Question

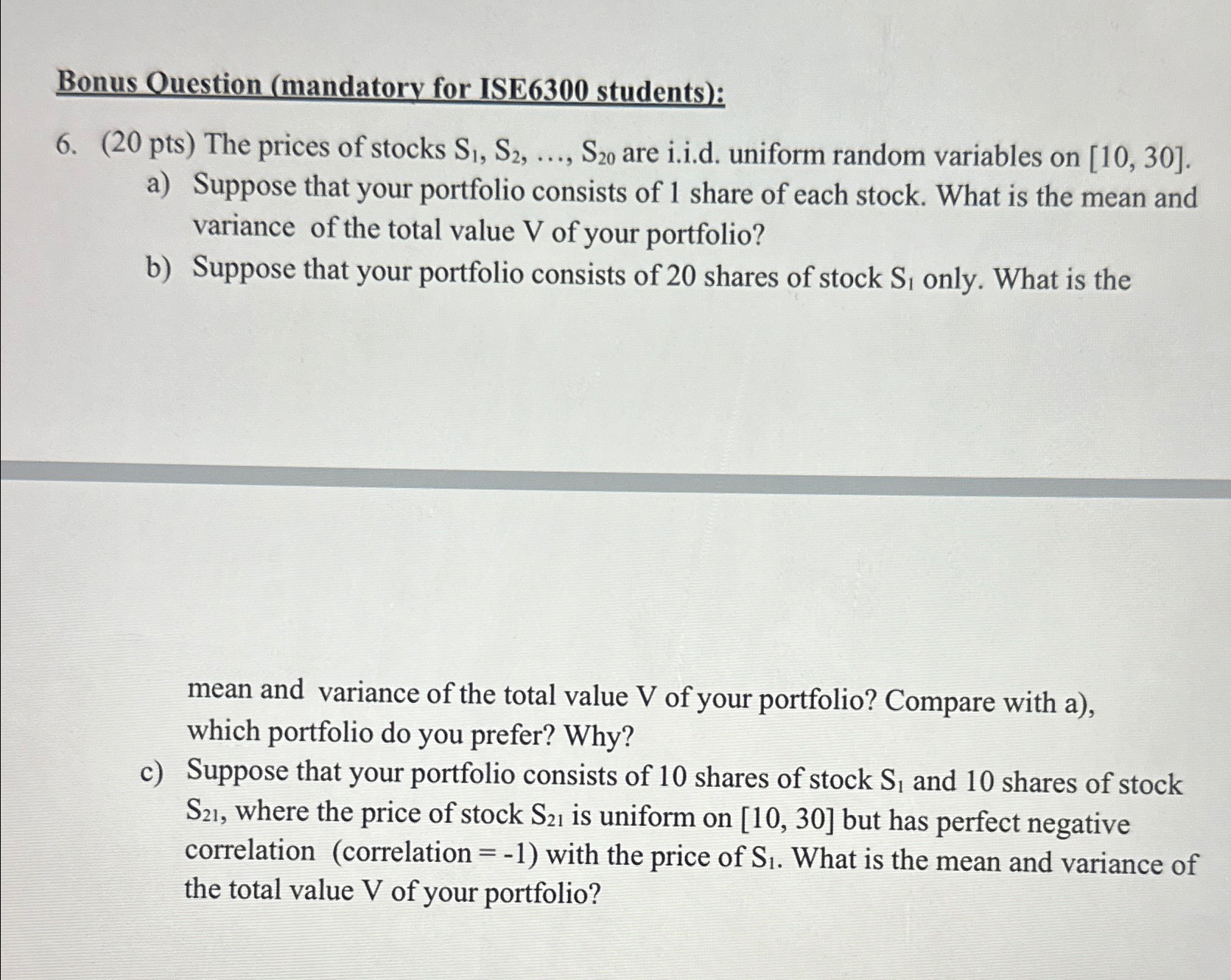

Bonus Ouestion (mandatory for ISE6300 students): 6. (20 pts) The prices of stocks S_(1),S_(2),dots,S_(20) are i.i.d. uniform random variables on 10,30 . a) Suppose that

Bonus Ouestion (mandatory for ISE6300 students):\ 6. (20 pts) The prices of stocks

S_(1),S_(2),dots,S_(20)are i.i.d. uniform random variables on

10,30.\ a) Suppose that your portfolio consists of 1 share of each stock. What is the mean and variance of the total value

Vof your portfolio?\ b) Suppose that your portfolio consists of 20 shares of stock

S_(1)only. What is the mean and variance of the total value

Vof your portfolio? Compare with a), which portfolio do you prefer? Why?\ c) Suppose that your portfolio consists of 10 shares of stock

S_(1)and 10 shares of stock

S_(21), where the price of stock

S_(21)is uniform on

10,30but has perfect negative correlation (correlation

=-1) with the price of

S_(1). What is the mean and variance of the total value

Vof your portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started