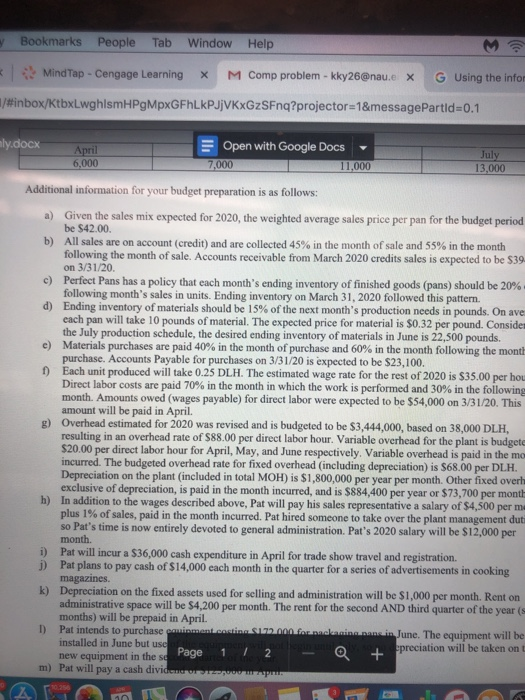

Bookmarks People Tab Window Help Mind Tap - Cengage Learning X M Comp problem - kky 26@nau.e X G Using the info #inbox/ktbxlwghismHPgMpxGFhLKPJjVKxGzSFng?projector=1&messagePartid=0.1 ily.docx = Open with Google Docs 7,000 11,000 April 6,000 July 13,000 Additional information for your budget preparation is as follows: a) Given the sales mix expected for 2020, the weighted average sales price per pan for the budget period be $42.00 b) All sales are on account credit) and are collected 45% in the month of sale and 55% in the month following the month of sale. Accounts receivable from March 2020 credits sales is expected to be $39 on 3/31/20 c) Perfect Pans has a policy that each month's ending inventory of finished goods (pans) should be 20% following month's sales in units. Ending inventory on March 31, 2020 followed this pattern. d) Ending inventory of materials should be 15% of the next month's production needs in pounds. On ave cach pan will take 10 pounds of material. The expected price for material is $0.32 per pound. Conside the July production schedule, the desired ending inventory of materials in June is 22,500 pounds. e) Materials purchases are paid 40% in the month of purchase and 60% in the month following the month purchase. Accounts Payable for purchases on 3/31/20 is expected to be $23,100. 1) Each unit produced will take 0.25 DLH. The estimated wage rate for the rest of 2020 is $35.00 per hou Direct labor costs are paid 70% in the month in which the work is performed and 30% in the following month. Amounts owed (wages payable) for direct labor were expected to be $54,000 on 3/31/20. This amount will be paid in April Overhead estimated for 2020 was revised and is budgeted to be $3,444,000, based on 38,000 DLH, resulting in an overhead rate of 588.00 per direct labor hour. Variable overhead for the plant is budget $20.00 per direct labor hour for April, May, and June respectively. Variable overhead is paid in the me incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plant (included in total MOH) is $1,800,000 per year per month. Other fixed over exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month h) In addition to the wages described above, Pat will pay his sales representative a salary of $4,500 per m. plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant management du so Pat's time is now entirely devoted to general administration. Pat's 2020 salary will be $12,000 per month. Pat will incur a $36,000 cash expenditure in April for trade show travel and registration 1) Pat plans to pay cash of $14,000 each month in the quarter for a series of advertisements in cooking magazines k) Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,200 per month. The rent for the second AND third quarter of the year months) will be prepaid in April. 1) Pat intends to purchase cominment.co . . .formanninn June. The equipment will be installed in June but use 1 1 2 new equipment in these Page - Q + preciation will be taken on m) Pat will pay a cash divider Bookmarks People Tab Window Help Mind Tap - Cengage Learning X M Comp problem - kky 26@nau.e X G Using the info #inbox/ktbxlwghismHPgMpxGFhLKPJjVKxGzSFng?projector=1&messagePartid=0.1 ily.docx = Open with Google Docs 7,000 11,000 April 6,000 July 13,000 Additional information for your budget preparation is as follows: a) Given the sales mix expected for 2020, the weighted average sales price per pan for the budget period be $42.00 b) All sales are on account credit) and are collected 45% in the month of sale and 55% in the month following the month of sale. Accounts receivable from March 2020 credits sales is expected to be $39 on 3/31/20 c) Perfect Pans has a policy that each month's ending inventory of finished goods (pans) should be 20% following month's sales in units. Ending inventory on March 31, 2020 followed this pattern. d) Ending inventory of materials should be 15% of the next month's production needs in pounds. On ave cach pan will take 10 pounds of material. The expected price for material is $0.32 per pound. Conside the July production schedule, the desired ending inventory of materials in June is 22,500 pounds. e) Materials purchases are paid 40% in the month of purchase and 60% in the month following the month purchase. Accounts Payable for purchases on 3/31/20 is expected to be $23,100. 1) Each unit produced will take 0.25 DLH. The estimated wage rate for the rest of 2020 is $35.00 per hou Direct labor costs are paid 70% in the month in which the work is performed and 30% in the following month. Amounts owed (wages payable) for direct labor were expected to be $54,000 on 3/31/20. This amount will be paid in April Overhead estimated for 2020 was revised and is budgeted to be $3,444,000, based on 38,000 DLH, resulting in an overhead rate of 588.00 per direct labor hour. Variable overhead for the plant is budget $20.00 per direct labor hour for April, May, and June respectively. Variable overhead is paid in the me incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plant (included in total MOH) is $1,800,000 per year per month. Other fixed over exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month h) In addition to the wages described above, Pat will pay his sales representative a salary of $4,500 per m. plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant management du so Pat's time is now entirely devoted to general administration. Pat's 2020 salary will be $12,000 per month. Pat will incur a $36,000 cash expenditure in April for trade show travel and registration 1) Pat plans to pay cash of $14,000 each month in the quarter for a series of advertisements in cooking magazines k) Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,200 per month. The rent for the second AND third quarter of the year months) will be prepaid in April. 1) Pat intends to purchase cominment.co . . .formanninn June. The equipment will be installed in June but use 1 1 2 new equipment in these Page - Q + preciation will be taken on m) Pat will pay a cash divider