Question

Both Bob and Ben have a current consumption credit of $1500. However, their future consumption credits will differ depending on the economic outcome which consists

Both Bob and Ben have a current consumption credit of $1500. However, their future consumption credits will differ depending on the economic outcome which consists of two states, "good" and "bad", with probability 0.6 and 0.4, respectively. Bob and Ben will have $2000 and $1000 if the good state occurs, and they will have $1000 and $2000 if the bad state occurs instead, respectively. Bob prefers a smooth consumption with utility function of (x-current consumption, ˜ y-future consumption) UBob(x, ˜ y) = ln(x) + ln(˜ y), while Ben is a little impatient with a utility function of

UBen(x, ˜ y) = 1.25ln(x) + ln(˜ y).

While Ben is a little impatient with a utility function of:

![]()

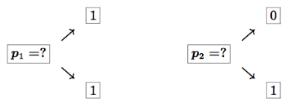

There are two financial securities, NORISK and PUT, available in the market for them to make tradeoff decisions with their current and future consumption credits.

(a) What are the equilibrium prices, p1 and p2, of NORIS K and PUT, respectively?

(b) Calculate the current and future optimal consumptions for each of the two investors?

(c) What is the implied risk-free rate?

(d) How much do they have to hold in each of the two securities, NORISK and PUT, to facilitate their future consumptions?

UBen = 1.25 In(x) + In (y)

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The equilibrium prices of NORISK and PUT are 150 and 050 respectively b The curr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started