Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BookWeb, Incorporated, sells books and software over the Internet. A recent article in a trade journal has caught the attention of management because the

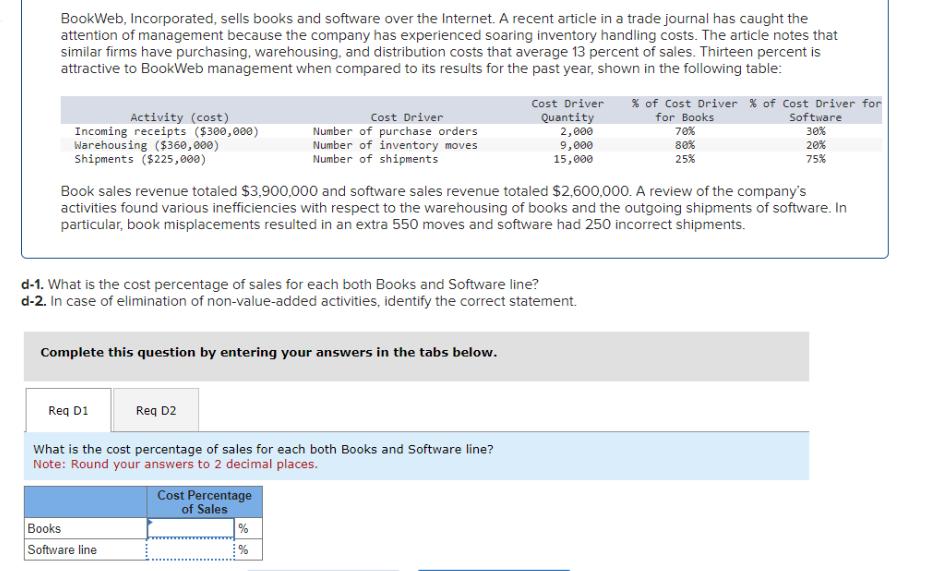

BookWeb, Incorporated, sells books and software over the Internet. A recent article in a trade journal has caught the attention of management because the company has experienced soaring inventory handling costs. The article notes that similar firms have purchasing, warehousing, and distribution costs that average 13 percent of sales. Thirteen percent is attractive to BookWeb management when compared to its results for the past year, shown in the following table: Cost Driver Cost Driver % of Cost Driver % of Cost Driver for Activity (cost) Incoming receipts ($300,000) Warehousing ($360,000) Quantity Shipments ($225,000) Number of purchase orders Number of inventory moves Number of shipments 2,000 9,000 for Books 70% 80% Software 30% 20% 15,000 25% 75% Book sales revenue totaled $3,900,000 and software sales revenue totaled $2,600,000. A review of the company's activities found various inefficiencies with respect to the warehousing of books and the outgoing shipments of software. In particular, book misplacements resulted in an extra 550 moves and software had 250 incorrect shipments. d-1. What is the cost percentage of sales for each both Books and Software line? d-2. In case of elimination of non-value-added activities, identify the correct statement. Complete this question by entering your answers in the tabs below. Req D1 Req D2 What is the cost percentage of sales for each both Books and Software line? Note: Round your answers to 2 decimal places. Books Software line Cost Percentage of Sales %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

d1 Cost percentage of sales calculation Books Total books cost Incoming receipts 70 of 300000 Wareh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started