Boodja-Dooga Ltd balances its accounts at month-end, using special journals, and the perpetual inventory system with the FIFO cost flow assumption. All purchases and sales of inventory are made on credit. The end of the reporting period is June 30. All transactions include GST. Sales and purchases of product JINX-87 in May 2019 were as follows.

| Date | Transaction | No. | Unit cost |

| May 1 May 7 May 11 May 17 May 21 May 24 May 29 | Inventory on hand Purchase (GST inclusive) Sale @ $77.00 per unit (GST Inclusive) Purchase (GST Inclusive) Purchase return (GST Inclusive) Sale @ $39.60 per unit (GST Inclusive) Sale return (on May 24 sale) | 50 20 54 30 10 30 8 | $20.00 $24.20 $26.40 $24.20 |

Requirements:

- For product JINX-87, calculate May 2019s cost of sales and cost of inventory on hand on as at May 31, 2019.

- Prepare any journal entries required on June 30, 2019, to correct any errors and to adjust the inventory account. Refer to the provided Chart of Accounts for the appropriate account names.

Part A:

For product JINX-87, calculate May 2019s cost of sales and cost of inventory on hand as at May 31, 2019

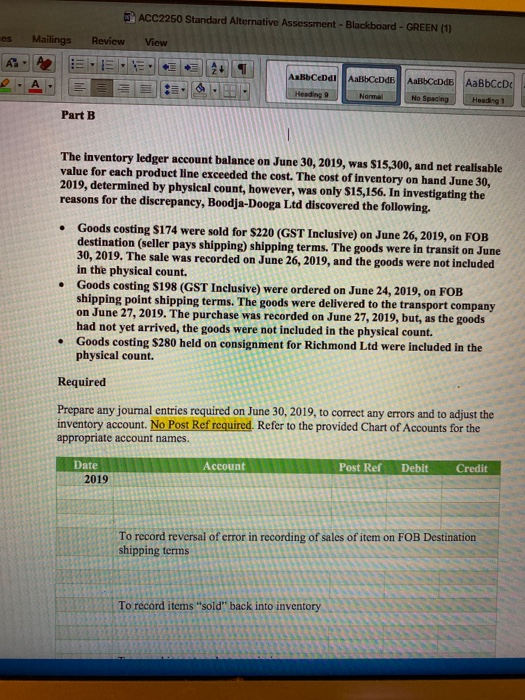

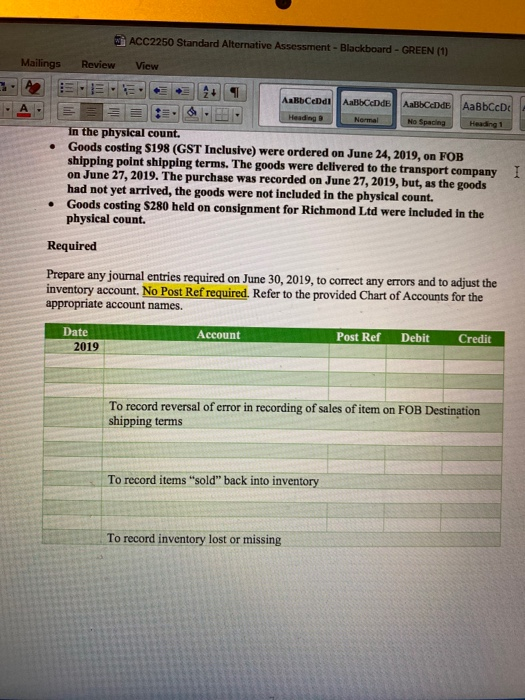

ACC2250 Standard Alternative Assessment - Blackboard - GREEN (1) es Mailings Review View A E- AalbCeDdE AaBbCcDdB Heading Normal AaBbCcD Heading 1 No Spacing Part B . The inventory ledger account balance on June 30, 2019, was $15,300, and net realisable value for each product line exceeded the cost. The cost of inventory on hand June 30, 2019, determined by physical count, however, was only $15,156. In investigating the reasons for the discrepancy, Boodja-Dooga Ltd discovered the following. Goods costing $174 were sold for S220 (GST Inclusive) on June 26, 2019, on FOB destination (seller pays shipping) shipping terms. The goods were in transit on June 30, 2019. The sale was recorded on June 26, 2019, and the goods were not included in the physical count. Goods costing S198 (GST Inclusive) were ordered on June 24, 2019, on FOB shipping point shipping terms. The goods were delivered to the transport company on June 27, 2019. The purchase was recorded on June 27, 2019, but, as the goods had not yet arrived, the goods were not included in the physical count. Goods costing $280 held on consignment for Richmond Ltd were included in the physical count. Required Prepare any journal entries required on June 30, 2019, to correct any errors and to adjust the inventory account. No Post Ref required. Refer to the provided Chart of Accounts for the appropriate account names. Date Account Post Ref Debit Credit 2019 To record reversal of error in recording of sales of item on FOB Destination shipping terms To record items "sold" back into inventory ACC2250 Standard Alternative Assessment - Blackboard - GREEN (1) Mailings Review View AalbCeDdl Aabbed Heading Normal No Spacing AaBbcade AaBbCcDc Heading 1 In the physical count. Goods costing $198 (GST Inclusive) were ordered on June 24, 2019, on FOB shipping point shipping terms. The goods were delivered to the transport company I on June 27, 2019. The purchase was recorded on June 27, 2019, but, as the goods had not yet arrived, the goods were not included in the physical count. Goods costing $280 held on consignment for Richmond Ltd were included in the physical count Required Prepare any journal entries required on June 30, 2019, to correct any errors and to adjust the inventory account. No Post Ref required. Refer to the provided Chart of Accounts for the appropriate account names. Date 2019 Account Post Ref Debit Credit To record reversal of error in recording of sales of item on FOB Destination shipping terms To record items "sold" back into inventory To record inventory lost or missing