Answered step by step

Verified Expert Solution

Question

1 Approved Answer

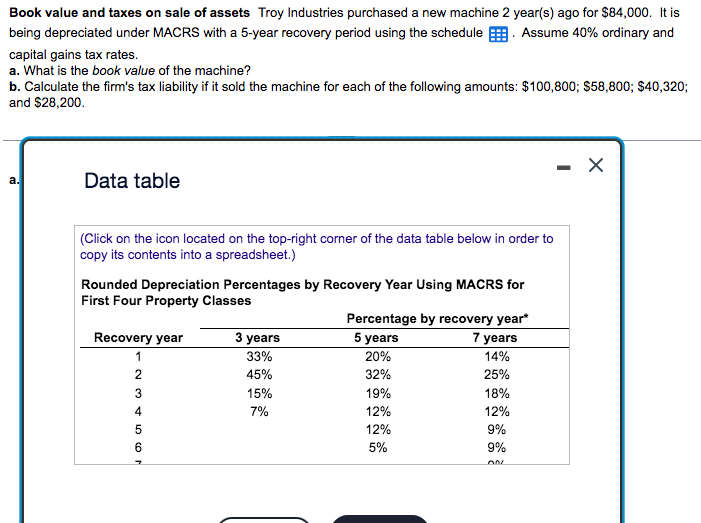

Book value and taxes on sale of assets Troy Industries purchased a new machine 2 year ( s ) ago for $ 8 4 ,

Book value and taxes on sale of assets Troy Industries purchased a new machine years ago for $ It is

being depreciated under MACRS with a year recovery period using the schedule Assume ordinary and

capital gains tax rates.

a What is the book value of the machine?

b Calculate the firm's tax liability if it sold the machine for each of the following amounts: $;$;$;

and $

a

Data table

Click on the icon located on the topright corner of the data table below in order to

copy its contents into a spreadsheet.

Rounded Depreciation Percentages by Recovery Year Using MACRS for

First Four Property Classes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started