Answered step by step

Verified Expert Solution

Question

1 Approved Answer

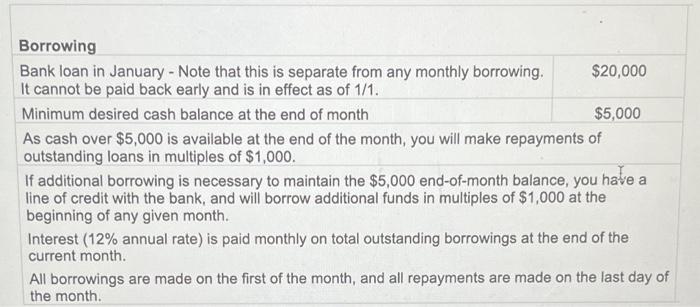

Borrowing Bank loan in January - Note that this is separate from any monthly borrowing. It cannot be paid back early and is in

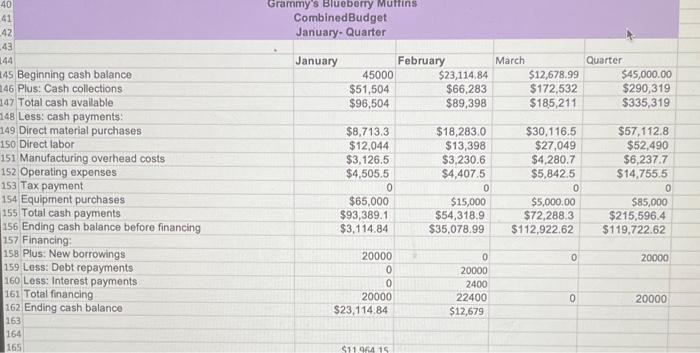

Borrowing Bank loan in January - Note that this is separate from any monthly borrowing. It cannot be paid back early and is in effect as of 1/1. Minimum desired cash balance at the end of month $20,000 $5,000 As cash over $5,000 is available at the end of the month, you will make repayments of outstanding loans in multiples of $1,000. If additional borrowing is necessary to maintain the $5,000 end-of-month balance, you have a line of credit with the bank, and will borrow additional funds in multiples of $1,000 at the beginning of any given month. Interest (12% annual rate) is paid monthly on total outstanding borrowings at the end of the current month. All borrowings are made on the first of the month, and all repayments are made on the last day of the month. 40 41 42 43 44 45 Beginning cash balance 146 Plus: Cash collections 147 Total cash available 148 Less: cash payments: 149 Direct material purchases 150 Direct labor 151 Manufacturing overhead costs 152 Operating expenses Grammy's Blueberry Muffins CombinedBudget January- Quarter January February March Quarter 45000 $51,504 $23,114.84 $66,283 $12,678.99 $45,000.00 $172,532 $290,319 $96,504 $89,398 $185,211 $335,319 $8,713.3 $18,283.0 $30,116.5 $57,112.8 $12,044 $13,398 $27,049 $52,490 $3,126.5 $3,230.6 $4,280.7 $6,237.7 $4,505.5 $4,407.5 $5,842.5 $14,755.5 153 Tax payment 0 0 0 154 Equipment purchases $65,000 $15,000 $5,000.00 $85,000 155 Total cash payments $93,389.1 $54,318.9. $72,288.3 156 Ending cash balance before financing $3,114.84 $35,078.99 $112,922.62 $215,596.4 $119,722.62 157 Financing: 158 Plus: New borrowings 20000 0 0 20000 159 Less: Debt repayments 160 Less: Interest payments 161 Total financing 162 Ending cash balance 163 0 20000 0 2400 20000 22400 0 20000 $23,114.84 $12,679 164 165 $11.964 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information it seems that the company has a specific borrowing and repayment structure with the bank Heres a summary of the key points 1 Bank loan in January The company has taken a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e7b568104e_881122.pdf

180 KBs PDF File

661e7b568104e_881122.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started