Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Borden Corporation provided the following partial trial balance for the current year (Click the icon to view the partial-trial balance) Prepare a single-step income

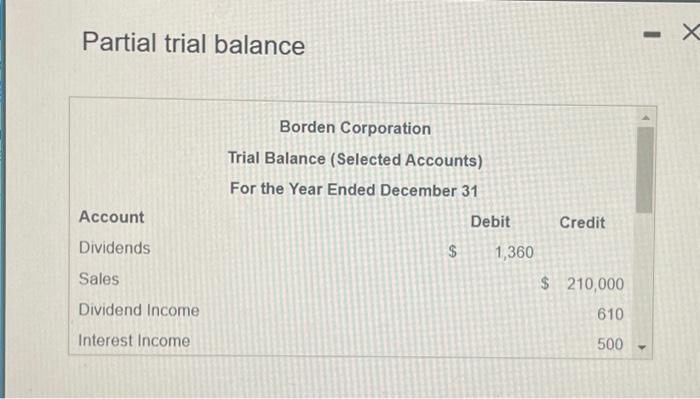

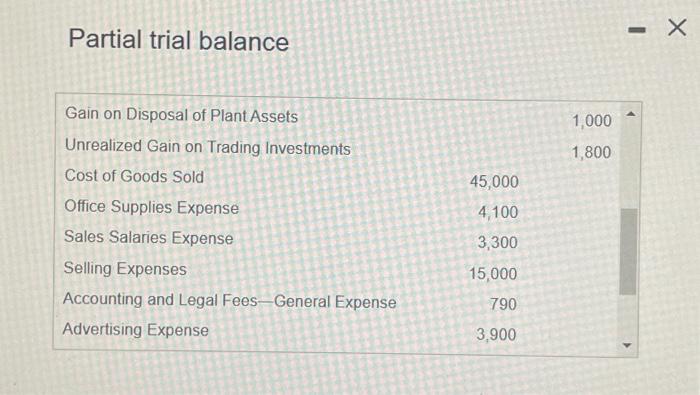

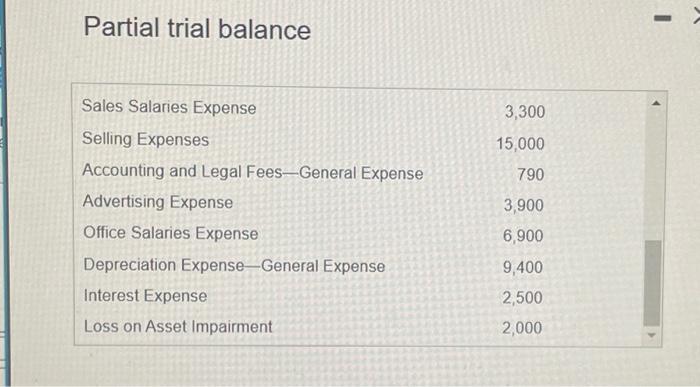

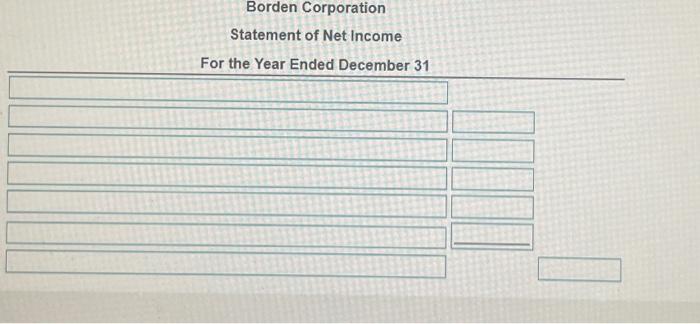

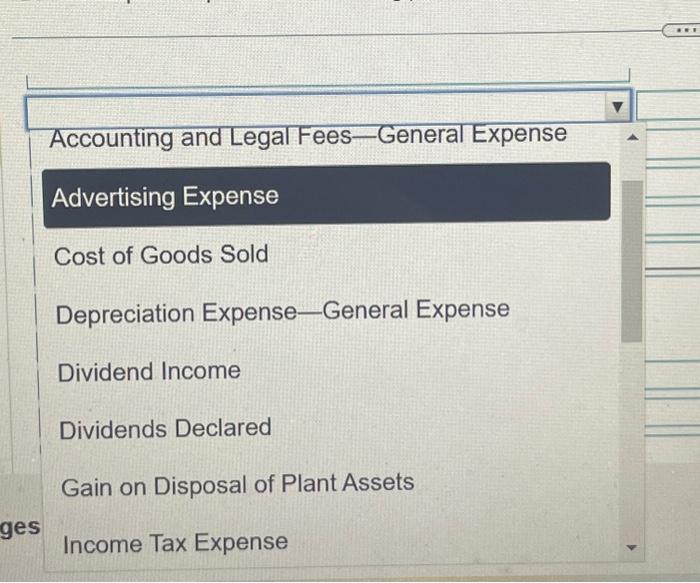

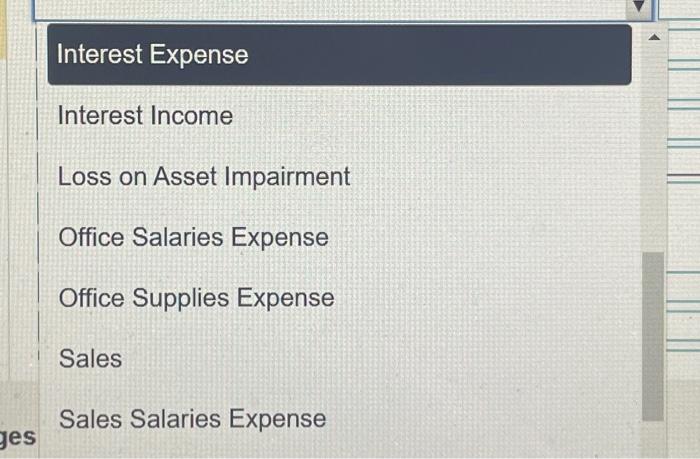

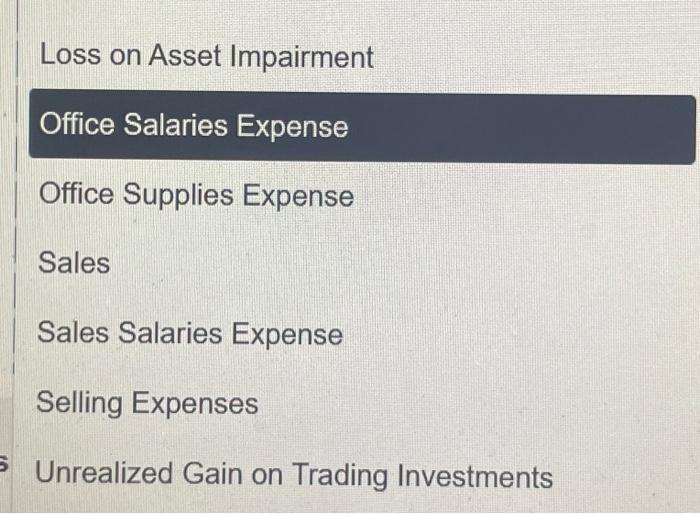

Borden Corporation provided the following partial trial balance for the current year (Click the icon to view the partial-trial balance) Prepare a single-step income statement for the year ended December 31 Borden is subject to a 40% income tax rate (Round all amounts to the nearest whole dollar) Borden Corporation Statement of Net Income For the Year Ended December 31 CITE Partial trial balance Account Dividends Sales Dividend Income Interest Income Borden Corporation Trial Balance (Selected Accounts) For the Year Ended December 31 $ Debit 1,360 Credit $ 210,000 610 500 - X Partial trial balance Gain on Disposal of Plant Assets Unrealized Gain on Trading Investments Cost of Goods Sold Office Supplies Expense Sales Salaries Expense Selling Expenses Accounting and Legal Fees-General Expense Advertising Expense 45,000 4,100 3,300 15,000 790 3,900 1,000 1,800 I X Partial trial balance Sales Salaries Expense Selling Expenses Accounting and Legal Fees-General Expense Advertising Expense Office Salaries Expense Depreciation Expense-General Expense. Interest Expense Loss on Asset Impairment 3,300 15,000 790 3,900 6,900 9,400 2,500 2,000 - Borden Corporation Statement of Net Income For the Year Ended December 31 Net Income: ges Accounting and Legal Fees-General Expense Advertising Expense Cost of Goods Sold Depreciation Expense-General Expense Dividend Income Dividends Declared Gain on Disposal of Plant Assets Income Tax Expense **T ges Interest Expense Interest Income Loss on Asset Impairment Office Salaries Expense Office Supplies Expense Sales Sales Salaries Expense Loss on Asset Impairment Office Salaries Expense Office Supplies Expense Sales Sales Salaries Expense Selling Expenses Unrealized Gain on Trading Investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The task is to prepare a singlestep income statement for Borden Corporation for the year ended December 31 A singlestep income statement is one of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started