Question: Henry Ltd has two divisions the Widget Division and the Gadget Division. The Widget Division manufactures widgets, which are then transferred to the Gadget

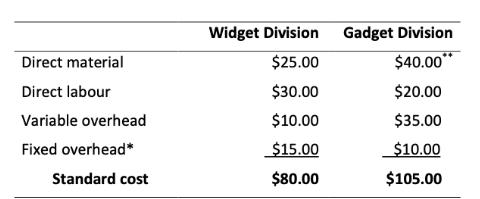

Henry Ltd has two divisions – the Widget Division and the Gadget Division. The Widget Division manufactures widgets, which are then transferred to the Gadget Division for further processing into gadgets. The standard cost of a gadget is as follows:

* This rate was obtained as 50% of direct labour cost.

** Excludes the transfer price for the widget.

The Widget Division is also able to sell widgets to external companies for $90 per unit. The Gadget Division sells gadgets for $125 per unit. The markets for both widgets and gadgets are very competitive and comprise of multiple sellers and buyers. The Widget Division and the Gadget Division both currently have excess capacity.

Required

a. Comment on the use of standard costs, as opposed to actual costs, as a basis for setting transfer prices. Comment on the use of absorption cost as a basis for setting transfer prices.

b. Assume that the transfer price for a widget is based on standard absorption cost plus a 25% mark-up. Assume also the Gadget Division has received a special order for 500 gadgets at a price of $180 each. Would an autonomous Gadget Division manager be motivated to make a decision regarding the special order that is in the best interests of the organisation as a whole? Provide calculations to support your answer.

c. Using the transfer pricing general rule, calculate the transfer price for widgets. Is this price likely to lead to the Gadget Division pursuing a goal-congruent outcome?

Widget Division Gadget Division Direct material $25.00 $40.00" Direct labour $30.00 $20.00 Variable overhead $10.00 $35.00 Fixed overhead* $15.00 $10.00 Standard cost $80.00 $105.00

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

A B C 36 Total variable cost of widget 8015 37 CM forg... View full answer

Get step-by-step solutions from verified subject matter experts