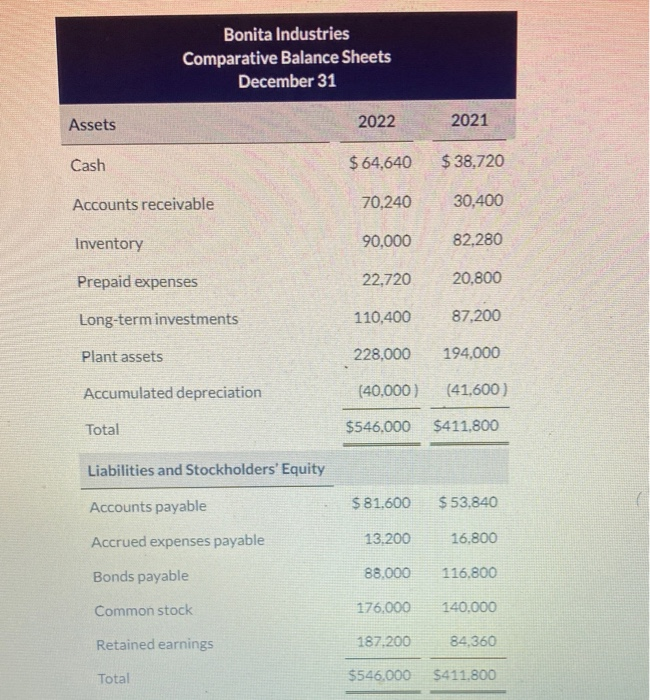

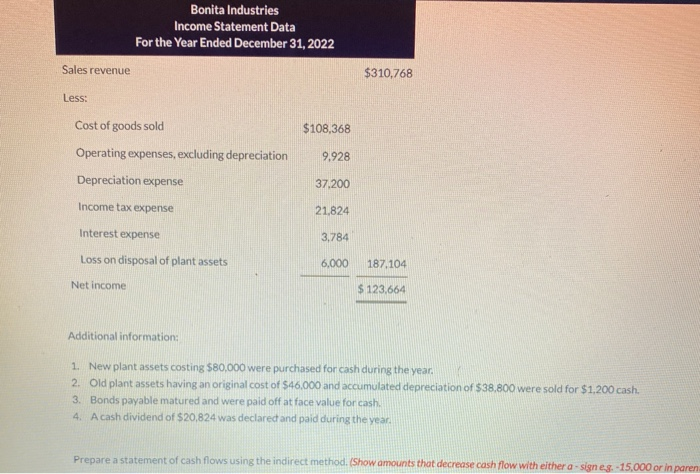

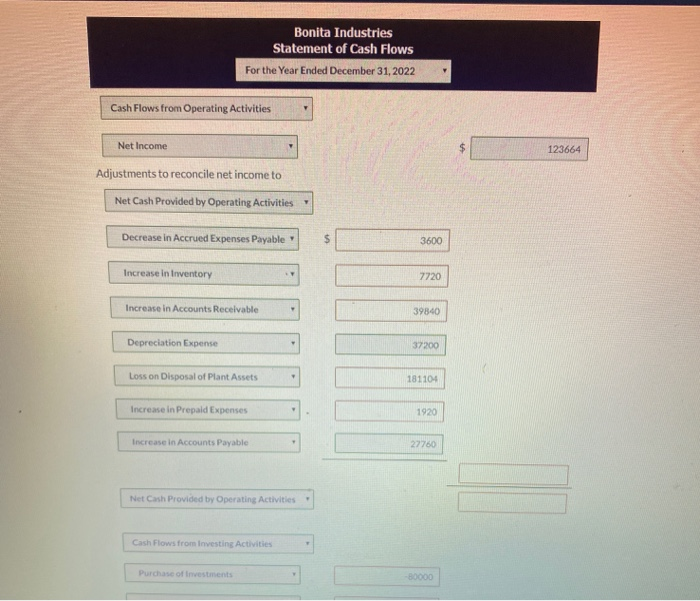

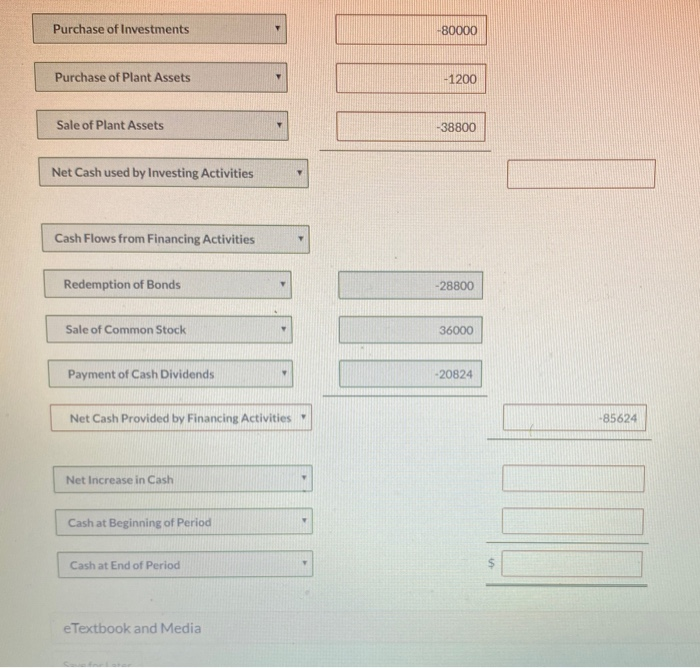

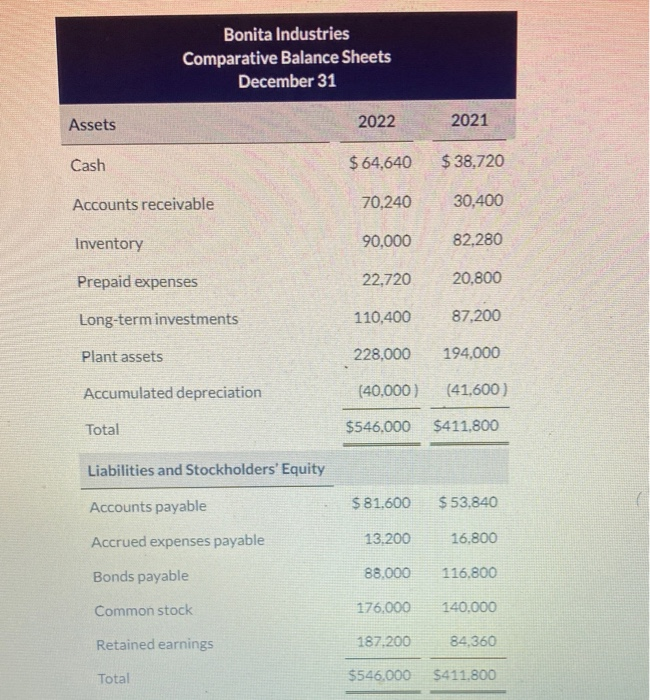

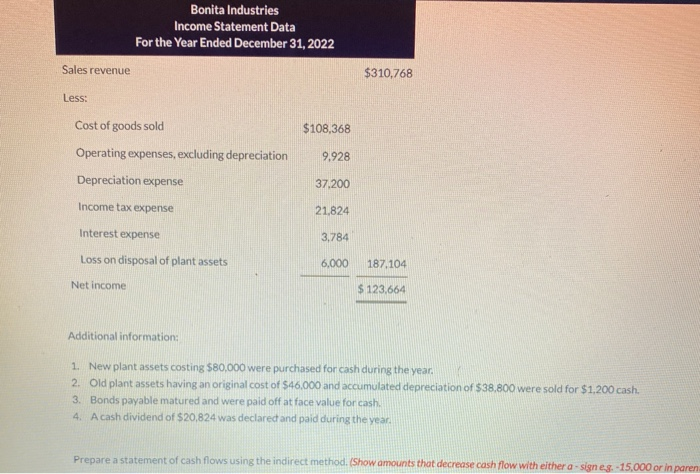

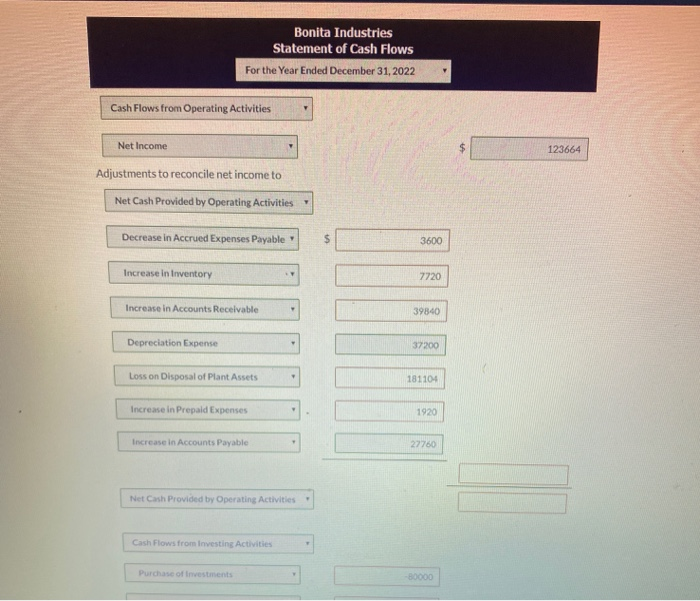

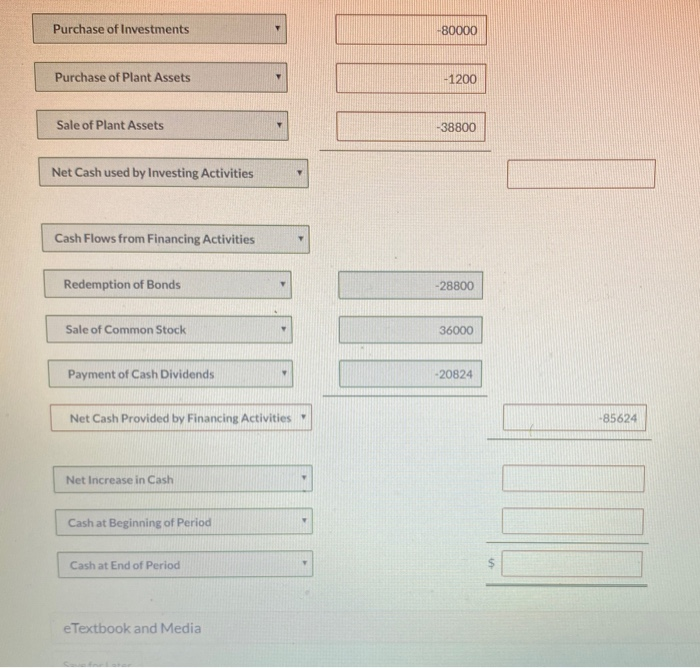

Bonita Industries Comparative Balance Sheets December 31 Assets 2022 2021 Cash $ 64,640 $38,720 Accounts receivable 70,24030,400 Inventory 90,00082,280 Prepaid expenses 22,720 Long-term investments 110,400 228,000 20,800 87,200 194,000 Plant assets Accumulated depreciation (40,000) (41,600 ) Total $546,000 $411,800 Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable $81,600 13,200 88,000 176,000 187.200 $53,840 16.800 116,800 140,000 84,360 Common stock Retained earnings Total $546,000 $411,800 Bonita Industries Income Statement Data For the Year Ended December 31, 2022 Sales revenue $310,768 Less: Cost of goods sold $108,368 Operating expenses, excluding depreciation 9.928 Depreciation expense 37.200 Income tax expense 21.824 Interest expense 3,784 Loss on disposal of plant assets 6,000 187.104 Net income $ 123,664 Additional information: 1. New plant assets costing $80,000 were purchased for cash during the year, 2. Old plant assets having an original cost of $46,000 and accumulated depreciation of $38.800 were sold for $1.200 cash 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $20,824 was declared and paid during the year. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a signes. -15,000 or in paren Bonita Industries Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities Net Income 123664 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Decrease in Accrued Expenses Payable 3600 Increase in Inventory 7720 Increase in Accounts Receivable 39840 Depreciation Expense 37200 Loss on Disposal of Plant Assets 181104 Increase in Prepaid Expenses 1920 Increase in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from investing Activities Purchase of investments 30000 Purchase of Investments -80000 Purchase of Plant Assets -1200 Sale of Plant Assets -38800 Net Cash used by Investing Activities Cash Flows from Financing Activities Redemption of Bonds -28800 Sale of Common Stock 36000 Payment of Cash Dividends -20824 Net Cash Provided by Financing Activities -85624 Net Increase in Cash Cash at Beginning of Period Cash at End of Period e Textbook and Media