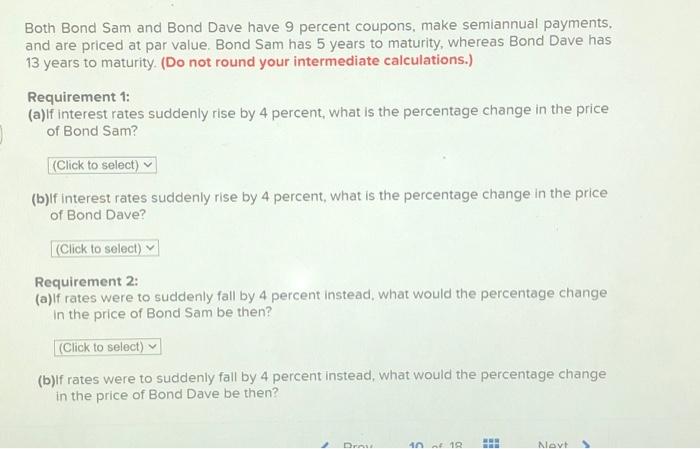

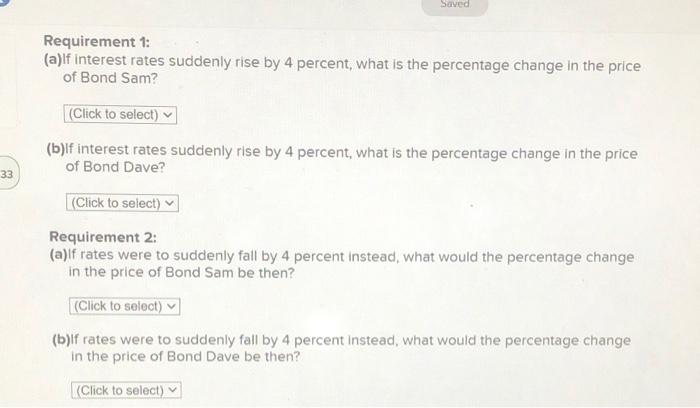

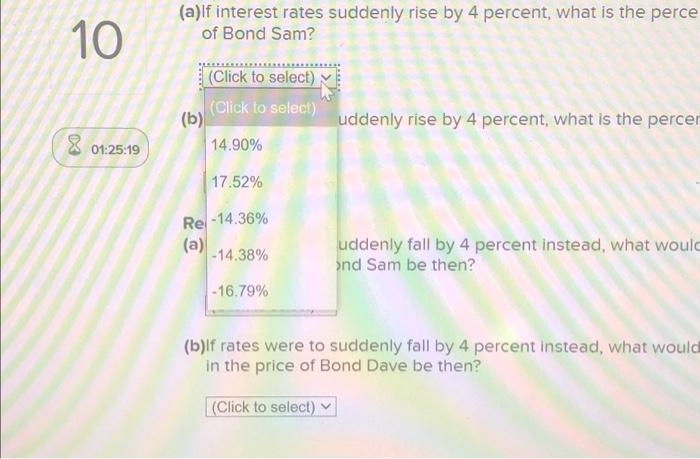

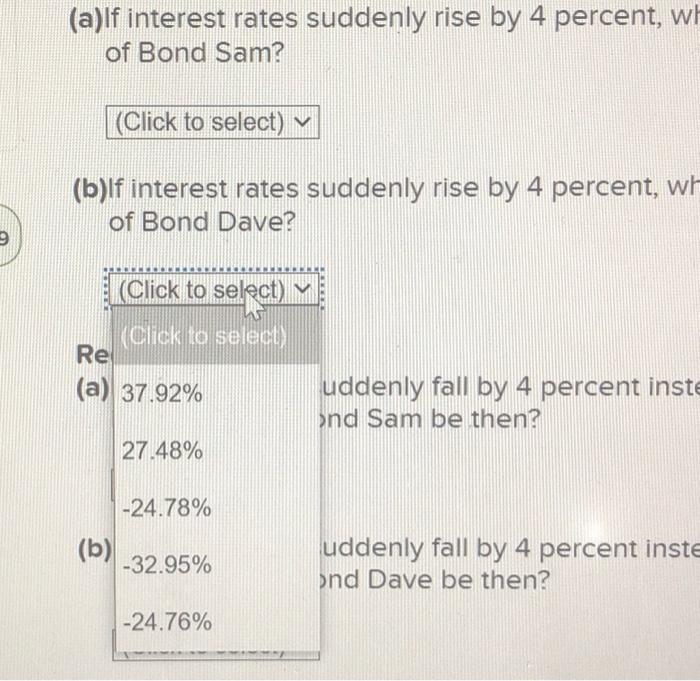

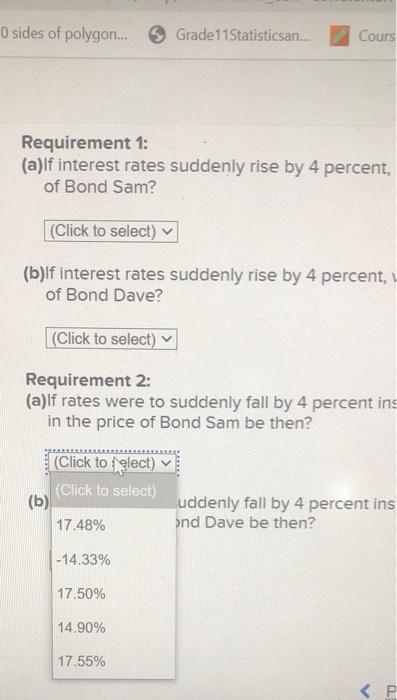

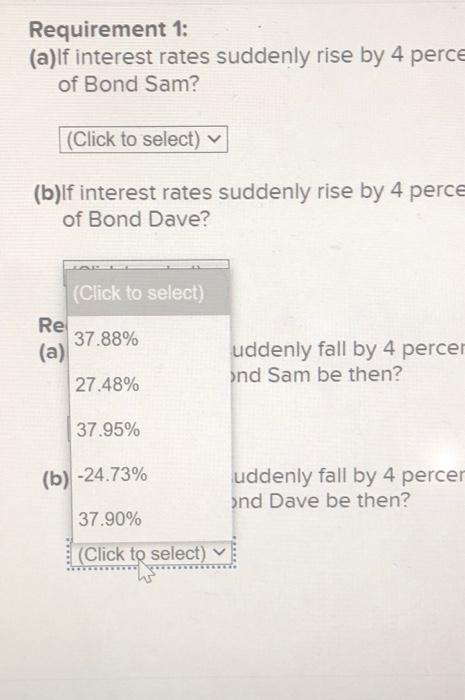

Both Bond Sam and Bond Dave have 9 percent coupons, make semiannual payments. and are priced at par value. Bond Sam has 5 years to maturity, whereas Bond Dave has 13 years to maturity. (Do not round your intermediate calculations.) Requirement 1: (a)lf Interest rates suddenly rise by 4 percent, what is the percentage change in the price of Bond Sam? (Click to select) (b)lf interest rates suddenly rise by 4 percent, what is the percentage change in the price of Bond Dave? (Click to select) Requirement 2: (a)lf rates were to suddenly fall by 4 percent instead, what would the percentage change in the price of Bond Sam be then? (Click to select) (b)lf rates were to suddenly fall by 4 percent instead, what would the percentage change in the price of Bond Dave be then? Dr 10 10 Saved Requirement 1: (a)lf interest rates suddenly rise by 4 percent, what is the percentage change in the price of Bond Sam? (Click to select) (b)lf interest rates suddenly rise by 4 percent, what is the percentage change in the price of Bond Dave? 33 (Click to select) Requirement 2: (a)lf rates were to suddenly fall by 4 percent instead, what would the percentage change in the price of Bond Sam be then? (Click to select) (b)lf rates were to suddenly fall by 4 percent instead, what would the percentage change in the price of Bond Dave be then? (Click to select) 10 (a)lf interest rates suddenly rise by 4 percent, what is the perce of Bond Sam? (Click to select) (Click to select) (b) 14.90% uddenly rise by 4 percent, what is the percer 8 01:25:19 17.52% Re-14.36% (a) - 14.38% uddenly fall by 4 percent instead, what would ond Sam be then? - 16.79% (b)lf rates were to suddenly fall by 4 percent instead, what would in the price of Bond Dave be then? (Click to select) (a)lf interest rates suddenly rise by 4 percent, wh of Bond Sam? (Click to select) (b)lf interest rates suddenly rise by 4 percent, wh of Bond Dave? 9 (Click to select) (Click to select Re (a) 37.92% uddenly fall by 4 percent inst Ond Sam be then? 27.48% -24.78% (b) -32.95% uddenly fall by 4 percent inste ond Dave be then? -24.76% 0 sides of polygon... s Grade 11 Statisticsan... Cours Requirement 1: (a)lf interest rates suddenly rise by 4 percent, of Bond Sam? (Click to select) (b)lf interest rates suddenly rise by 4 percent, of Bond Dave? (Click to select) Requirement 2: (a)lf rates were to suddenly fall by 4 percent ins in the price of Bond Sam be then? (Click to elect) (Click to select) (b) 17.48% uddenly fall by 4 percent ins ond Dave be then? - 14.33% 17.50% 14.90% 17.55%