Answered step by step

Verified Expert Solution

Question

1 Approved Answer

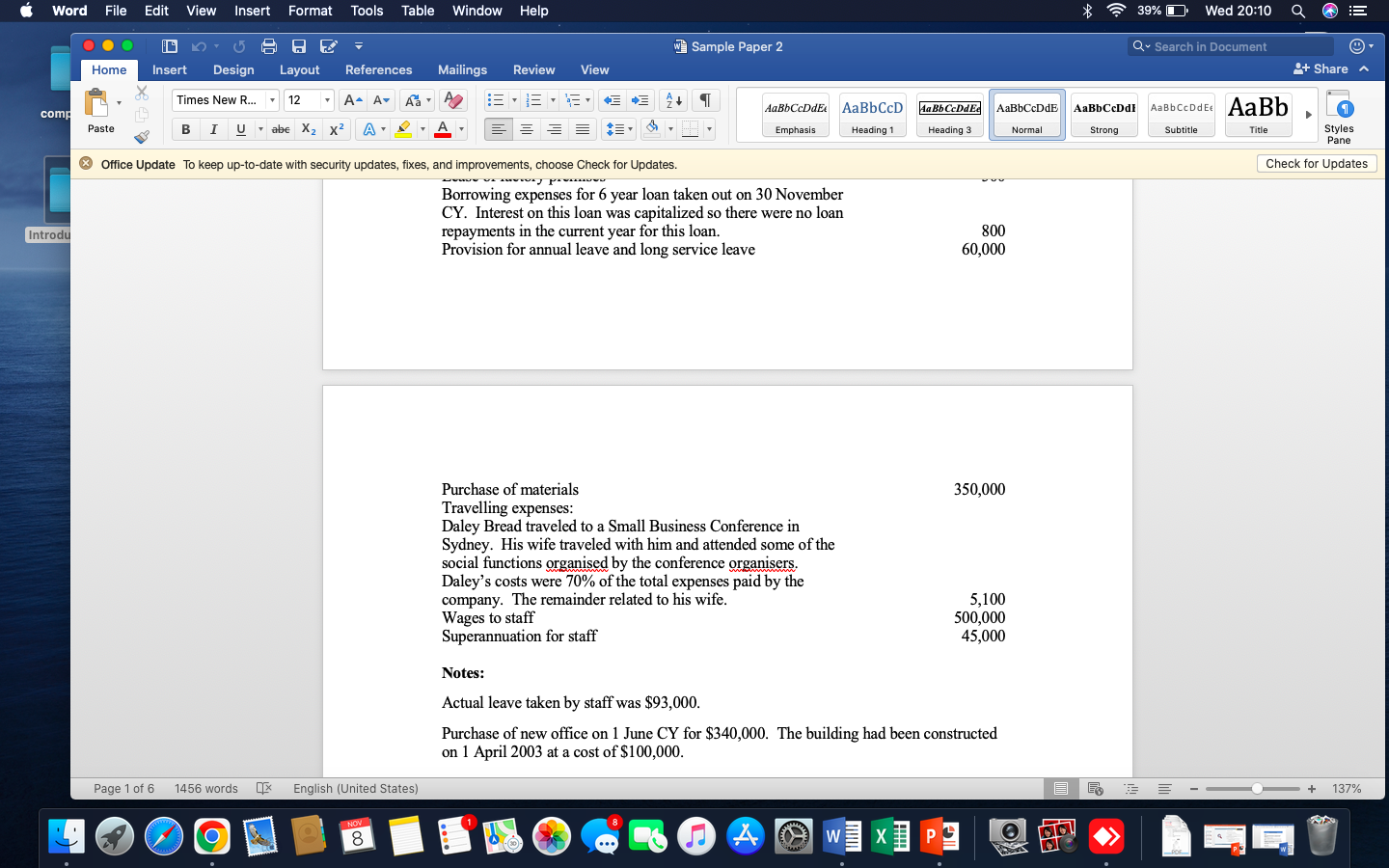

Borrowing expenses for 6 year loan taken out on 30 November CY. Interest on this loan was capitalized so there were no loan repayments in

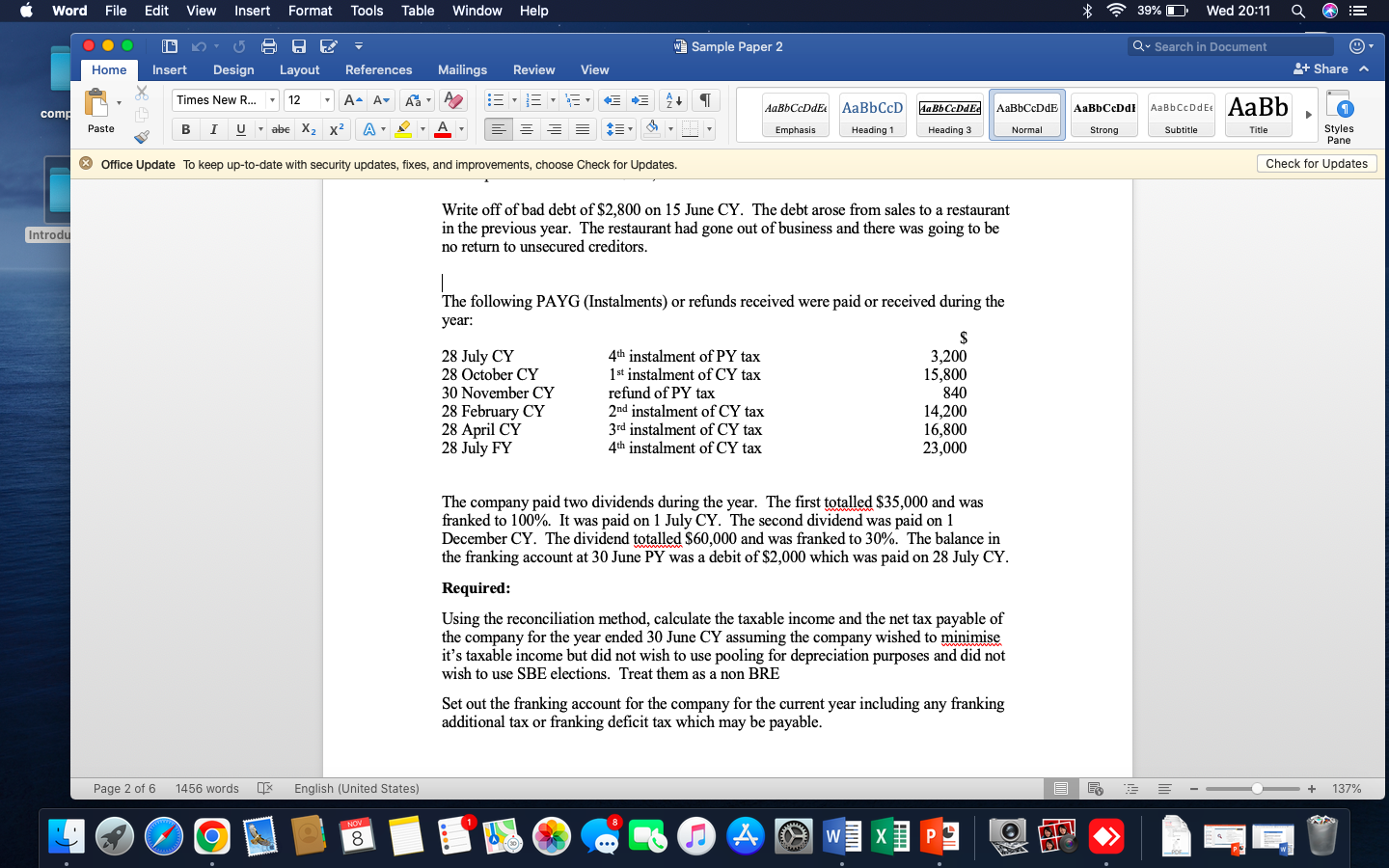

Borrowing expenses for 6 year loan taken out on 30 November CY. Interest on this loan was capitalized so there were no loan repayments in the current year for this loan. Provision for annual leave and long service leave Write off of bad debt of $2,800 on 15 June CY. The debt arose from sales to a restaurant in the previous year. The restaurant had gone out of business and there was going to be no return to unsecured creditors. The following PAYG (Instalments) or refunds received were paid or received during the year: The company paid two dividends during the year. The first totalled $35,000 and was franked to 100%. It was paid on 1 July CY. The second dividend was paid on 1 December CY. The dividend totalled $60,000 and was franked to 30%. The balance in the franking account at 30 June PY was a debit of $2,000 which was paid on 28 July CY. Required: Using the reconciliation method, calculate the taxable income and the net tax payable of the company for the year ended 30 June CY assuming the company wished to minimise it's taxable income but did not wish to use pooling for depreciation purposes and did not wish to use SBE elections. Treat them as a non BRE Set out the franking account for the company for the current year including any franking additional tax or franking deficit tax which may be payable. Borrowing expenses for 6 year loan taken out on 30 November CY. Interest on this loan was capitalized so there were no loan repayments in the current year for this loan. Provision for annual leave and long service leave Write off of bad debt of $2,800 on 15 June CY. The debt arose from sales to a restaurant in the previous year. The restaurant had gone out of business and there was going to be no return to unsecured creditors. The following PAYG (Instalments) or refunds received were paid or received during the year: The company paid two dividends during the year. The first totalled $35,000 and was franked to 100%. It was paid on 1 July CY. The second dividend was paid on 1 December CY. The dividend totalled $60,000 and was franked to 30%. The balance in the franking account at 30 June PY was a debit of $2,000 which was paid on 28 July CY. Required: Using the reconciliation method, calculate the taxable income and the net tax payable of the company for the year ended 30 June CY assuming the company wished to minimise it's taxable income but did not wish to use pooling for depreciation purposes and did not wish to use SBE elections. Treat them as a non BRE Set out the franking account for the company for the current year including any franking additional tax or franking deficit tax which may be payable

Borrowing expenses for 6 year loan taken out on 30 November CY. Interest on this loan was capitalized so there were no loan repayments in the current year for this loan. Provision for annual leave and long service leave Write off of bad debt of $2,800 on 15 June CY. The debt arose from sales to a restaurant in the previous year. The restaurant had gone out of business and there was going to be no return to unsecured creditors. The following PAYG (Instalments) or refunds received were paid or received during the year: The company paid two dividends during the year. The first totalled $35,000 and was franked to 100%. It was paid on 1 July CY. The second dividend was paid on 1 December CY. The dividend totalled $60,000 and was franked to 30%. The balance in the franking account at 30 June PY was a debit of $2,000 which was paid on 28 July CY. Required: Using the reconciliation method, calculate the taxable income and the net tax payable of the company for the year ended 30 June CY assuming the company wished to minimise it's taxable income but did not wish to use pooling for depreciation purposes and did not wish to use SBE elections. Treat them as a non BRE Set out the franking account for the company for the current year including any franking additional tax or franking deficit tax which may be payable. Borrowing expenses for 6 year loan taken out on 30 November CY. Interest on this loan was capitalized so there were no loan repayments in the current year for this loan. Provision for annual leave and long service leave Write off of bad debt of $2,800 on 15 June CY. The debt arose from sales to a restaurant in the previous year. The restaurant had gone out of business and there was going to be no return to unsecured creditors. The following PAYG (Instalments) or refunds received were paid or received during the year: The company paid two dividends during the year. The first totalled $35,000 and was franked to 100%. It was paid on 1 July CY. The second dividend was paid on 1 December CY. The dividend totalled $60,000 and was franked to 30%. The balance in the franking account at 30 June PY was a debit of $2,000 which was paid on 28 July CY. Required: Using the reconciliation method, calculate the taxable income and the net tax payable of the company for the year ended 30 June CY assuming the company wished to minimise it's taxable income but did not wish to use pooling for depreciation purposes and did not wish to use SBE elections. Treat them as a non BRE Set out the franking account for the company for the current year including any franking additional tax or franking deficit tax which may be payable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started