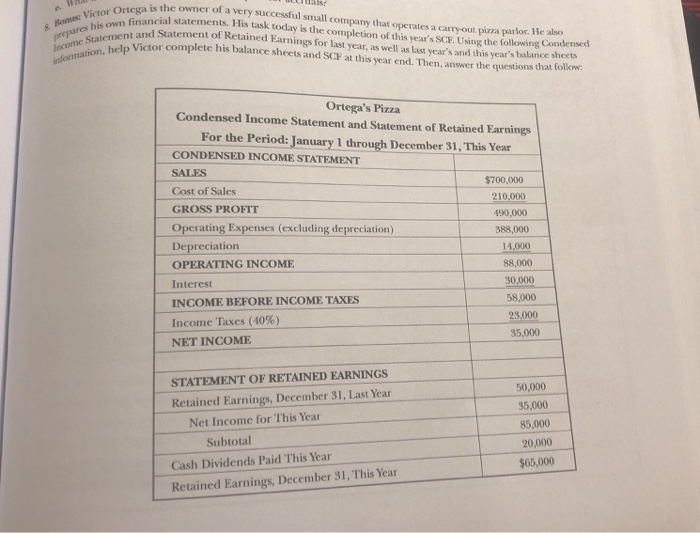

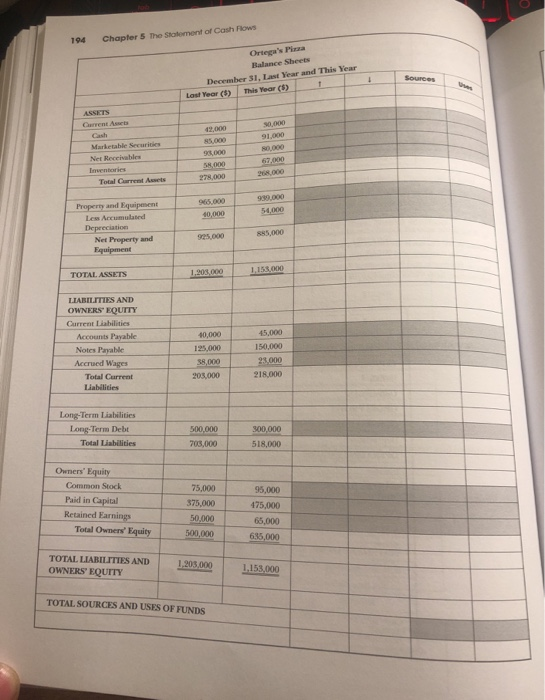

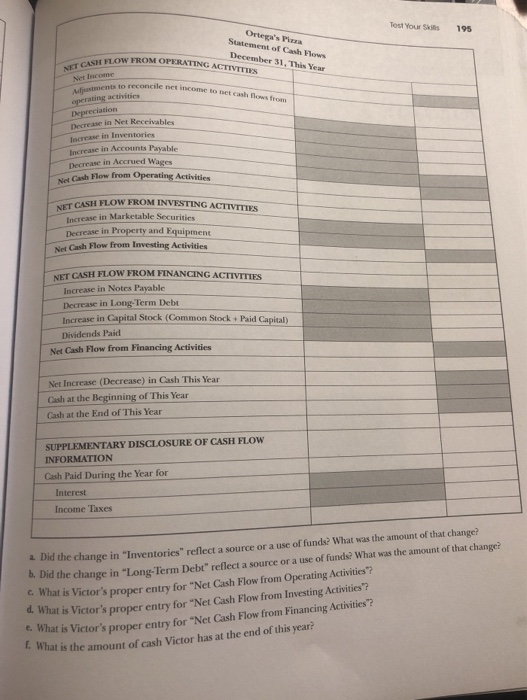

Bonus Victor Ortega prepares his own Income Statement and s information, help Vice is the owner of a very successful small company that operates a crout pizza parlor. He also Gancial statements. His task today is the completion of this year's SC in the following Condensed and Statement of Retained Earnings for last year as well as last year's and this year's balance sheets Victor complete his balance sheets and SCF at this warend Then anwer the questions that follow Ortega's Pizza Condensed Income Statement and Statement of Retained Earnings For the Period: January 1 through December 31, This Year CONDENSED INCOME STATEMENT SALES $700,000 Cost of Sales 210,000 GROSS PROFIT 490.000 Operating Expenses (excluding depreciation) 388,000 Depreciation 14,000 OPERATING INCOME 88,000 Interest 30,000 INCOME BEFORE INCOME TAXES 58,000 23,000 Income Taxes (40%) 35,000 NET INCOME STATEMENT OF RETAINED EARNINGS Retained Earnings, December 31, Last Year Net Income for This Year Subtotal Cash Dividends Paid This Year Retained Earnings, December 31, This Year 50,000 35,000 85,000 20,000 $65,000 194 Chapter 5 The Statement of Cash Pows Ortega's Pizza Balance Sheets December 31, Last Year and This Year Last Year ($) This Year (5) 50.000 19.000 $5.000 9,000 SH000 278.000 Not Receivables 268.000 Total Current Awets 05.000 40,000 54,000 Property and Equipment Lew Accumulated Depreciation Net Property and Equipment 925.000 45,000 TOTAL ASSETS 1,203000 1.158.000 LIABILITIES AND OWNERS' EQUITY Current Llabilities Accounts Payable Notes Payable 40,000 125.000 58.000 205,000 45,000 150,000 23.000 Accrued Wages Total Current Llabilities 218,000 Long-Term Liabilities Long-Term Debt Total Liabilities 300.000 500,000 700.000 518,000 75,000 Owners' Equity Common Stock Paid in Capital Retained Earnings Total Owners' Equity 375,000 95,000 475,000 65,000 635,000 50,000 500,000 TOTAL LIABILITIES AND OWNERS' EQUITY 1.200.000 1.153,000 TOTAL SOURCES AND USES OF FUNDS Test Yours 195 Ortega's Pla Statement of Cash Flows December 31, 'This Year SHFLOW FROM OPERATING ACTIV DATING ACTIVITIES NET CASH to reconcile net income to Net Income Apments to reco operating activities Depreciation cash flows Decrease in Net Receivables Increase in Inventories Increase in Accounts Payable Decrease in Accrued Wages Cash Flow from Operating Activiti CCASH FLOW FROM INVESTING ACTIVITIES NET CASH Increase in Marketable Securit Decrease in Property and Equipment Cash Flow from Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Increase in Notes Payable Decrease in Long Term Debt Tecrease in Capital Stock (Common Stock + Paid Capital) Dividends Paid Net Cash Flow from Financing Activities Net Increase (Decrease) in Cash This Year Cash at the Beginning of This Year Cash at the End of This Year SUPPLEMENTARY DISCLOSURE OF CASH FLOW INFORMATION Cash Paid During the Year for Interest Income Taxes Did the change in "Inventories" reflect a source or a use of funds? What was the amount of that change! Did the change in "Long Term Debt" reflect a source or a use of funds? What was the amount of that changed What is Victor's proper entry for "Net Cash Flow from Operating Activities? 4. What is Victor's proper entry for "Net Cash Flow from Investing Activities? hat is Victor's proper entry for "Net Cash Flow from Financing Activities"? What is the amount of cash Victor has at the end of this year