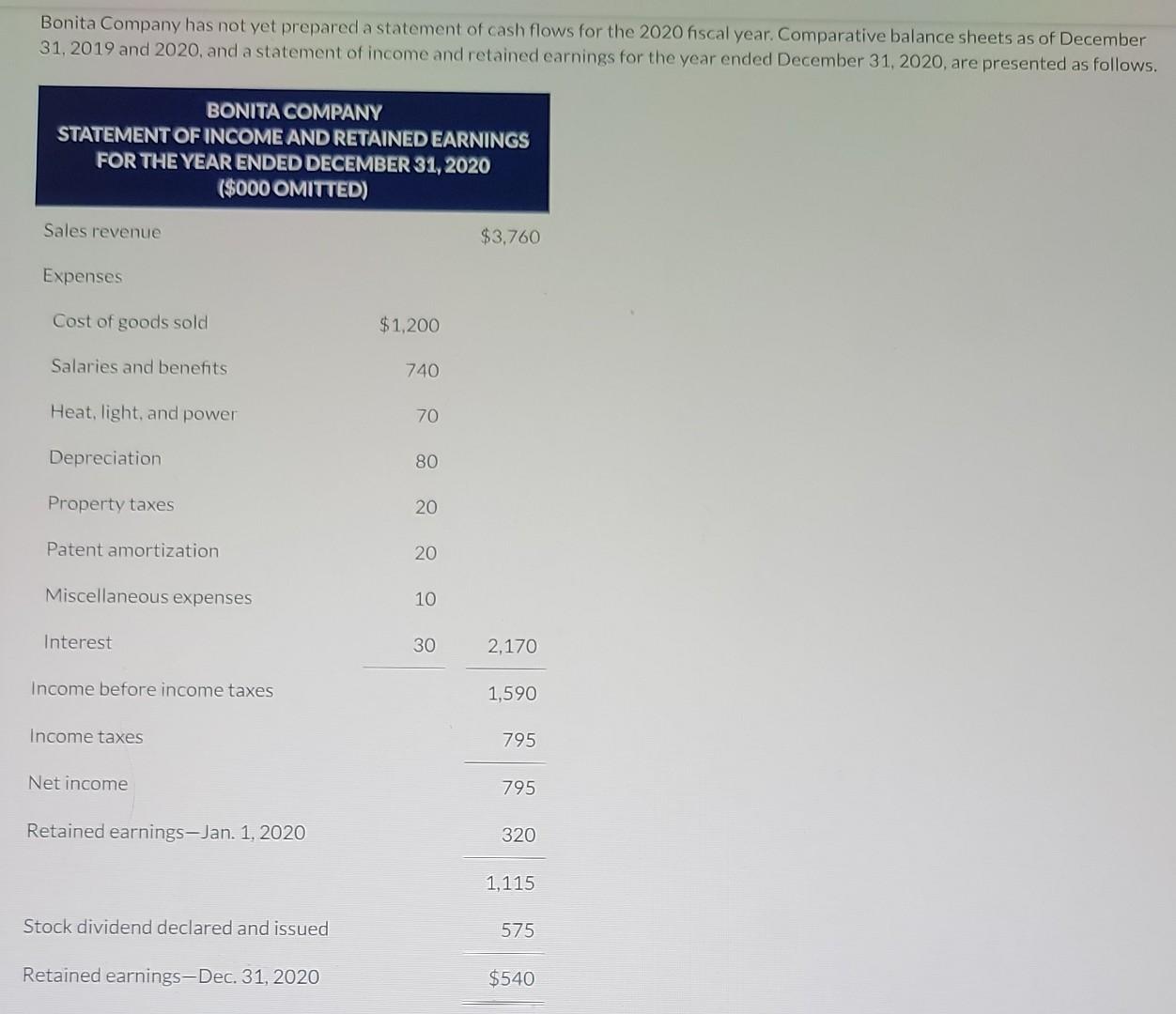

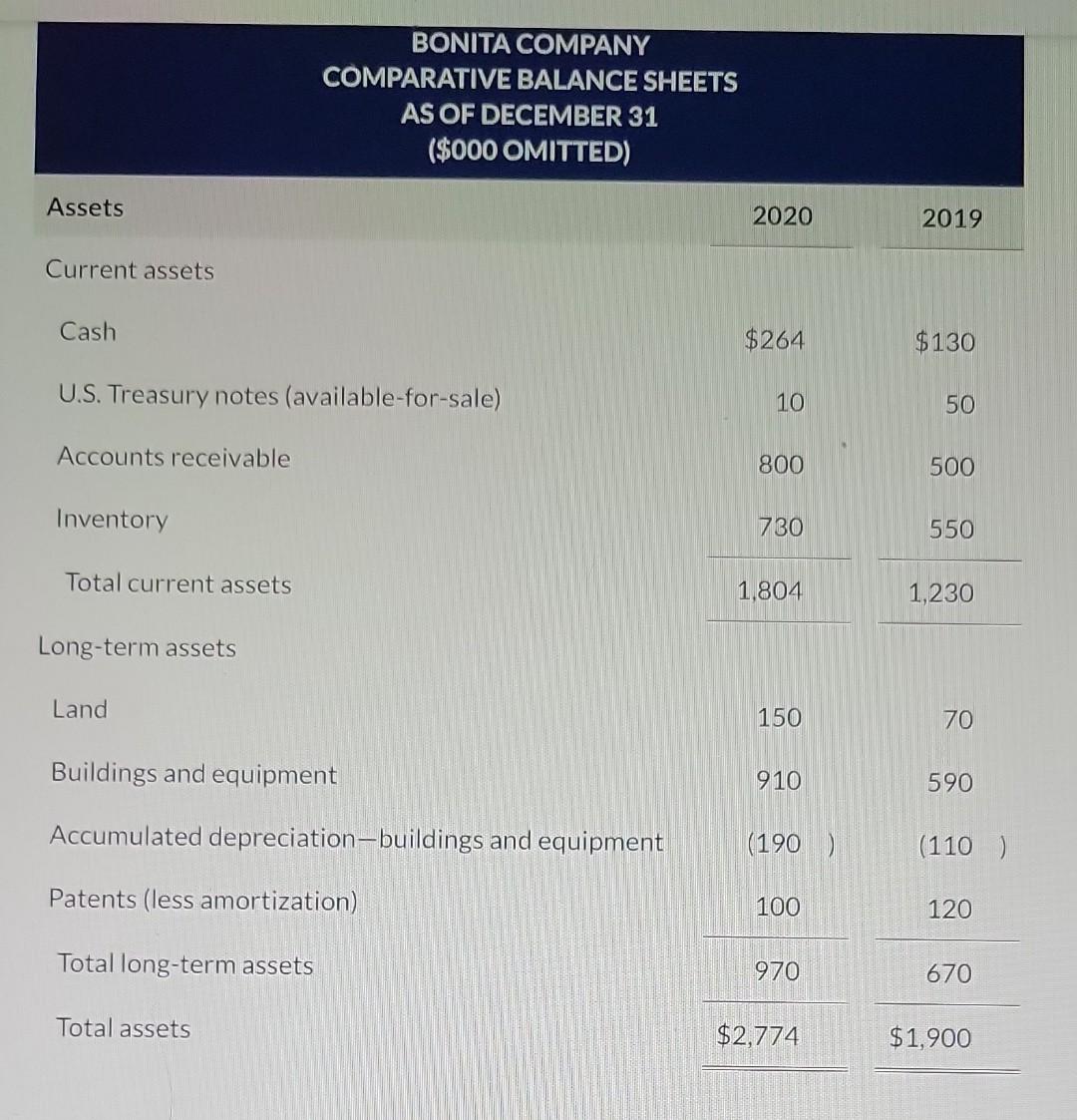

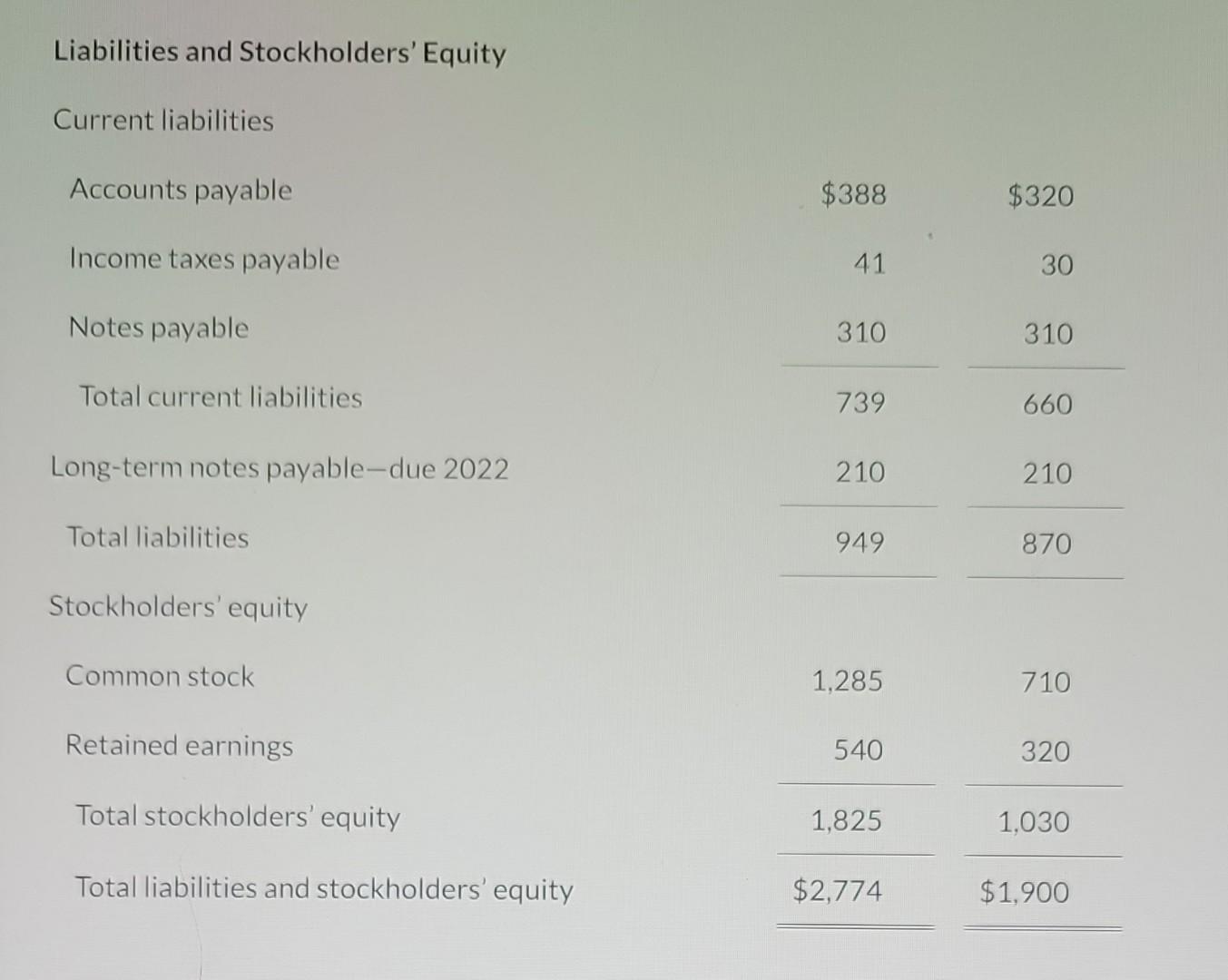

Bonita Company has not yet prepared a statement of cash flows for the 2020 fiscal year. Comparative balance sheets as of December 31. 2019 and

Bonita Company has not yet prepared a statement of cash flows for the 2020 fiscal year. Comparative balance sheets as of December 31. 2019 and 3020 and a ctatamant af innnma mon for the year ended December 31, 2020, are presented as follows. BONITA COMPANY COMPARATIVE BALANCE SHEETS ASOF DECEMBER 31 (\$000 OMITTED) Assets Current assets Cash $264 U.S. Treasury notes (available-for-sale) 10 Accounts receivable Inventory Total current assets Long-term assets Land 150 Buildings and equipment 910 Accumulated depreciation-buildings and equipment (190) (110) Patents (less amortization) Total long-term assets Total assets \begin{tabular}{rc} 120100 \\ \hline$770 & $1,900670 \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Notes payable Total current liabilities Long-term notes payable-due 2022 Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Prepare a statement of cash flows using the direct method. Changes in accounts receivable and accounts payable relate to sales and cost of goods sold. (Show amounts in the investing and financing sections that decrease cash flow with either a-sign e.g. 15,000 or in parenthesis e.g. (15.000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started