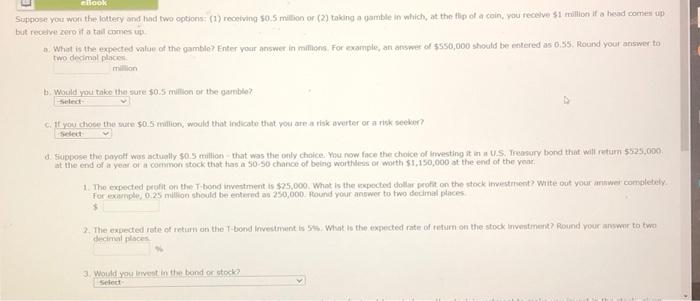

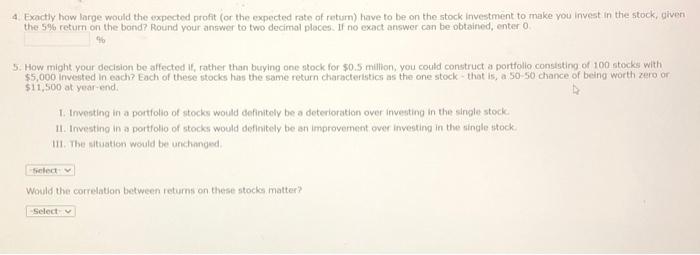

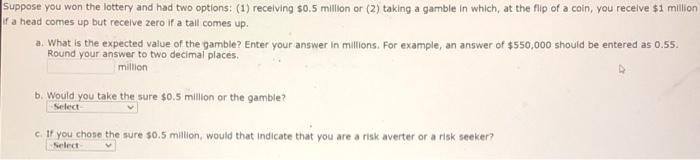

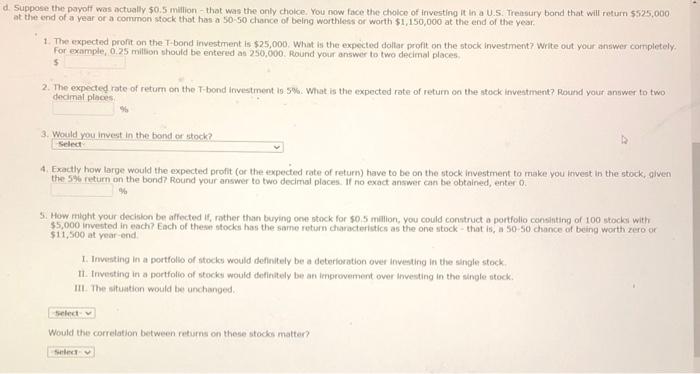

Book Suppose you won the lottery and had two options: (1) receiving 50.5 million or (2) taking a gamble in which at the flip of a coin, you receive 1 million if a head comes up but receve zero it a tail comes up 5. What is the expected value of the gamble> Enter your answer in motions. For example, an answer of $550,000 should be entered as 0.155. Round your neeswer to two million b. Would you take the sure $0.5 million or the gamble? citl you do the mate $0.5 million, would that indicate that you are a risk verter or a risk secer? Select . Suppose the payoff was actually $0.5 million that was the only choice. You now face the choice of investing it in a US Treasury bond that will retum $525,000 at the end of a year of a common stock that has a 50-50 chance of being worthless or worth $1,150,000 at the end of the year 1. The expected profit on the bond investment is $25,000. What is the expected dollar profit on the stock investment wit out your we completely For example, 0.25 million should be entered 250,000. Round your answer to two decimal places $ 2. The expected rute of return on the T-bond Investment is 5 Wit is the expected rate or retum on the stock Inventment? Round your answer to two decimal places 3. Would you live in the bond on stock Seed 4. Exactly how large would the expected profit (or the expected rate of return) have to be on the stock Investment to make you invest in the stock, given the 5% return on the bond? Round your answer to two decimal places. If no exact answer can be obtained, enter 0 5. How might your decision be affected It, rather than buying one stock for $0.5 million, you could construct a portfolio consisting of 100 stocks with $5,000 invested in each? Each of these stocks has the same return characteristics as the one stock that is, a 50-50 chance of being worth zero or $11,500 at year-end 1. Investing in a portfolio of stocks would definitely be a deterioration over investing in the single stock 1. Investing in a portfolio of stocks would definitely be an improvement over Investing in the single stock in. The situation would be unchanged Would the correlation between returns on these stock matter? Select Suppose you won the lottery and had two options: (1) receiving $0.5 million or (2) taking a gamble in which, at the flip of a coin, you receive $1 million Ir a head comes up but receive zero if a tall comes up. a. what is the expected value of the gamble? Enter your answer in millions. For example, an answer of $550,000 should be entered as 0.55. Round your answer to two decimal places. million b. Would you take the sure $0.5 million or the gamble? Select c. If you chose the sure $0.5 million would that indicate that you are a risk averter or a risk seeker? Select d. Suppose the payoff was actually $0.5 million that was the only choice. You now face the choice of Investing it in a U.S. Treasury bond that will return $525.000 at the end of a year or a common stock that has a 50-50 chance of being worthless of worth $1,150,000 at the end of the year 1. The expected profit on the T-bond investment is $25,000. What is the expected dollar profit on the stock investment? Write out your answer completely For example, 0,25 million should be entered as 250,000. Round your answer to two decimal places $ 2. The expected rate of return on the T-bond investment is 5%. What is the expected rate of return on the stock investment? Round your answer to two decimal places 3. Would you invest in the bond or stock? Select 4. Exactly how large would the expected profit (or the expected rate of return) have to be on the stock investment to make you invest in the stock, given the 5% return on the bond? Round your answer to two decimal places. If no exact answer can be obtained, enter 0 5. How might your decision be affected it, rather than buying one stock for $0.5 million, you could construct a portfolio consting of 100 stock with $5,000 invested in each Each of these stocks has the same return characteristics as the one stock - that is, 50-50 chance of being worth zero or $11,500 at year end I. Investing in a portfolio of stocks would definitely be a deterioration over investing in the single stock IL. trivesting in a portfolio of stocks would definitely be an improvement over Investing in the single stock. III. The situation would be unchanged select Would the correlation between returns on these stocks matter