Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bonus Rates+ Make up your own data Note: Make up your own numbers: Show all calculations, please. Operating Budget Management needs to issue a budget

Bonus Rates+

Bonus Rates+Make up your own data

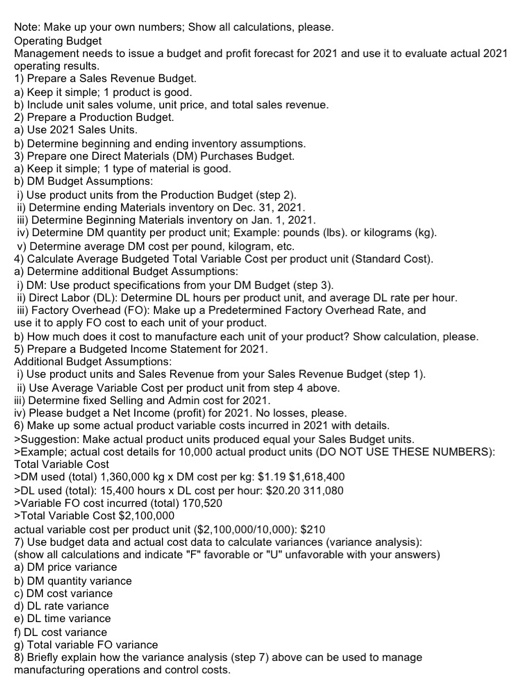

Note: Make up your own numbers: Show all calculations, please. Operating Budget Management needs to issue a budget and profit forecast for 2021 and use it to evaluate actual 2021 operating results. 1) Prepare a Sales Revenue Budget. a) Keep it simple; 1 product is good. b) Include unit sales volume, unit price, and total sales revenue. 2) Prepare a Production Budget. a) Use 2021 Sales Units. b) Determine beginning and ending inventory assumptions. 3) Prepare one Direct Materials (DM) Purchases Budget. a) Keep it simple; 1 type of material is good. b) DM Budget Assumptions: i) Use product units from the Production Budget (step 2). ii) Determine ending Materials inventory on Dec. 31, 2021. i) Determine Beginning Materials inventory on Jan. 1, 2021. iv) Determine DM quantity per product unit: Example: pounds (lbs). or kilograms (kg). v) Determine average DM cost per pound, kilogram, etc. 4) Calculate Average Budgeted Total Variable Cost per product unit (Standard Cost). a) Determine additional Budget Assumptions: i) DM: Use product specifications from your DM Budget (step 3). ii) Direct Labor (DL): Determine DL hours per product unit, and average DL rate per hour. ih) Factory Overhead (FO): Make up a predetermined Factory Overhead Rate, and use it to apply FO cost to each unit of your product. b) How much does it cost to manufacture each unit of your product? Show calculation, please. 5) Prepare a Budgeted Income Statement for 2021. Additional Budget Assumptions: 1) Use product units and Sales Revenue from your Sales Revenue Budget (step 1). ii) Use Average Variable Cost per product unit from step 4 above. ii) Determine fixed Selling and Admin cost for 2021. iv) Please budget a Net Income (profit) for 2021. No losses, please. 6) Make up some actual product variable costs incurred in 2021 with details. >Suggestion: Make actual product units produced equal your Sales Budget units. >Example; actual cost details for 10,000 actual product units (DO NOT USE THESE NUMBERS): Total Variable Cost >DM used (total) 1,360,000 kg x DM cost per kg: 91.19 $1,618,400 >DL used (total): 15,400 hours x DL cost per hour: $20.20 311,080 >Variable FO cost incurred (total) 170,520 >Total Variable Cost $2,100,000 actual variable cost per product unit ($2,100,000/10,000): $210 7) Use budget data and actual cost data to calculate variances (variance analysis): (show all calculations and indicate "F" favorable or "U" unfavorable with your answers) a) DM price variance b) DM quantity variance c) DM cost variance d) DL rate variance e) DL time variance f) DL cost variance 9) Total variable FO variance 8) Briefly explain how the variance analysis (step 7) above can be used to manage manufacturing operations and control costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started