Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Book value and taxes on sale of assets Troy Industries purchased a new machine 5 year(s) ago for $84,000. It is being depreciated under MACRS

Book value and taxes on sale of assets

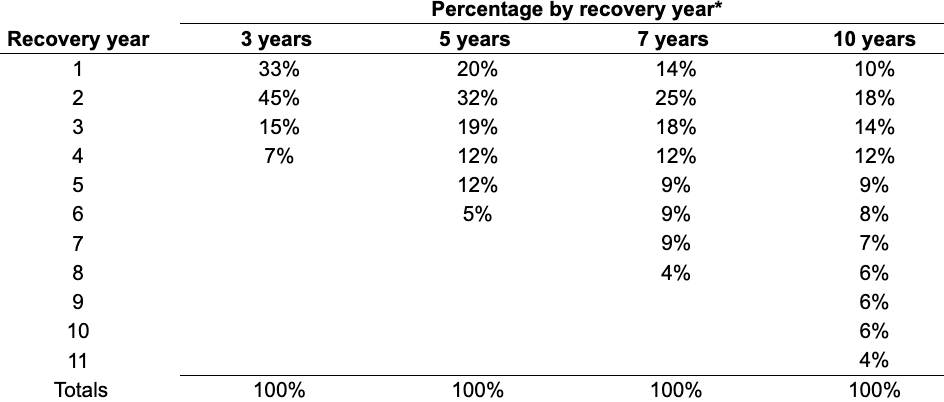

Troy Industries purchased a new machine 5 year(s) ago for $84,000. It is being depreciated under MACRS with a 5-year recovery period using the schedule:

Assume 21% ordinary and capital gains tax rates.

The remaining book value is $4200.

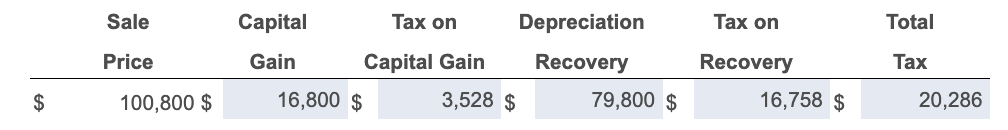

Calculate the capital gain, tax on capital gain, depreciation recovery, and tax on recovery to find the total tax, if the machine sold for each of the following amounts:

$58,800;$4,200; and $2,900.

Please provide work for an upvote.

For example: If the machine sold for 100,800:

Percentage by recovery year* \begin{tabular}{ccccc} Recovery year & 3 years & 5 years & 7 years & 10 years \\ \hline 1 & 33% & 20% & 14% & 10% \\ 2 & 45% & 32% & 25% & 18% \\ 3 & 15% & 19% & 18% & 14% \\ 4 & 7% & 12% & 12% & 12% \\ 5 & & 12% & 9% & 9% \\ 6 & & 5% & 9% \\ 7 & & 4% & 7% \\ 8 & & & 6% \\ 9 & & & 6% \\ 10 & & & & 6% \\ 11 & 100% & & & 4% \\ Totals & & & & 100% \end{tabular}

Percentage by recovery year* \begin{tabular}{ccccc} Recovery year & 3 years & 5 years & 7 years & 10 years \\ \hline 1 & 33% & 20% & 14% & 10% \\ 2 & 45% & 32% & 25% & 18% \\ 3 & 15% & 19% & 18% & 14% \\ 4 & 7% & 12% & 12% & 12% \\ 5 & & 12% & 9% & 9% \\ 6 & & 5% & 9% \\ 7 & & 4% & 7% \\ 8 & & & 6% \\ 9 & & & 6% \\ 10 & & & & 6% \\ 11 & 100% & & & 4% \\ Totals & & & & 100% \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started