Question

BONUS: Consider Andy who bought a corporate AAA bond 4 years ago with a face value of $5,800, a coupon rate of 3.25%, and

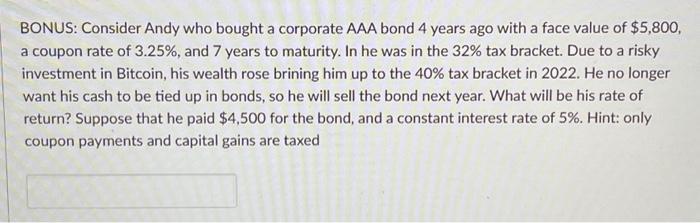

BONUS: Consider Andy who bought a corporate AAA bond 4 years ago with a face value of $5,800, a coupon rate of 3.25%, and 7 years to maturity. In he was in the 32% tax bracket. Due to a risky investment in Bitcoin, his wealth rose brining him up to the 40% tax bracket in 2022. He no longer want his cash to be tied up in bonds, so he will sell the bond next year. What will be his rate of return? Suppose that he paid $4,500 for the bond, and a constant interest rate of 5%. Hint: only coupon payments and capital gains are taxed

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate Andys rate of return we need to determine the cash flows from the bond taking into account the coupon payments the capital gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App