Answered step by step

Verified Expert Solution

Question

1 Approved Answer

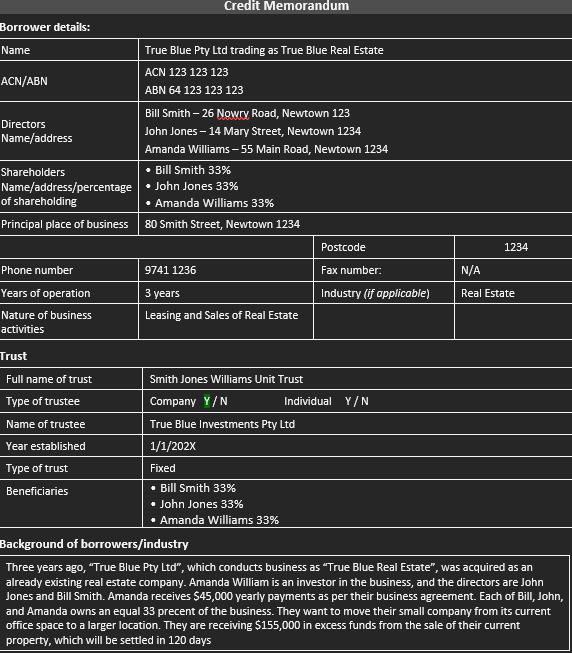

Borrower details: Name ACN/ABN Directors Name/address Shareholders Credit Memorandum True Blue Pty Ltd trading as True Blue Real Estate ACN 123 123 123 ABN

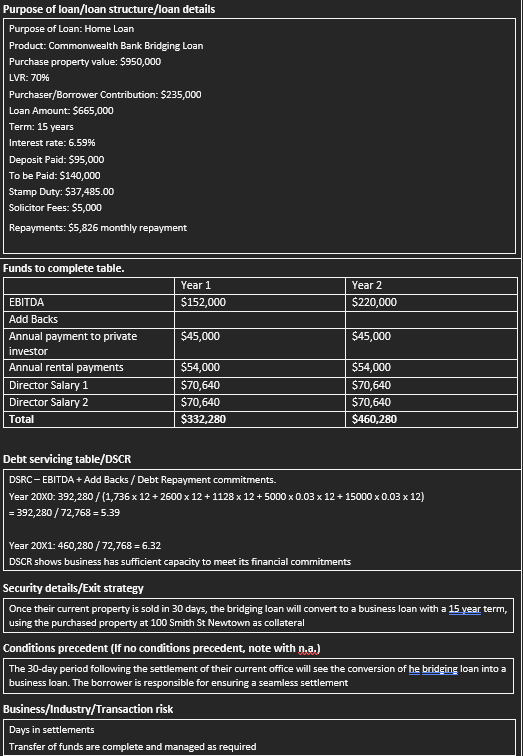

Borrower details: Name ACN/ABN Directors Name/address Shareholders Credit Memorandum True Blue Pty Ltd trading as True Blue Real Estate ACN 123 123 123 ABN 64 123 123 123 Bill Smith - 26 Nowry Road, Newtown 123 John Jones - 14 Mary Street, Newtown 1234 Amanda Williams - 55 Main Road, Newtown 1234 Bill Smith 33% Name/address/percentage John Jones 33% of shareholding Principal place of business Amanda Williams 33% 80 Smith Street, Newtown 1234 Phone number Years of operation Nature of business activities Trust Postcode 1234 9741 1236 Fax number: 3 years Industry (if applicable) N/A Real Estate Leasing and Sales of Real Estate Type of trustee Full name of trust Smith Jones Williams Unit Trust Company Y/N Individual Y/N True Blue Investments Pty Ltd Name of trustee Year established Type of trust Beneficiaries 1/1/202X Fixed Bill Smith 33% John Jones 33% Amanda Williams 33% Background of borrowers/industry Three years ago, "True Blue Pty Ltd", which conducts business as "True Blue Real Estate", was acquired as an already existing real estate company. Amanda William is an investor in the business, and the directors are John Jones and Bill Smith. Amanda receives $45,000 yearly payments as per their business agreement. Each of Bill, John, and Amanda owns an equal 33 precent of the business. They want to move their small company from its current office space to a larger location. They are receiving $155,000 in excess funds from the sale of their current property, which will be settled in 120 days Purpose of loan/loan structure/loan details Purpose of Loan: Home Loan Product: Commonwealth Bank Bridging Loan Purchase property value: $950,000 LVR: 70% Purchaser/Borrower Contribution: $235,000 Loan Amount: $665,000 Term: 15 years Interest rate: 6.59% Deposit Paid: $95,000 To be Paid: $140,000 Stamp Duty: $37,485.00 Solicitor Fees: $5,000 Repayments: $5,826 monthly repayment Funds to complete table. Year 1 Year 2 EBITDA $152,000 $220,000 Add Backs Annual payment to private $45,000 $45,000 investor Annual rental payments $54,000 $54,000 Director Salary 1 $70,640 $70,640 Director Salary 2 $70,640 $70,640 Total $332,280 $460,280 Debt servicing table/DSCR DSRC-EBITDA + Add Backs / Debt Repayment commitments. Year 20X0: 392,280 / (1,736 x 12 +2600 x 12 + 1128 x 12 + 5000 x 0.03 x 12 + 15000 x 0.03 x 12) = 392,280 / 72,768 = 5.39 Year 20X1: 460,280 / 72,768 = 6.32 DSCR shows business has sufficient capacity to meet its financial commitments Security details/Exit strategy Once their current property is sold in 30 days, the bridging loan will convert to a business loan with a 15 year term, using the purchased property at 100 Smith St Newtown as collateral Conditions precedent (If no conditions precedent, note with n.a.) The 30-day period following the settlement of their current office will see the conversion of he bridging loan into a business loan. The borrower is responsible for ensuring a seamless settlement Business/Industry/Transaction risk Days in settlements Transfer of funds are complete and managed as required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started