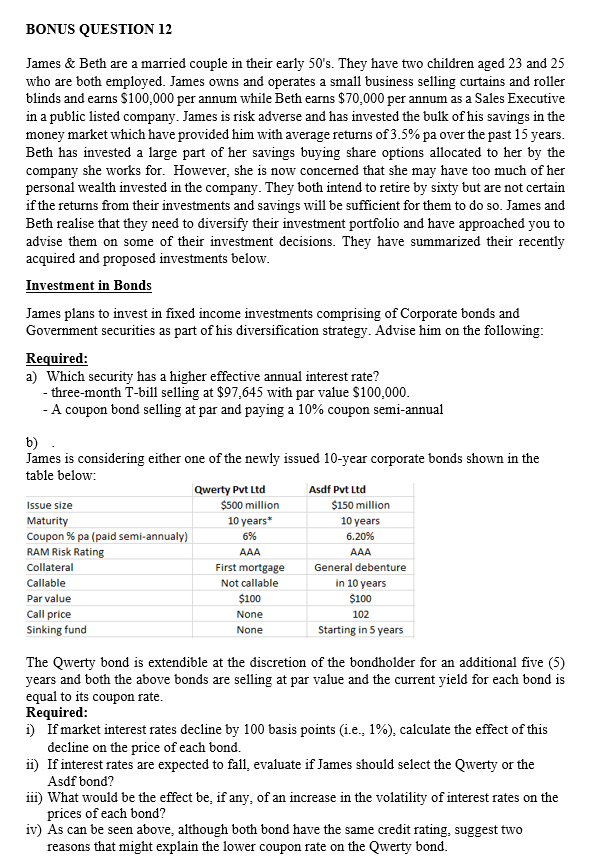

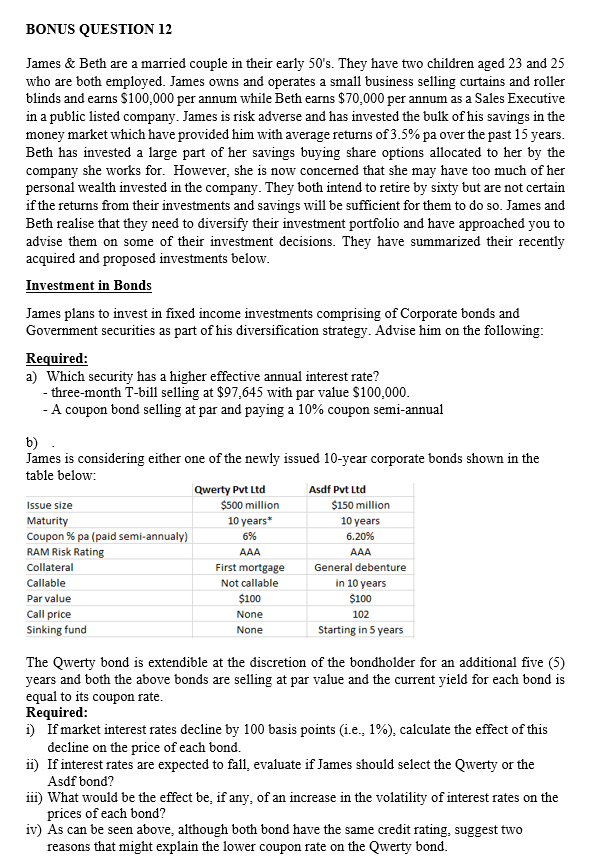

BONUS QUESTION 12 James & Beth are a married couple in their early 50's. They have two children aged 23 and 25 who are both employed. James owns and operates a small business selling curtains and roller blinds and earns $100,000 per annum while Beth earns $70,000 per annum as a Sales Executive in a public listed company. James is risk adverse and has invested the bulk of his savings in the money market which have provided him with average returns of 3.5% pa over the past 15 years. Beth has invested a large part of her savings buying share options allocated to her by the company she works for. However, she is now concerned that she may have too much of her personal wealth invested in the company. They both intend to retire by sixty but are not certain if the returns from their investments and savings will be sufficient for them to do so. James and Beth realise that they need to diversify their investment portfolio and have approached you to advise them on some of their investment decisions. They have summarized their recently acquired and proposed investments below. Investment in Bonds James plans to invest in fixed income investments comprising of Corporate bonds and Government securities as part of his diversification strategy. Advise him on the following: Required: a) Which security has a higher effective annual interest rate? -three-month T-bill selling at $97,645 with par value $100,000. - A coupon bond selling at par and paying a 10% coupon semi-annual b) James is considering either one of the newly issued 10-year corporate bonds shown in the table below: Qwerty Pvt Ltd Asdf Pvt Ltd Issue size $500 million $150 million Maturity 10 years* 10 years Coupon % pa (paid semi-annualy) 6.20% RAM Risk Rating AAA AAA Collateral First mortgage General debenture Callable Not callable in 10 years Par value $100 $100 Call price None 102 Sinking fund None Starting in 5 years 6% The Qwerty bond is extendible at the discretion of the bondholder for an additional five (5) years and both the above bonds are selling at par value and the current yield for each bond is equal to its coupon rate. Required: 1) If market interest rates decline by 100 basis points (i.e., 1%), calculate the effect of this decline on the price of each bond. ii) If interest rates are expected to fall, evaluate if James should select the Qwerty or the Asdf bond? iii) What would be the effect be, if any, of an increase in the volatility of interest rates on the prices of each bond? iv) As can be seen above, although both bond have the same credit rating, suggest two reasons that might explain the lower coupon rate on the Qwerty bond. BONUS QUESTION 12 James & Beth are a married couple in their early 50's. They have two children aged 23 and 25 who are both employed. James owns and operates a small business selling curtains and roller blinds and earns $100,000 per annum while Beth earns $70,000 per annum as a Sales Executive in a public listed company. James is risk adverse and has invested the bulk of his savings in the money market which have provided him with average returns of 3.5% pa over the past 15 years. Beth has invested a large part of her savings buying share options allocated to her by the company she works for. However, she is now concerned that she may have too much of her personal wealth invested in the company. They both intend to retire by sixty but are not certain if the returns from their investments and savings will be sufficient for them to do so. James and Beth realise that they need to diversify their investment portfolio and have approached you to advise them on some of their investment decisions. They have summarized their recently acquired and proposed investments below. Investment in Bonds James plans to invest in fixed income investments comprising of Corporate bonds and Government securities as part of his diversification strategy. Advise him on the following: Required: a) Which security has a higher effective annual interest rate? -three-month T-bill selling at $97,645 with par value $100,000. - A coupon bond selling at par and paying a 10% coupon semi-annual b) James is considering either one of the newly issued 10-year corporate bonds shown in the table below: Qwerty Pvt Ltd Asdf Pvt Ltd Issue size $500 million $150 million Maturity 10 years* 10 years Coupon % pa (paid semi-annualy) 6.20% RAM Risk Rating AAA AAA Collateral First mortgage General debenture Callable Not callable in 10 years Par value $100 $100 Call price None 102 Sinking fund None Starting in 5 years 6% The Qwerty bond is extendible at the discretion of the bondholder for an additional five (5) years and both the above bonds are selling at par value and the current yield for each bond is equal to its coupon rate. Required: 1) If market interest rates decline by 100 basis points (i.e., 1%), calculate the effect of this decline on the price of each bond. ii) If interest rates are expected to fall, evaluate if James should select the Qwerty or the Asdf bond? iii) What would be the effect be, if any, of an increase in the volatility of interest rates on the prices of each bond? iv) As can be seen above, although both bond have the same credit rating, suggest two reasons that might explain the lower coupon rate on the Qwerty bond