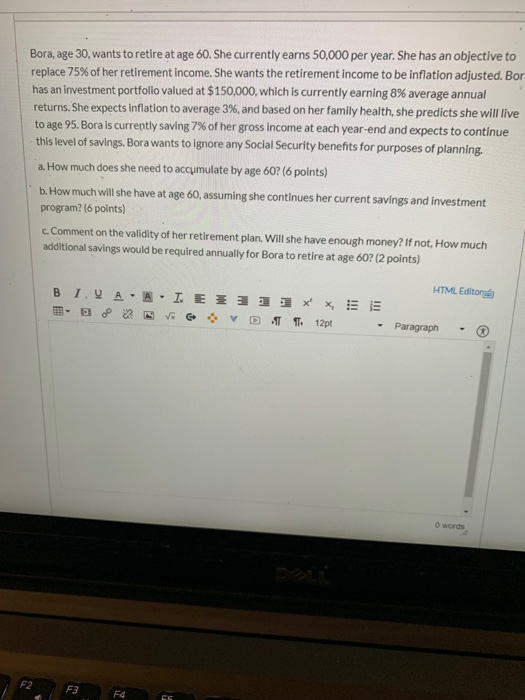

Bora, age 30, wants to retire at age 60. She currently earns 50,000 per year. She has an objective to replace 75% of her retirement income. She wants the retirement income to be inflation adjusted. Bor has an investment portfolio valued at $150,000, which is currently earning 8% average annual returns. She expects Inflation to average 3%, and based on her family health, she predicts she will live to age 95. Bora is currently saving 7% of her gross income at each year-end and expects to continue this level of savings. Bora wants to ignore any Social Security benefits for purposes of planning. a. How much does she need to accumulate by age 60? (6 points) b. How much will she have at age 60, assuming she continues her current savings and investment program? (6 points) c. Comment on the validity of her retirement plan. Will she have enough money? If not, How much additional savings would be required annually for Bora to retire at age 60? (2 points) B 1. V AA- IEE3 - B V V HTML Editore X XEE TT 12pt - Paragraph . O words F2 F3 F4 65 Bora, age 30, wants to retire at age 60. She currently earns 50,000 per year. She has an objective to replace 75% of her retirement income. She wants the retirement income to be inflation adjusted. Bor has an investment portfolio valued at $150,000, which is currently earning 8% average annual returns. She expects Inflation to average 3%, and based on her family health, she predicts she will live to age 95. Bora is currently saving 7% of her gross income at each year-end and expects to continue this level of savings. Bora wants to ignore any Social Security benefits for purposes of planning. a. How much does she need to accumulate by age 60? (6 points) b. How much will she have at age 60, assuming she continues her current savings and investment program? (6 points) c. Comment on the validity of her retirement plan. Will she have enough money? If not, How much additional savings would be required annually for Bora to retire at age 60? (2 points) B 1. V AA- IEE3 - B V V HTML Editore X XEE TT 12pt - Paragraph . O words F2 F3 F4 65