Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bot sure D Question 15 1 pts Givens, Inc., is a fast-growing technology company that paid a $1.25 dividend last week. The company's expected dividend

bot sure

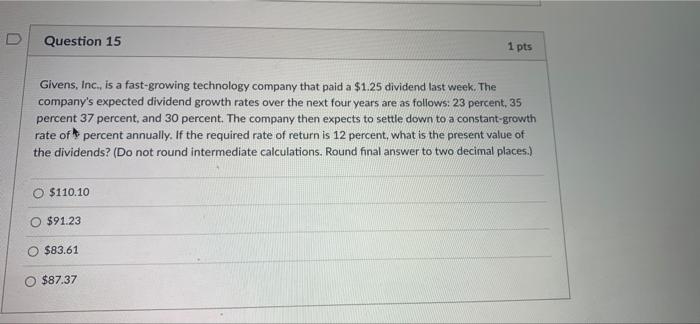

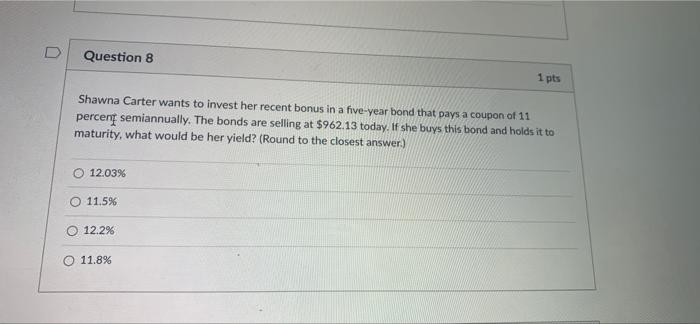

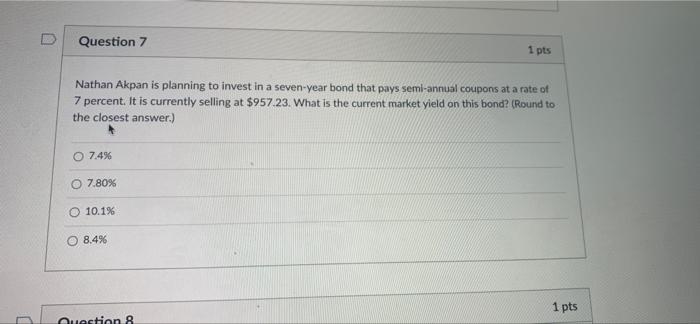

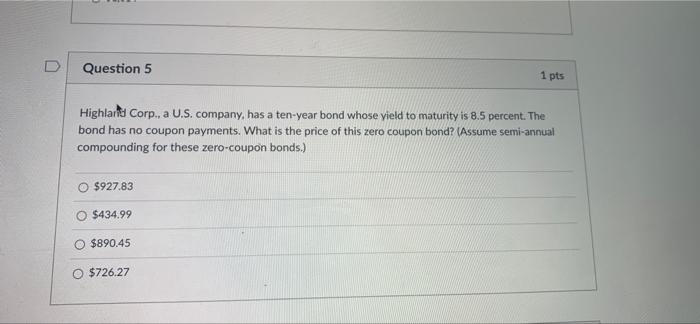

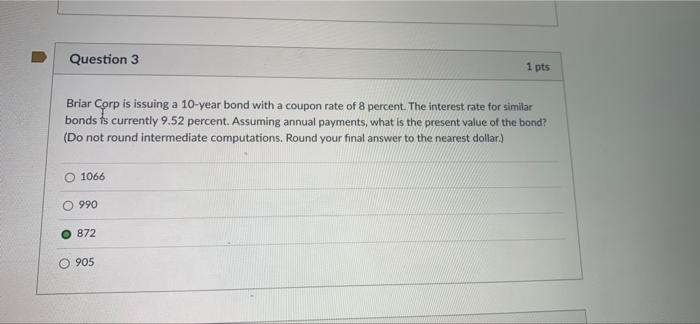

D Question 15 1 pts Givens, Inc., is a fast-growing technology company that paid a $1.25 dividend last week. The company's expected dividend growth rates over the next four years are as follows: 23 percent, 35 percent 37 percent, and 30 percent. The company then expects to settle down to a constant-growth rate of percent annually. If the required rate of return is 12 percent, what is the present value of the dividends? (Do not round intermediate calculations. Round final answer to two decimal places.) $110.10 O $91.23 $83.61 $87.37 D Question 8 1 pts Shawna Carter wants to invest her recent bonus in a five-year bond that pays a coupon of 11 percent semiannually. The bonds are selling at $962.13 today. If she buys this bond and holds it to maturity, what would be her yield? (Round to the closest answer.) 12.03% 0 11.5% 12.2% O 11.8% D Question 7 1 pts Nathan Akpan is planning to invest in a seven-year bond that pays semi-annual coupons at a rate of 7 percent. It is currently selling at $957.23. What is the current market yield on this bond? (Round to the closest answer.) O 7.4% 7.80% 10.1% 8.496 1 pts Question 8 Question 5 1 pts Highlarile Corp., a U.S.company, has a ten-year bond whose yield to maturity is 8.5 percent. The bond has no coupon payments. What is the price of this zero coupon bond? Assume semi-annual compounding for these zero-coupon bonds.) O $927.83 $434.99 $890.45 $726.27 Question 3 1 pts Briar Corp is issuing a 10-year bond with a coupon rate of 8 percent. The interest rate for similar bonds ts currently 9.52 percent. Assuming annual payments, what is the present value of the bond? (Do not round intermediate computations. Round your final answer to the nearest dollar.) 1066 990 872 905 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started