Answered step by step

Verified Expert Solution

Question

1 Approved Answer

boost Use the following information for questions 37 through 42: You are given the following cash flow information about a project (20 points): - net

boost

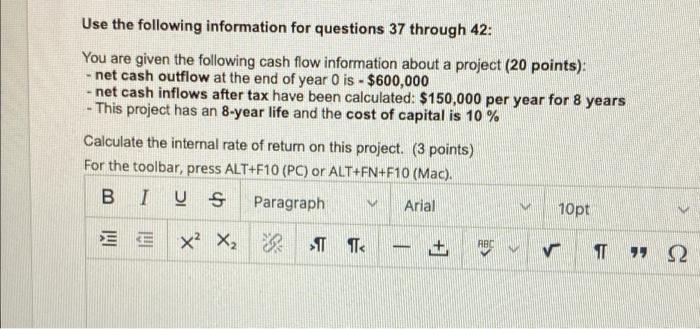

Use the following information for questions 37 through 42: You are given the following cash flow information about a project (20 points): - net cash outflow at the end of year O is - $600,000 net cash inflows after tax have been calculated: $150,000 per year for 8 years This project has an 8-year life and the cost of capital is 10% - Calculate the internal rate of return on this project. (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I US Paragraph Arial V V 10pt EE X2 X2 x? X2 82 T Ta ABC TT " S2 What is the net present value for the project? (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B TUS Paragraph Arial 10pt Calculate the payback period (not discounted). (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). QUESTION 40 Would you accept or reject? (2 points) Why? (2 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I y S BI Paragraph Arial V 10pt ART QUESTION 41 By how much will the total value of the company's stock change if they accept this project? (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac), os Paragraph Arial 10pt V x? X, TTT + T 22 QUESTION 42 Calculate the modified internal rate of return for this project. (4 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). 6 Paragraph Arial V 10pt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started