Answered step by step

Verified Expert Solution

Question

1 Approved Answer

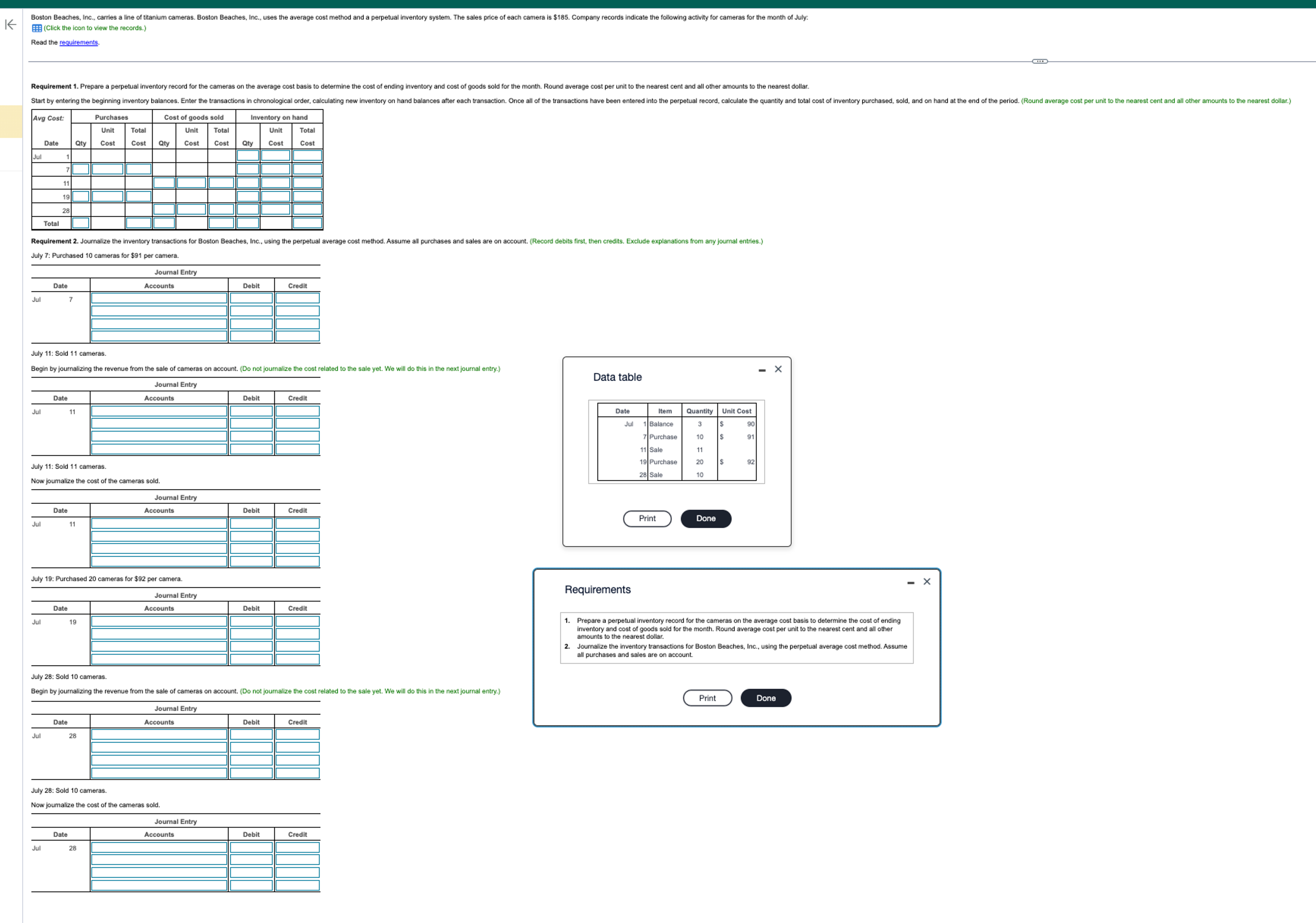

Boston Beaches , Inc . , carries a line of titanium cameras. Boston Beaches , Inc . , uses the average cost method and a

Boston BeachesInc carries a line of titanium cameras. Boston BeachesInc uses the average cost method and a perpetual inventory system. The sales price of each camera is $ Company records indicate the following activity for cameras for the month of July:

LOADING...Click the icon to view the records.

Read the requirementsLOADING....

Question content area bottom

Part

Requirement Prepare a perpetual inventory record for the cameras on the average cost basis to determine the cost of ending inventory and cost of goods sold for the month. Round average cost per unit to the nearest cent and all other amounts to the nearest dollar.

Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the end of the period. Round average cost per unit to the nearest cent and all other amounts to the nearest dollar.

Part Part Part Part Part

Avg Cost:

Purchases

Cost of goods sold

Inventory on hand

Unit

Total

Unit

Total

Unit

Total

Date

Qty

Cost

Cost

Qty

Cost

Cost

Qty

Cost

Cost

Jul

Total

Part

Requirement Journalize the inventory transactions for Boston BeachesInc using the perpetual average cost method. Assume all purchases and sales are on account. Record debits first, then credits. Exclude explanations from any journal entries.

July : Purchased cameras for $ per camera.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Part

July : Sold cameras.

Begin by journalizing the revenue from the sale of cameras on account. Do not journalize the cost related to the sale yet. We will do this in the next journal entry.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Part

July : Sold cameras.

Now journalize the cost of the cameras sold.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Part

July : Purchased cameras for $ per camera.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Part

July : Sold cameras.

Begin by journalizing the revenue from the sale of cameras on account. Do not journalize the cost related to the sale yet. We will do this in the next journal entry.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Part

July : Sold cameras.

Now journalize the cost of the cameras sold.

Journal Entry

Date

Accounts

Debit

Credit

Jul

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started