Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Book: Health Care Finance Judith J. Baker Assignment 9 Instructions Using the Balance Sheet and the Income Statement (Statement of Revenues and Expenses) provided in

Book:

Health Care Finance

Judith J. Baker

Assignment 9

Instructions

Using the Balance Sheet and the Income Statement (Statement of Revenues and Expenses) provided in Figure 12-1 (within Chapter 12 on page 130), calculate both the OPERATING MARGIN and the RETURN ON TOTAL ASSETS using the formulas on page 132.

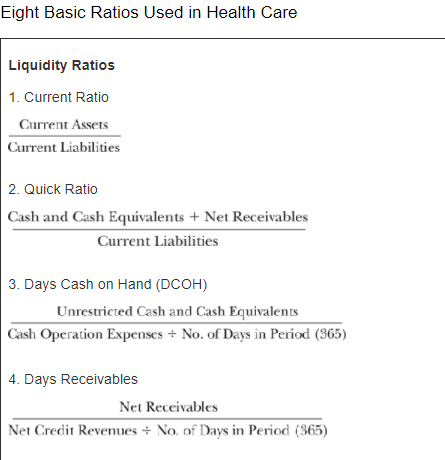

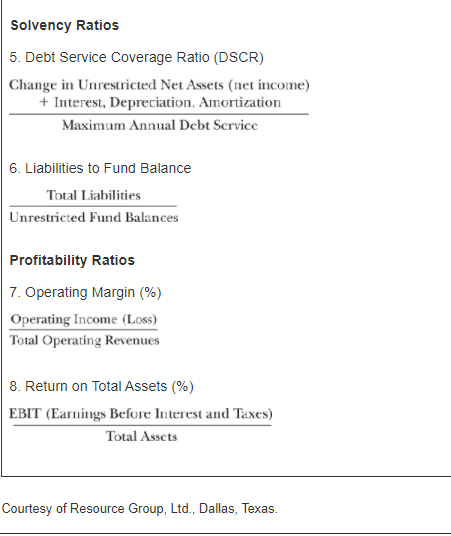

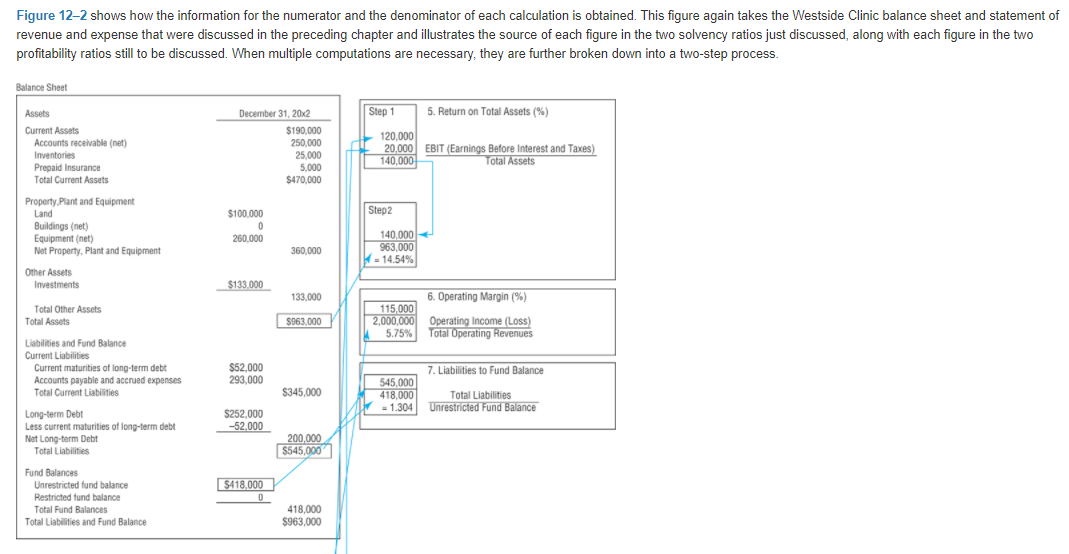

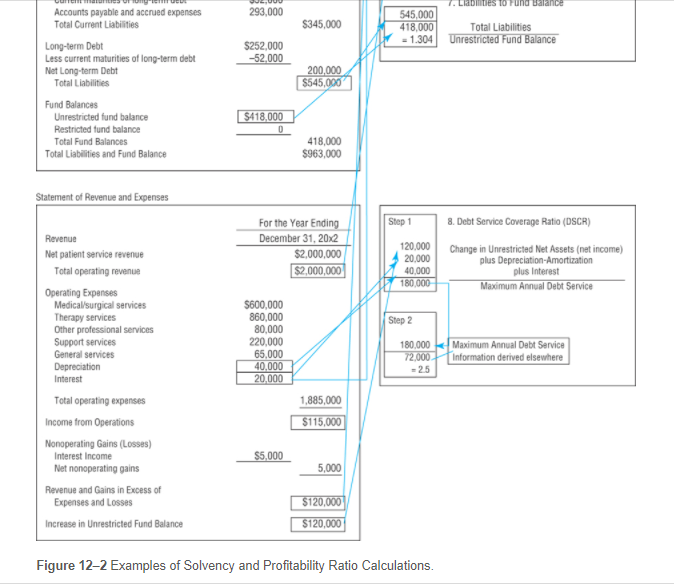

Eight Basic Ratios Used in Health Care Liquidity Ratios 1. Current Ratio Current Assets Current Liabilities 2. Quick Ratio Cash and Cash Equivalents + Net Receivables Current Liabilities 3. Days Cash on Hand (DCOH) Unrestricted Cash and Cash Equivalents Cash Operation Expenses + No. of Days in Period (365) 4. Days Receivables Net Receivables Net Credit Revenues + No. of Days in Period (365) Solvency Ratios 5. Debt Service Coverage Ratio (DSCR) Change in Unrestricted Net Assets (net income) + Interest, Depreciation, Amortization Maximum Annual Debt Service 6. Liabilities to Fund Balance Total Liabilities Unrestricted Fund Balances Profitability Ratios 7. Operating Margin (%) Operating Income (Loss) Total Operating Revenues 8. Return on Total Assets (%) EBIT (Earnings Before Interest and Taxes) Total Assets Courtesy of Resource Group, Ltd., Dallas, Texas. Figure 12-2 shows how the information for the numerator and the denominator of each calculation is obtained. This figure again takes the Westside Clinic balance sheet and statement of revenue and expense that were discussed in the preceding chapter and illustrates the source of each figure in the two solvency ratios just discussed, along with each figure in the two profitability ratios still to be discussed. When multiple computations are necessary, they are further broken down into a two-step process. Balance Sheet Assets Current Assets Accounts receivable (net) Inventories Prepaid Insurance Total Current Assets December 31, 20x2 , $190,000 250,000 25,000 5,000 $470,000 Step 1 5. Return on Total Assets (%) 120,000 20,000 EBIT (Earnings Before Interest and Taxes) 140,000 Total Assets Step 2 Property Plant and Equipment Land Buildings (net) Equipment (net) Net Property, Plant and Equipment $100.000 0 260.000 360,000 140,000 963,000 W = = 14.54% Other Assets Investments $133.000 133,000 $963,000 6. Operating Margin (%) 115,000 2,000,000 Operating Income (Loss) 5.75% Total Operating Revenues Total Other Assets Total Assets Liabilities and Fund Balance Current Liabilities Current maturities of long-term debt Accounts payable and accrued expenses Total Current Liabilities Long-term Debt Less current maturities of long-term debt Net Long-term Debt Total Liabilities $52,000 293.000 7. Liabilities to Fund Balance $345,000 545,000 418,000 = 1.304 Total Liabilities Unrestricted Fund Balance $252,000 -52.000 200,000 $545,000 Fund Balances Unrestricted fund balance Restricted fund balance Total Fund Balances Total Liabilities and Fund Balance $418,000 0 418,000 $963,000 Llamtes To und Balance 293.000 $345,000 545,000 418,000 = 1.304 Total Liabilities Unrestricted Fund Balance $252,000 -52.000 Accounts payable and accrued expenses Total Current Liabilities Long-term Debt Less current maturities of long-term debt Net Long-term Debt Total Liabilities Fund Balances Unrestricted fund balance Restricted fund balance Total Fund Balances Total Liabilities and Fund Balance 200,000 $545,000 $418,000 0 418,000 $963,000 Statement of Revenue and Expenses Step 1 For the Year Ending December 31, 20:2 $2,000,000 $2,000,000 120.000 20.000 40,000 180,000 8. Debt Service Coverage Ratio (DSCR) Change in Unrestricted Net Assets (net income) plus Depreciation Amortization plus interest Maximum Annual Debt Service Step 2 $600,000 860,000 80,000 220,000 65,000 40,000 20.000 180.000 72.000 -25 Revenue Net patient service revenue Total operating revenue Operating Expenses Medical/surgical services Therapy services Other professional services Support services General services Depreciation Interest Total operating expenses Income from Operations Nonoperating Gains (Losses) Interest Income Net nonoperating pains Revenue and Gains in Excess of Expenses and Losses Increase in Unrestricted Fund Balance Maximum Annual Debt Service Information derived elsewhere 1,885,000 $115,000 $5,000 5,000 $120,000 $120,000 Figure 12-2 Examples of Solvency and Profitability Ratio CalculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started