Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bonus points to whoever can show steps to solution. cheers St. John's Shipyard is considering the replacement of an 8-year old machine that has been

Bonus points to whoever can show steps to solution. cheers

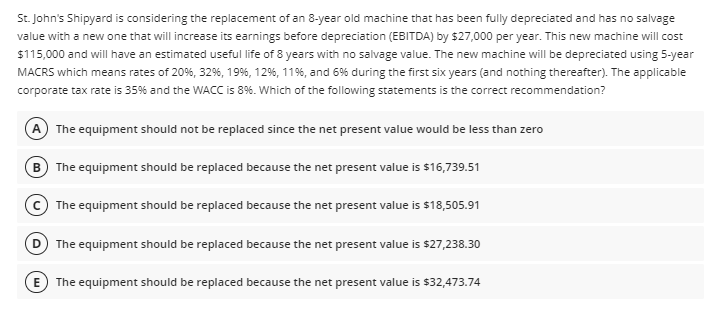

St. John's Shipyard is considering the replacement of an 8-year old machine that has been fully depreciated and has no salvage value with a new one that will increase its earnings before depreciation (EBITDA) by $27,000 per year. This new machine will cost $115,000 and will have an estimated useful life of 8 years with no salvage value. The new machine will be depreciated using 5 -year MACRS which means rates of 20%,32%,19%,12%,11%, and 6% during the first six years (and nothing thereafter). The applicable corporate tax rate is 35% and the WACC is 8%. Which of the following statements is the correct recommendation? The equipment should not be replaced since the net present value would be less than zero (B) The equipment should be replaced because the net present value is $16,739.51 The equipment should be replaced because the net present value is $18,505.91 (D) The equipment should be replaced because the net present value is $27,238.30 The equipment should be replaced because the net present value is $32,473.74Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started