Answered step by step

Verified Expert Solution

Question

1 Approved Answer

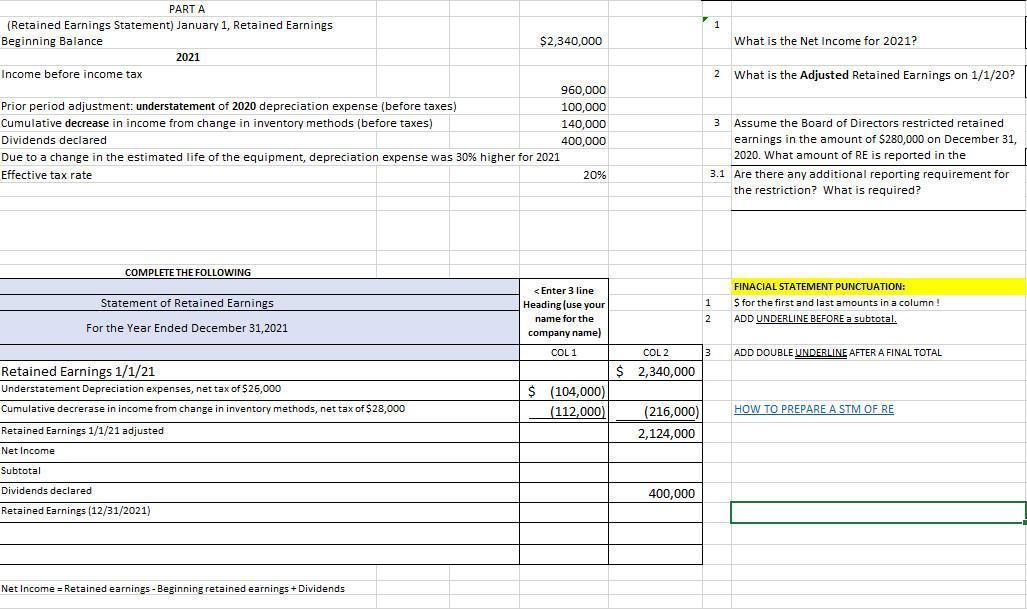

PART A (Retained Earnings Statement) January 1, Retained Earnings Beginning Balance 2021 Income before income tax 1 $2,340,000 Prior period adjustment: understatement of 2020

PART A (Retained Earnings Statement) January 1, Retained Earnings Beginning Balance 2021 Income before income tax 1 $2,340,000 Prior period adjustment: understatement of 2020 depreciation expense (before taxes) Cumulative decrease in income from change in inventory methods (before taxes) Dividends declared Due to a change in the estimated life of the equipment, depreciation expense was 30% higher for 2021 Effective tax rate COMPLETE THE FOLLOWING Statement of Retained Earnings For the Year Ended December 31,2021 Retained Earnings 1/1/21 Understatement Depreciation expenses, net tax of $26,000 Cumulative decrerase in income from change in inventory methods, net tax of $28,000 Retained Earnings 1/1/21 adjusted Net Income Subtotal Dividends declared Retained Earnings (12/31/2021) Net Income = Retained earnings - Beginning retained earnings + Dividends What is the Net Income for 2021? 2 What is the Adjusted Retained Earnings on 1/1/20? 960,000 100,000 140,000 3 400,000 20% Assume the Board of Directors restricted retained earnings in the amount of $280,000 on December 31, 2020. What amount of RE is reported in the 3.1 Are there any additional reporting requirement for the restriction? What is required? < Enter 3 line Heading (use your name for the company name) FINACIAL STATEMENT PUNCTUATION: 1 2 $ for the first and last amounts in a column ! ADD UNDERLINE BEFORE a subtotal. COL 1 COL 2 3 ADD DOUBLE UNDERLINE AFTER A FINAL TOTAL $ 2,340,000 $ (104,000) (112,000) (216,000) 2,124,000 HOW TO PREPARE A STM OF RE 400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started