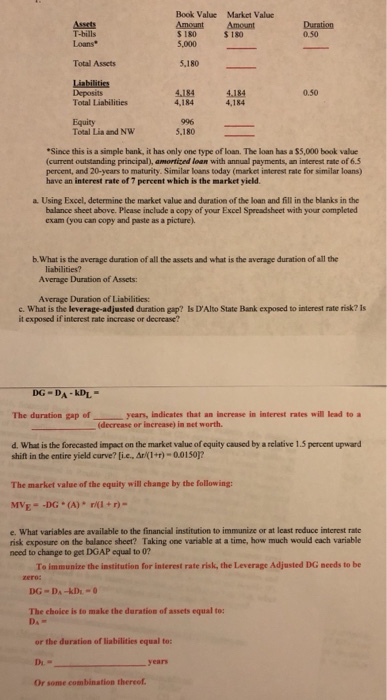

Book Value Market Valuc Assets T-bills Loans" Amount Amount S 180 Duration 0.50 $ 180 5,000 Total Assets 5,180 Liabilitics Deposits Total Liabilities 4.184 4.184 0.50 4,184 996 5.180_ 4,184 Equity Total Lia and NW Since this is a simple bank, it has only one type of loan. The loan has a $5,000 book value (current outstanding principal), amortized lean with annual payments, an interest rate of 6.5 percent, and 20-years to maturity. Similar loans today (market intcrest rate for similar loans) have an interest rate of 7 percent which is the market yield a Using Excel, determine the market value and duration of the loan and fill in the blanks in the balance sheet above. Please include a copy of your Excel Spreadsheet with your completed exam (you can copy and paste as a picture). b.What is the average duration of all the assets and what is the average duration of all the liabilities? Average Duration of Assets: Average Duration of Liabilitics: c. What is the leverage-adjusted duration gap? Is D'Alto State Bank exposed to interest rate risk? is it exposed if interest rate increase or decrease DG-DA-kL The duration gap of years, Indicates that an increase in interest rates will lead to a d. What is the forecasted impact on the market value of equity caused by a relative 1.5 percent upward shift in the entire yield curve? [ie, ?/(1+r)-00150r The market value of the equity will change by the following: MVE- DG (A) +r)- e. What variables are available to the financial institution to immunize or at least reduce interest rate risk exposare on the balance sheet? Taking one variable at a time, how much would each variable need to change to get DGAP equal to 0? To immunize the institution for interest rate risk, the Leverage Adjusted DG needs to be DG-DA-kD- The choice is to make the duration of assets equal to: DA or the duration of liabilities equal to: years Or some combination thereof. Book Value Market Valuc Assets T-bills Loans" Amount Amount S 180 Duration 0.50 $ 180 5,000 Total Assets 5,180 Liabilitics Deposits Total Liabilities 4.184 4.184 0.50 4,184 996 5.180_ 4,184 Equity Total Lia and NW Since this is a simple bank, it has only one type of loan. The loan has a $5,000 book value (current outstanding principal), amortized lean with annual payments, an interest rate of 6.5 percent, and 20-years to maturity. Similar loans today (market intcrest rate for similar loans) have an interest rate of 7 percent which is the market yield a Using Excel, determine the market value and duration of the loan and fill in the blanks in the balance sheet above. Please include a copy of your Excel Spreadsheet with your completed exam (you can copy and paste as a picture). b.What is the average duration of all the assets and what is the average duration of all the liabilities? Average Duration of Assets: Average Duration of Liabilitics: c. What is the leverage-adjusted duration gap? Is D'Alto State Bank exposed to interest rate risk? is it exposed if interest rate increase or decrease DG-DA-kL The duration gap of years, Indicates that an increase in interest rates will lead to a d. What is the forecasted impact on the market value of equity caused by a relative 1.5 percent upward shift in the entire yield curve? [ie, ?/(1+r)-00150r The market value of the equity will change by the following: MVE- DG (A) +r)- e. What variables are available to the financial institution to immunize or at least reduce interest rate risk exposare on the balance sheet? Taking one variable at a time, how much would each variable need to change to get DGAP equal to 0? To immunize the institution for interest rate risk, the Leverage Adjusted DG needs to be DG-DA-kD- The choice is to make the duration of assets equal to: DA or the duration of liabilities equal to: years Or some combination thereof